Hyperliquid Jumps 7% Amid Broad Market Rebound

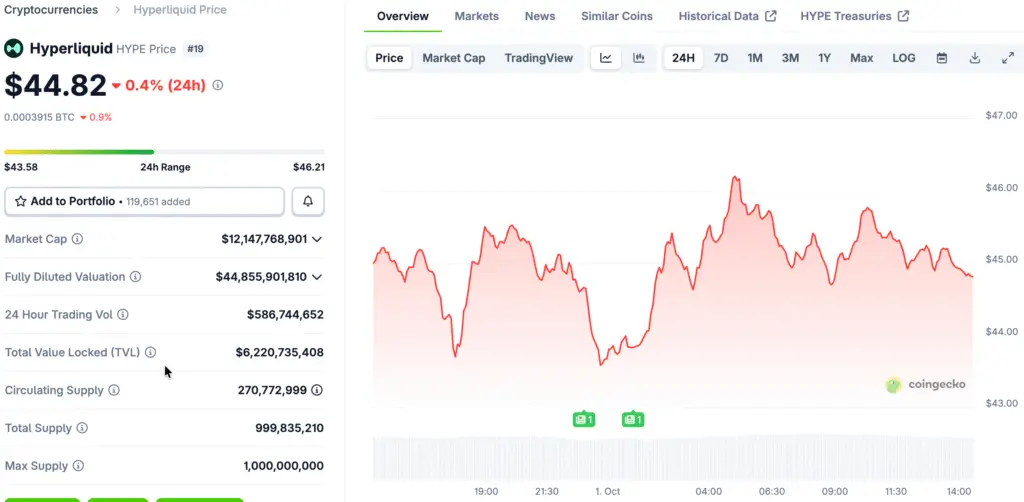

The crypto market has bounced back sharply in the last 24 hours, and Hyperliquid (HYPE) is one of the best performers. The decentralized exchange token rose 7% every day, getting closer to the $48 level as the mood in the market turned bullish.

Along with this rise, Bitcoin also made a strong comeback, rising back above $112,000 after briefly falling below $109,000 over the weekend. The price action of Hyperliquid shows that traders are once again confident in decentralized trading platforms as they get ready to take on more risk in October.

Bitcoin’s Recovery Lifts Market Sentiment

The rise in Bitcoin prices was a big reason for the market-wide rebound. After a few bearish sessions, bulls took over again, pushing BTC to a local high of $112,300 before settling down near $112,000. Analysts say that upcoming U.S. employment data and other macroeconomic indicators could be reasons for the market to keep going up this week.

October has been one of the best months for crypto in the past. Traders often call it “Uptober,” and this seasonal pattern is making people think that prices will keep going up. Bitcoin’s market cap has reached $2.23 trillion, which means it still controls about 56.4% of the market for altcoins.

Hyperliquid Outperforms Major Altcoins

Ethereum rose 3% to get back to the $4,100 level, but Hyperliquid’s 7% rise was faster than most large-cap tokens. Ripple’s XRP went up 4% to $2.90, and Binance Coin went back above $1,000 after a 4.4% rise. Only a few tokens, like TRON (TRX) and Plasma (XPL), saw small drops in value each day among the top 100 assets.

HYPE’s success shows that decentralized trading venues that combine fast infrastructure with community-driven governance are becoming more popular. More and more traders are looking for alternatives to centralized exchanges, and Hyperliquid’s model has put it at the center of that shift.

Recommended Article: OKX CEO: Hyperliquid Proves On-Chain Perpetuals Can Thrive With Small Teams

Market Cap Close to $4 Trillion as Hope Grows

The total market capitalization of all cryptocurrencies rose by 2.5% to about $3.96 trillion, getting close to the important $4 trillion mark again. Analysts see this as a psychological milestone that could bring in more money if the market keeps going up.

This general market optimism is shown by Hyperliquid’s quick rise. Its job as a next-generation decentralized exchange, powered by HyperEVM and an on-chain order book that can handle speeds like those of centralized exchanges, keeps traders interested in both performance and trustless infrastructure.

Hyperliquid’s Position Strengthens Ahead of Q4

As more institutional capital flows in and new ETFs change the way liquidity works, platforms like Hyperliquid are becoming more important strategically. The exchange’s focus on the community and refusal to take venture capital funding have helped it build a loyal user base, which is now benefiting from market tailwinds.

If Bitcoin keeps going up and October follows past patterns, HYPE could go up even more as trading volumes rise and speculation picks up. The macro environment and the fact that leveraged strategies are moving to decentralized platforms will both help Hyperliquid’s ecosystem.

Uptober Could Accelerate HYPE’s Momentum

October has often been a turning point for the crypto markets, and early signs point to this year being the same. Hyperliquid’s strong performance opens the door for more gains if bullish sentiment spreads more widely.

Hyperliquid’s 7% daily rise puts it among the top tokens to watch as we head into the last quarter of 2025. The market cap is close to $4 trillion, Bitcoin is rising, and altcoins are gaining ground.