The crypto market is facing heightened volatility, with assets like ASTER and XRP bleeding recent price gains. Seeking the best altcoins to recover losses, many investors are turning their attention to the PayDax Protocol (PDP) for the way it democratizes access to stablecoin loans.

Keep reading to discover why analysts praise PayDax’s DeFi ecosystem, and why PDP is tipped to outperform ASTER and XRP with 8000% gains in the coming months.

ASTER extends weekly losses to 35%

Like many altcoins, Aster initially benefited from Bitcoin’s recent ATH, climbing over 10% overnight. However, Aster’s upward momentum has been overturned, and it now trades for $1.30 amid the broader market crash. This represents 35.1% losses on its 7-day chart.

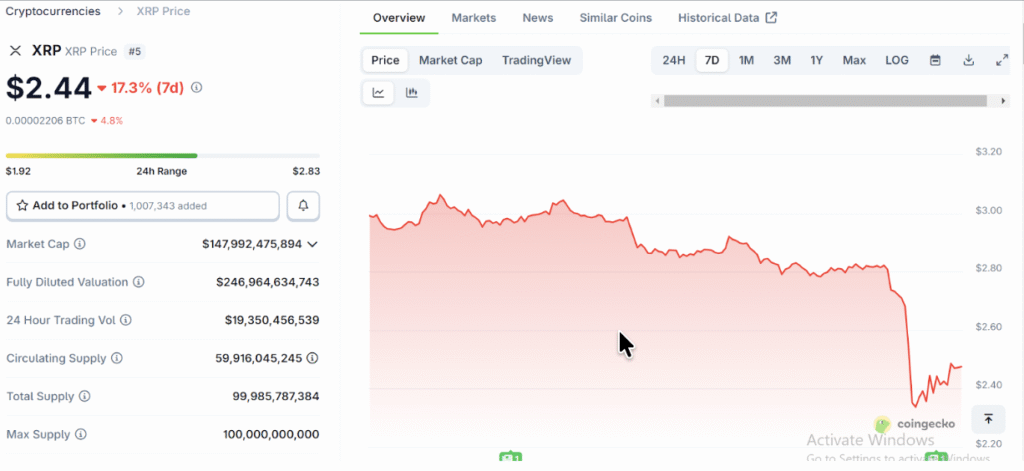

XRP Price 7-day losses extend to 12%

The XRP price is down in the second week of October, mirroring downturn momentum across the broader altcoin market. At the time of writing, XRP trades for $2.44, representing 17% sell-offs over the previous week.

Looking ahead, investors are projecting when the XRP and ASTER price recovery will occur. According to one prediction, if Bitcoin returns to the $120k psychological mark, high potential tokens like XRP and Aster could rally 20% before December.

Get Liquidity Without Selling Your Blue-Chip Tokens

Crypto holders often face the choice of selling blue-chip tokens for quick cash or holding them long-term, risking a shortage of capital. But that was until PayDax came into the picture.

Paydax Protocol (PDP) allows users to collateralize their crypto assets, such as XRP and ASTER, receiving high-value stablecoin loans. This means a trader can access funds without having to sell their possessions.

What’s more, Paydax does not limit tokenization to cryptos. Users may also collateralize high-value Real-World Assets (RWAs) such as luxury watches, diamonds, or fine artwork, turning idle stores of wealth into an active, liquid source of capital.

High-Yield Opportunities for Lenders and Stakers

Through its P2P lending ecosystem, Paydax Protocol (PDP) offers attractive high-yield opportunities for network participants. For example:

- Lenders earn up to 15.2% Annual Percentage Yield (APY), far surpassing payouts on deposits.

- Stakers can earn up to 20% APY for insuring loans on the network.

- Leveraged stakers earn up to 41.25% rewards using advanced yield farming strategies.

Could the PDP token Surge 8000% in 2026

To bridge the gap between DeFi and RWA, PayDax partners with internationally-recognized custody providers. For instance, Sotheby’s and Brinks help secure all user collateral. While the dApp v.1 uses chainlink oracles to prevent any mispriced deals.

In addition, the team is fully doxxed, separating PayDax from crypto projects that operate anonymously.

These factors, combined with the trajectory of RWA tokenization by 2026, are pushing the spotlight to PayDax’s ongoing presale. With $1m raised, stages are selling out fast as investors rush to capitalize on the 25% token bonus available using the code PD25BONUS.

At the time of writing, PDP is available for the low entry of $0.015. However, analysts say a listing on tier-1 exchanges could propel PDP to $1.2 in the next three months. If this holds, it would mean over 8000% gains for investors who enter PDP from this very moment.

Join the PayDax Protocol (PDP) presale Today

Join Paydax Protocol (PDP) presale | Website | Whitepaper | X (Twitter) | Telegram