Capital Shifts Focus to High-Utility Networks in Crypto Markets

The 4th quarter of 2025 is seeing a shift in capital as investors move away from weaker narratives towards more robust blockchain utility. Initiatives showcasing genuine adoption, rapid execution, and robust scalability are currently drawing in liquidity from both institutional and retail investors.

Momentum is increasingly leaning towards networks that provide tangible benefits, particularly in terms of transaction speed and cost-effectiveness. In this dynamic landscape, Kaspa stands out as traders assess the most promising avenues for enduring long-term growth.

Kaspa’s DAG Architecture Enhances Network Efficiency

Kaspa utilizes a Directed Acyclic Graph (DAG) framework, allowing for swift confirmation times even in periods of significant network congestion. This technology supports its standing as a swift and dependable blockchain, bolstering investor confidence during bullish market trends.

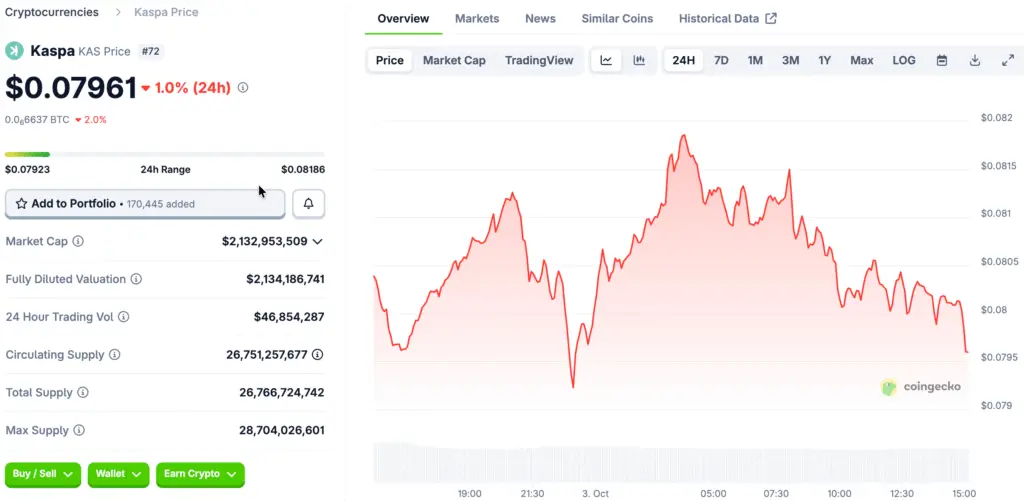

Currently priced at $0.078, Kaspa continues to attract significant interest from users looking for minimal fees and impressive transaction speeds. The network maintains its efficiency even during peak times, reinforcing its position as a viable blockchain option compared to slower alternatives.

Market Structure Shows Strength Through Higher Lows Formation

Kaspa’s price movement shows strength, consistently creating higher lows even in the face of competitive challenges and issuance obstacles. This behavior indicates that there is growing buying pressure lurking below the surface, typically foreshadowing notable bullish momentum shifts.

Traders pay careful attention to these structural patterns, seeing them as early signs of potential upward price movements. Kaspa’s capacity to uphold a positive structure during times of volatility solidifies its position as a compelling option for investments in Q4.

Recommended Article: Kaspa Analysts Highlight Key Edge Driving Long Term Growth

Investor Interest Grows As Liquidity Chases Scalable Solutions

Liquidity tends to flow toward scalable blockchain solutions that can effortlessly manage real-world transaction volumes. Kaspa aligns perfectly with this narrative, delivering speed and efficiency that strongly appeal to both active traders and developers.

Institutional participants are increasingly acknowledging that scalability is a vital factor that sets them apart during periods of market expansion. The increasing acknowledgment of this trend is attracting capital investments into networks such as Kaspa, which reliably provide significant performance benefits.

Kaspa’s Momentum Strengthens Amid Broader Crypto Market Rotation

The wider cryptocurrency landscape is experiencing a shift, favoring initiatives that showcase real-world applications rather than mere speculative excitement. Kaspa’s emphasis on throughput and cost efficiency strategically positions it to attract capital from the changing investor landscape.

As less compelling narratives diminish, high-performing networks rise to prominence in technical discussions and portfolio allocation strategies. This change in momentum highlights Kaspa’s increasing recognition among analysts who are pinpointing high-performing assets for the rest of 2025.

Analyzing Other Popular Q4 Crypto Initiatives

Worldcoin emphasizes identity and payment solutions, Pi Coin is deeply rooted in community engagement and Remittix aims at enhancing payment infrastructure. In contrast, Kaspa sets itself apart with its technological execution, focusing on speed and network efficiency rather than speculative themes.

In contrast to other projects grappling with regulatory, adoption, or development challenges, Kaspa’s foundational architecture provides clear and immediate functional benefits. This distinction boosts its appeal to traders looking for robust fundamentals paired with evident technological differentiation.

Kaspa Positioned As A Strategic Long-Term Investment Opportunity

Analysts are increasingly pointing out that Kaspa stands out as a highly attractive long-term investment opportunity in the blockchain space this quarter. The blend of technical scalability, resilient market structure, and growing liquidity flows bolsters a positive investment outlook.

For those focused on practical value and long-term growth, Kaspa stands out as a reliable option compared to tokens driven by speculation and hype. As Q4 progresses, keeping an eye on performance-driven stories could benefit those who act swiftly and strategically align with Kaspa’s growing momentum.