Kaspa Attracts Analyst Interest Due to Its Distinct Market Framework

Kaspa is garnering attention from market analysts due to its unique and equitable distribution framework. Unlike many blockchain projects that utilize pre-mining or venture capital funding, Kaspa has avoided these methods. Currently, all KAS coins in circulation have been mined or purchased from open markets, creating a fair environment for all participants.

This method prevents insider dumping, a common issue that disrupts price discovery in other cryptocurrencies. The inherent transparency of Kaspa is believed to provide it with a significant long-term structural advantage, fostering a natural interaction between demand and supply and reflecting genuine market sentiment rather than relying on artificial token unlock strategies.

Absence Of Pre-Mines Supports Natural Price Movements Over Time

One of the key features of Kaspa is its lack of pre-mines, pre-sales, or locked allocations for insiders, which protects it from sudden token price surges caused by venture capital unlock timelines that can destabilize other blockchain projects’ initial growth. This unique structure facilitates a gradual and stable price discovery process, enhancing investor confidence.

As a result, traders can analyze price movements without fearing unexpected fluctuations from internal token supply. This steadiness particularly appeals to long-term investors who prefer sustained accumulation phases over volatile cycles of rapid growth and decline.

Analysts Compare Kaspa to Bitcoin’s Decentralized Ethos

Market observers are increasingly comparing Kaspa and Bitcoin regarding their decentralization principles and technological design. Analyst DC 𐤊 praised Kaspa for maintaining proof-of-work security and addressing the blockchain trilemma, achieving block processing every second.

Future enhancements to DAGKnight aim to improve throughput while preserving decentralization. This positions Kaspa similarly to Bitcoin while offering scalability benefits for real-world applications. Some analysts view Kaspa as the most significant technological advancement since 2017, warning that ignoring it could mirror the early dismissals of Solana before its growth.

Recommended Article: Kaspa Breaks Out on zkEVM Hype, Solana Holds $200, But BlockDAG’s $405M Raise Steals the Spotlight

Fair Distribution Strengthens Holder Conviction During Market Cycles

Kaspa’s equitable distribution method fosters a distinctly unique holder base in contrast to venture-backed cryptocurrencies. Skibum Trading highlighted that the lack of insider token overhang has cultivated a community primarily made up of genuine supporters and miners. These holders generally perceive Kaspa as a long-term investment instead of a rapid speculative opportunity.

This aspect plays a crucial role in Kaspa’s strength amid tough market scenarios. By steering clear of impending unlock events, Kaspa sidesteps the sudden sell-offs that frequently disrupt rival tokens. Consequently, price fluctuations generally mirror wider market trends and advancements in technology, rather than being influenced by artificial liquidity events instigated by insiders.

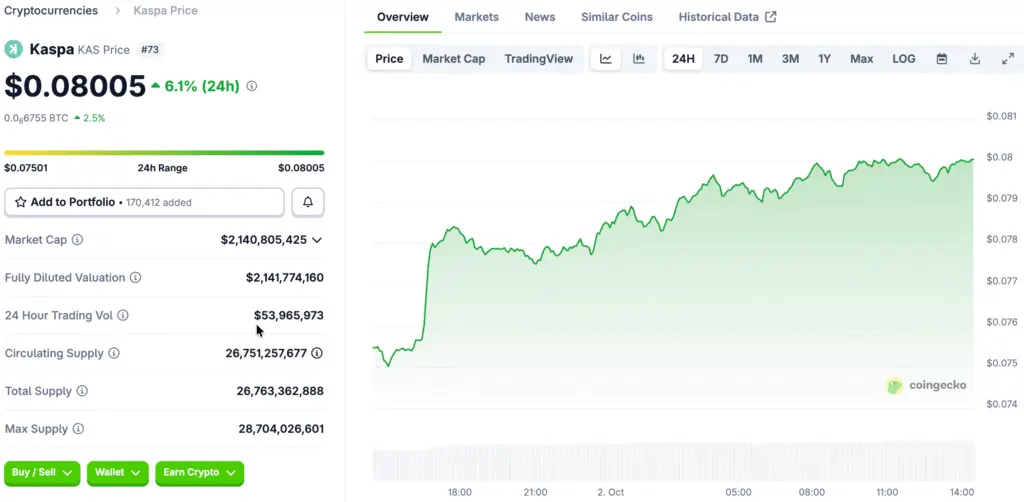

Valuation Metrics Suggest Kaspa Remains Undervalued Today

Experts argue that Kaspa’s market capitalization, around two billion dollars, does not accurately reflect its long-term potential. Historical data shows its rapid rise from half a cent in 2023 to seven cents by 2025, suggesting current valuations may be undervalued.

Additionally, a lack of marketing efforts has contributed to a disconnect between its foundational strengths and market visibility. Some analysts reportedly avoided including Kaspa in comparison reports, indicating a gap between market perception and the underlying technological and economic fundamentals of the project.

Technological Roadmap Adds Long-Term Strategic Growth Catalysts

Kaspa’s technology pipeline is set for significant upgrades that could enhance network utility and increase demand for its native token, KAS. An anticipated open-source Layer Two solution is expected to foster growth in Kaspa’s decentralized finance ecosystem, with KAS serving as the gas token for applications on this network.

This vision positions Kaspa not just as a fast proof of work blockchain but as a core layer for decentralized finance, potentially altering its role in the cryptocurrency sector and impacting its long-term price trajectory.

Experts Emphasize Kaspa’s Unique Risk-Reward Dynamics

The investment profile of Kaspa is characterized as asymmetric, with limited downside risks and significant upside potential, according to experts. Skibum Trading highlights this as an “asymmetric bet,” supported by historical pricing trends and projected technological advancements.

For strategic long-term investors, Kaspa presents a unique opportunity, circumventing common challenges faced by venture-backed tokens and positioning itself for growth in decentralized finance. Continuous accumulation is advised for patient investors, as market recognition is anticipated to align with its strong fundamentals.