XRP Encounters Fresh Decline Amid Increasing Selling Pressure

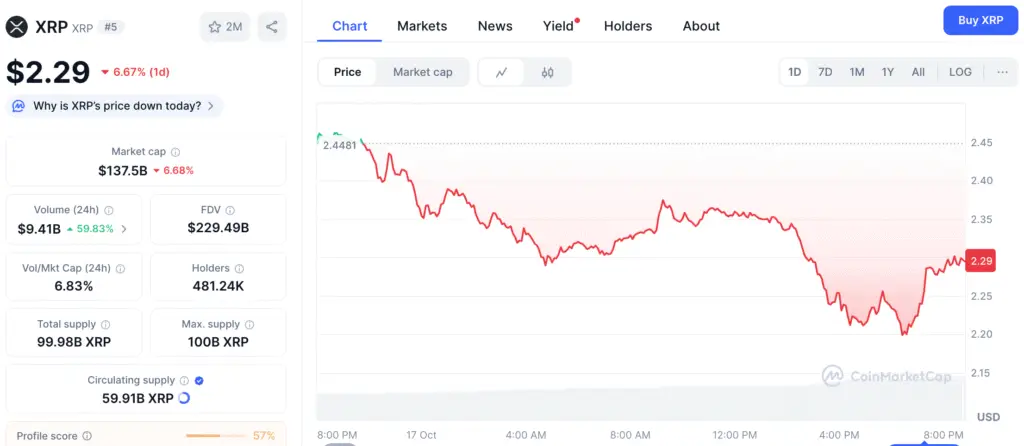

XRP is encountering ongoing selling pressure, finding it difficult to sustain momentum above its key resistance levels. The token is presently valued at approximately $2.27, indicating a 6% decrease in the last 24 hours and a 19% fall over the course of the past week. The persistent barrier around $2.80 remains a significant hurdle for recovery efforts, raising growing apprehension among traders that an inability to regain this level may lead to intensified losses.

Experts observe that the $2.40 mark, once a point of short-term support, has now shifted to act as resistance. This shift underscores a prevailing negative outlook, indicating that the mood in the market continues to be unstable. A swift recovery is crucial; otherwise, the critical support levels at $2.10 and $1.78 may come into play, possibly establishing XRP’s immediate bottom.

Analytical Signals Suggest Continued Fragility

The price structure of XRP reflects technical patterns commonly observed in corrective phases. The 50-day moving average has dipped below the 100-day moving average, signaling a possible continuation of downward trends. Furthermore, the MACD line has dipped below its signal line, indicating a decline in momentum and diminishing interest from buyers.

Currently, the Relative Strength Index (RSI) is positioned at 44, falling short of the neutral 50 threshold, indicating a lack of robust demand. The convergence of these signals suggests a bearish sentiment for XRP in the near future, unless fresh catalysts arise to stimulate buying activity.

XRP Volatility Exposes Payroll Startups to Cash Flow Instability

Startups looking into cryptocurrency-based payrolls should be aware that the current volatility of XRP highlights considerable operational risks. Rapid price changes ranging from 10% to 20% can significantly impact cash flow management and the consistency of employee compensation. Moreover, unexpected market corrections can diminish working capital if treasury allocations lack adequate hedging strategies.

Startups that depend on immediate crypto payments need to understand that factors like timing, liquidity, and transaction exposure can significantly affect the efficiency of payroll processes. Establishing a well-defined risk-mitigation framework is essential when integrating assets such as XRP into payment systems.

Recommended Article: XRP Drops 35% as Traders Decide to Buy the Dip or Sell the Rip

Regulatory Uncertainty Adds Another Layer of Complexity

In addition to the fluctuations in the market, the lack of clear regulations continues to pose a significant hurdle. The ongoing legal and compliance discussions surrounding XRP with various jurisdictions underscore the potential risks that startups might encounter when they adopt crypto payrolls too early. A sudden change in policy may impact how assets are classified, influence taxation, or alter access to liquidity, leading to unforeseen compliance challenges.

Authorities recommend that as global regulatory frameworks evolve, startups ought to remain adaptable in their payment strategies. Integrating stablecoins, ETFs, or indirect exposure to cryptocurrencies may provide more secure avenues for blockchain adoption, mitigating the complete volatility risks associated with assets such as XRP.

Startups Balance Crypto and Stablecoins to Reduce Market Exposure

Startups must adopt a multifaceted approach to financial strategies in order to navigate risks successfully. Employing futures contracts serves to mitigate price fluctuations, ensuring a consistent payout landscape. In a similar vein, balancing crypto assets with stablecoins in treasury holdings can effectively mitigate short-term market fluctuations.

Furthermore, the integration of stop-loss mechanisms alongside AI-driven prediction algorithms has the potential to streamline risk management processes. These tools enhance the timing of conversions and safeguard against abrupt market declines. Adhering to the changing landscape of financial regulations bolsters long-term operational resilience.

Establishing Robust Frameworks via Adherence and Coverage

Adhering to regulations is a fundamental aspect of ensuring the responsible integration of cryptocurrency. Startups must actively connect with regulatory bodies, create clear reporting mechanisms, and pursue insurance options to reduce the impact of external risk factors.

Furthermore, utilizing top-tier custody solutions can safeguard assets while ensuring liquidity is preserved. These measures guarantee that startups are shielded from disruptions in the market and their operations. The objective is to harmonize creativity with responsibility in overseeing digital payroll systems.

XRP’s Challenges Emphasize Importance of Flexibility in Crypto Operations

The downturn of XRP highlights the need for vigilance while simultaneously offering an important insight for emerging companies exploring the realm of cryptocurrency initiatives. The fluctuations highlight the necessity for crypto payroll solutions to transition from mere speculation to well-organized, risk-managed financial frameworks. By broadening their exposure, utilizing predictive tools, and emphasizing compliance, startups can harness the benefits of blockchain while maintaining stability.

Ultimately, XRP’s challenges underscore the necessity of being flexible and responsive. For startups, achieving success in the realm of digital payments hinges not on market timing but on skillfully maneuvering through uncertainty, turning volatility into opportunity via disciplined treasury management and strong risk frameworks.