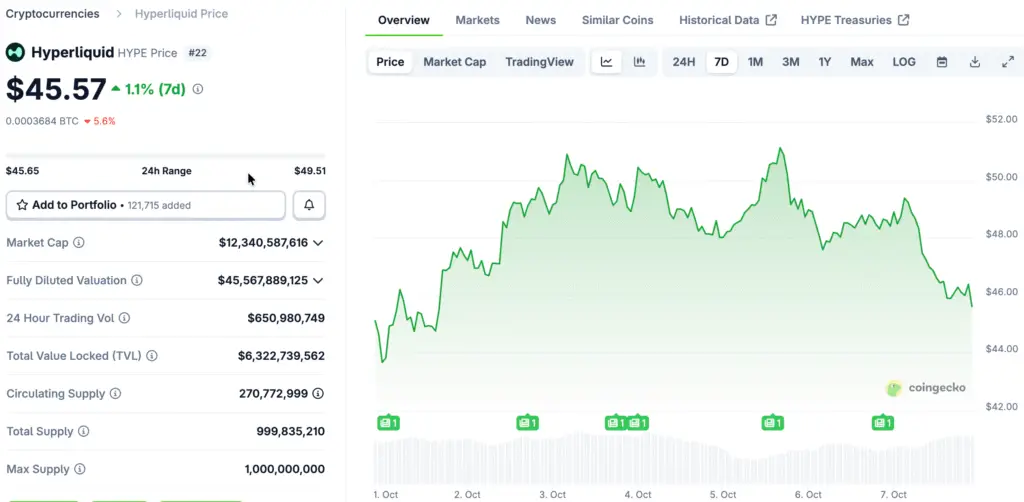

HYPE Recovers Strongly After Sharp Late-September Decline

Hyperliquid is demonstrating positive indicators of recovery following its drop to $39.73 on September 25. The token has regained upward momentum, steadily climbing past important technical levels and sparking renewed optimism among traders.

Market participants are closely monitoring this rebound as the asset fluctuates between key support and resistance levels. The transition comes after a tumultuous phase where both optimistic and pessimistic influences vied for immediate dominance over the price trend.

HYPE Trades Between Key SMAs as Buyers and Sellers Battle for Momentum Shift Ahead

HYPE is presently positioned between its 21-day and 50-day simple moving averages, a range typically linked to consolidation periods. This range indicates a market where buyers and sellers are in close alignment, setting the stage for a significant shift ahead.

Bulls are striving to drive prices past the 21-day SMA threshold to regain positive momentum. At the same time, sellers are actively protecting resistance levels, striving to thwart any lasting movement towards elevated targets.

Technical Indicators Point Toward Emerging Bullish Pressure

The 4-hour chart indicates that moving averages are trending upward, as the 21-day SMA has crossed above the 50-day SMA. This technical alignment often indicates a robust bullish momentum and an increase in trader confidence.

Furthermore, the occurrence of several doji candlesticks underscores uncertainty in the market, frequently observed prior to significant directional shifts. Should bullish momentum increase, Hyperliquid could embark on a new rally towards higher resistance levels.

Recommended Article: Hyperliquid Eyes $60 Breakout as $52 Resistance Weakens

Resistance at $52 Represents Critical Short-Term Breakout Zone

The $52 level has become a critical short-term resistance point after the recent rebound. The price action has consistently paused in this region, indicating significant selling pressure from those looking to take profits and from short-term traders.

A decisive move and a daily close above $52 may pave the way toward the $59 area, in line with past resistance points and technical forecasts. Market participants are keeping a vigilant eye on this area to determine if the ongoing rally can maintain its upward trajectory.

Support Levels Provide Foundation for Continued Recovery

Support is currently positioned around $40, a threshold that proved resilient throughout the decline in September. Keeping this floor intact is crucial for upholding positive sentiment and avoiding any resurgence of downward pressure.

The secondary support is positioned at $30, marking the lower boundary of the existing range. Should bearish forces regain dominance, a retest of this level might indicate more significant corrections ahead. However, at this moment, buyers seem resolute in their efforts to maintain higher ground.

Market Outlook Highlights Sideways Structure Before Breakout

Even with the positive recovery, price bars are still mostly trapped within horizontal moving averages, suggesting a lateral formation. This kind of arrangement frequently comes before major directional shifts as liquidity accumulates within established boundaries.

Market participants expect a number of upcoming sessions characterized by limited price movement before a clear shift in momentum occurs. Breakouts from these consolidation periods can be significant, highlighting the importance of this current phase for market positioning.

Hyperliquid Targets $59 Breakout as Traders Watch Key $52 Resistance for Bullish Move

If Hyperliquid convincingly surpasses $52, optimistic traders anticipate a continuation toward $59, coinciding with the next significant resistance area. This situation would signify a pivotal transition from consolidation to a resurgence of upward movement.

On the other hand, not maintaining the current levels may result in the token remaining confined between support and resistance for a few more days. As market sentiment leans towards cautious optimism, numerous observers consider this a crucial juncture for the asset’s short-term direction.