A Hong Kong Company’s Bold Bitcoin Bet

In a move that signals a significant shift in corporate financial strategy, Ming Shing Group Holdings Limited, a Hong Kong-based company historically focused on wet trades, has announced a landmark deal. The firm has committed to purchasing 4,250 Bitcoin in a transaction valued at nearly $483 million. This bold acquisition represents a profound diversification for the company, moving beyond its core business operations to embrace what it sees as a highly liquid and valuable digital asset.

The acquisition is not merely an opportunistic trade but a carefully calculated strategic decision that could redefine the company’s financial posture for years to come. By allocating a substantial portion of its treasury to a digital asset like Bitcoin, Ming Shing Group is following a growing global trend of corporations seeking to fortify their balance sheets against macroeconomic uncertainties and capitalize on the potential for long-term appreciation.

The Financial Mechanics of a Complex Transaction

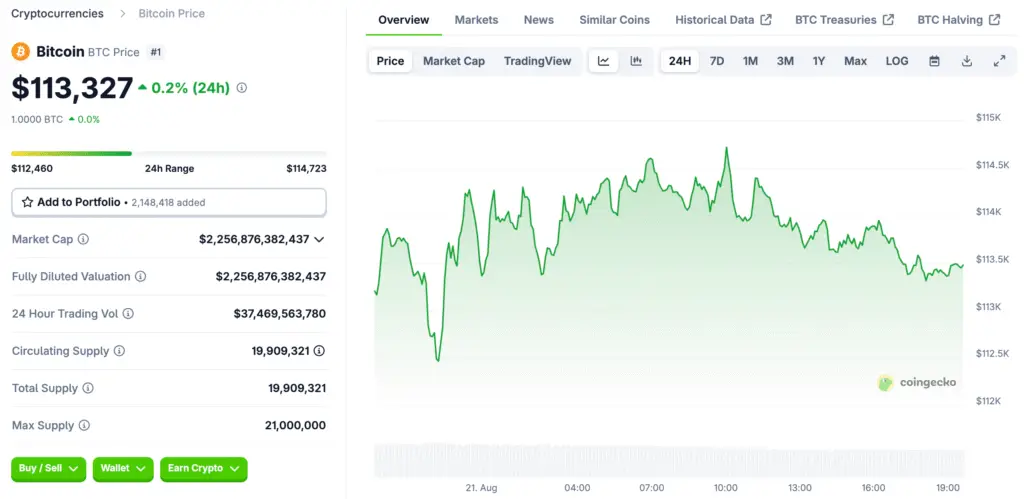

Ming Shing Group has agreed to acquire Bitcoin at an average of $113,638 per coin through a complex transaction, structured through a convertible promissory note and warrant issuance. The deal is expected to be finalized by the end of 2025. The convertible promissory note, a debt instrument, can be converted into equity at a future date, providing a reduced cash interest payment and the potential for an equity stake.

The note has a 3% annual interest rate with a 10-year maturity and is convertible into ordinary shares at $1.20 per share. Warrants, exercisable for 12 years, give the holder the right to purchase shares at a set price. This financial engineering allows Ming Shing to acquire a significant digital asset without a massive cash outflow, distributing risk and reward over a longer period.

Bitcoin as a Modern Corporate Treasury Asset

Ming Shing Group has decided to hold Bitcoin in its treasury, as part of an evolving trend in corporate finance. Historically, treasuries have been conservative, with cash and equivalents, short-term government bonds, and other low-risk assets. However, in an era of inflation and economic uncertainty, companies are exploring alternative assets like Bitcoin, which has a decentralized nature and a capped supply of 21 million coins.

Its verifiable scarcity on a public blockchain distinguishes it from fiat currencies and traditional assets, which can be subject to inflationary pressures from central bank policies.

Hong Kong’s Progressive Regulatory Environment

Ming Shing Group’s move is particularly significant given its location in Hong Kong. The city has taken a proactive and progressive stance on digital assets, aiming to position itself as a global hub for the Web3 and crypto industry in the Asia-Pacific region. This approach stands in contrast to the stricter regulations seen in other major financial centers and highlights Hong Kong’s “one country, two systems” framework, which allows it to maintain a distinct financial and regulatory autonomy.

Over the past few years, Hong Kong’s Securities and Futures Commission (SFC) has been building a comprehensive licensing and regulatory regime for digital assets, including the approval of Bitcoin and Ethereum spot ETFs. This clear regulatory framework provides the legal and operational certainty that traditional companies need to feel comfortable making such a bold financial commitment.

The Potential Impact on Shareholder Value

According to Ming Shing Group’s CEO, Wenjin Li, the acquisition is a strategic step into highly liquid assets, which could enhance the company’s balance sheet and deliver long-term value for shareholders. This statement addresses a key consideration for any public company making such a move: investor and shareholder confidence. The core argument is that by holding Bitcoin, the company is not only protecting its capital from inflation but is also directly tying the company’s fortunes to a potentially high-growth asset class.

If Bitcoin’s value continues to appreciate, it could lead to a significant increase in the company’s net worth, ultimately benefiting shareholders through an increased stock price or other financial gains. This is a model that has been successfully demonstrated by other companies, which have seen their stock prices surge following major Bitcoin acquisitions.

A Global Trendsetter for Corporate Bitcoin Adoption

While Ming Shing Group’s acquisition is noteworthy, it is by no means an isolated event. It is a part of a much larger, global trend of companies integrating Bitcoin into their treasury strategies. Prominent examples include business intelligence firm MicroStrategy, which has become a de facto Bitcoin proxy for many investors, and electric car manufacturer Tesla. These companies, along with others like Block Inc. and Coinbase, have publicly announced and committed to holding significant amounts of Bitcoin.

This trend, which began with tech-focused companies, is now spreading to more traditional industries, as evidenced by Ming Shing Group’s entry. This widespread adoption suggests a growing confidence in Bitcoin’s viability as a long-term asset and a legitimate component of a modern corporate balance sheet.

How Bitcoin Is Shaping a New Future

The acquisition by Ming Shing Group is more than just a business transaction. It is a powerful illustration of the continuing convergence between traditional finance and the burgeoning world of digital assets. It highlights how companies in established industries are increasingly looking to innovative financial instruments and assets to navigate a complex and uncertain global economy.

This shift is not without its risks, as Bitcoin’s price remains volatile. However, it also represents a willingness to adapt to new paradigms and embrace the potential of digital finance. As more companies follow this path, we can expect to see further integration of cryptocurrencies into mainstream business practices, cementing their place as a core component of the future financial landscape.

Read More: Police Warn Investors After £2.1 Million Bitcoin Scam Hits UK