Hyperliquid Extends Losing Streak With Technical Weakness Emerging

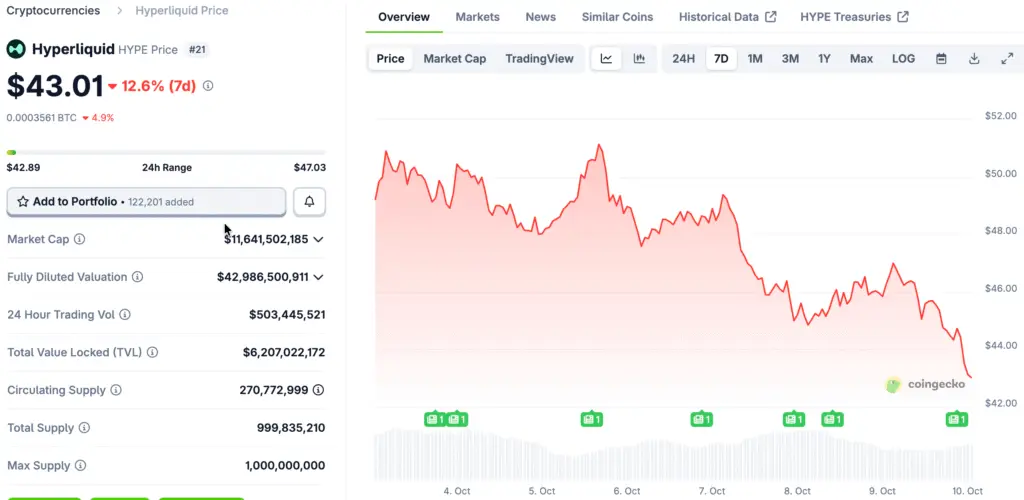

Hyperliquid experienced its 5th consecutive daily drop, decreasing by nearly 6% and trading in the vicinity of the $45 mark. The rejection came after an effort to break out above the recently regained ascending trend line earlier this week.

Currently, short-term momentum indicators are showing a bearish trend; however, various market metrics are beginning to display early signs of stabilization. Should the price action stabilize above the existing support level, a potential rise toward the range of $55 to $60 may occur.

Derivatives Traders Turn Defensive as Long Positions Shrink

Data from Coinglass indicates that the long-to-short ratio has experienced a significant decline, dropping to 0.8, marking its lowest level in more than a month. This figure suggests that derivative traders are becoming more cautious and are bracing for possible further declines.

Momentum indicators such as the Relative Strength Index at 45 and the MACD bearish crossover indicate short-term weakness. Experts in technical analysis caution that not regaining lost territory promptly may challenge more profound support levels.

Hyperliquid Faces 7% Pullback After Failing to Hold $48 Uptrend Support Level

Recent chart patterns indicate that Hyperliquid has encountered a significant setback, failing to successfully retest its previously established uptrend line around the $48 mark. The correction approached nearly 7% from Friday to Monday, indicating a prolonged pullback phase.

If sellers continue to push, the next key support level is around $39 to $40, where previous buying interest has been established. Maintaining that zone will be essential for upholding the medium-term bullish framework.

Recommended Article: Hyperliquid Swaps Join MetaMask in Polymarket Integration

On-Chain Activity Signals Resilient Fundamental Backdrop

Even with a negative outlook in derivatives, on-chain data reveals robust strength in the spot market and consistent involvement from long-term investors. Purchasers are steadily gathering within the range of $45 to $47, showcasing their belief in the long-term prospects.

Hyperliquid showcases impressive staking engagement, with participation surpassing 660,000 HYPE tokens, valued at approximately $30 million. Buybacks of protocols have effectively tightened the circulating supply, leading to a decrease in selling pressure on exchanges.

Hyperliquid Generates $3M Daily Revenue as Liquidity and Stability Remain Strong

The platform reliably generates daily protocol revenue close to $3,000,000, indicating a steady demand even in the face of increasing competition from other decentralized exchanges. Consistent fee generation ensures operational stability during fluctuating trading periods.

Consistent liquidity conditions and balanced financing rates further enhance the underlying fundamentals. As leveraged shorts unwind their positions, liquidity could realign with spot buyers, contributing to the stabilization of market structure and mitigating downside volatility.

Trading Range Establishes Near-Term Roadmap for Recovery

The current trading range is established between $44 and $49. Achieving a daily close above $49 would eliminate the selling bias. This action may draw in technical traders looking for momentum towards the levels of $52 and $55.

A confirmed breakout past $55 could lead to additional gains, potentially reaching the $60 area as forecasted by multiple analysts. Nonetheless, a drop below $46 support could lead to a return to $44 or potentially even lower demand zones around the $40 mark.

Hyperliquid Buyback Support and Strong Metrics Signal Potential V-Shaped Recovery

Market analysts highlight that the existing structural strength and buyback support create advantageous conditions for a possible V-shaped recovery. The internal metrics, including funding rates and liquidation levels, are showing a stable condition, suggesting that risk exposure is being managed effectively.

If buyers in the spot market continue to outpace leveraged shorts, we may see a quicker price recovery heading toward mid-range targets as the quarter comes to a close. Experts recommend vigilant observation of trend confirmation and staking activity to achieve more robust bullish validation.