Robinhood Listing News Spurs ONDO Rally

Robinhood has provided a strong signal that a listing of Ondo Finance (ONDO) may be imminent by adding a dedicated landing page for the token on its website. This development has sparked a significant rally for the price of ONDO, which is one of the leading tokenization platforms. The landing page hints at trading coming soon and gives ONDO exposure to a mainstream audience, including retail users in the U.S. and Europe. The addition of ONDO was reportedly intercepted by tracking bots, although Robinhood has not yet made an official announcement. This potential listing could be a major catalyst for ONDO, opening it up to millions of new investors and solidifying its position in the market.

Vlad Tenev and the Push for Tokenization

The news of a potential Ondo Finance listing on Robinhood aligns with the recent comments from Robinhood’s co-founder, Vlad Tenev. Tenev has publicly expressed his support for tokenization as a sustainable trend, rather than just a fleeting fad. He has also voiced his expectation to offer tokenized private equity and real estate through Robinhood, a move that would bridge traditional finance with the digital asset world. Ondo Finance, with its focus on bringing global markets on-chain and offering convenient ways to trade equities and other real-world assets (RWAs), is a perfect fit for this vision. The project already offers tokenization of T-bills from Franklin Templeton and Wisdom Tree, demonstrating its established presence in the tokenization space.

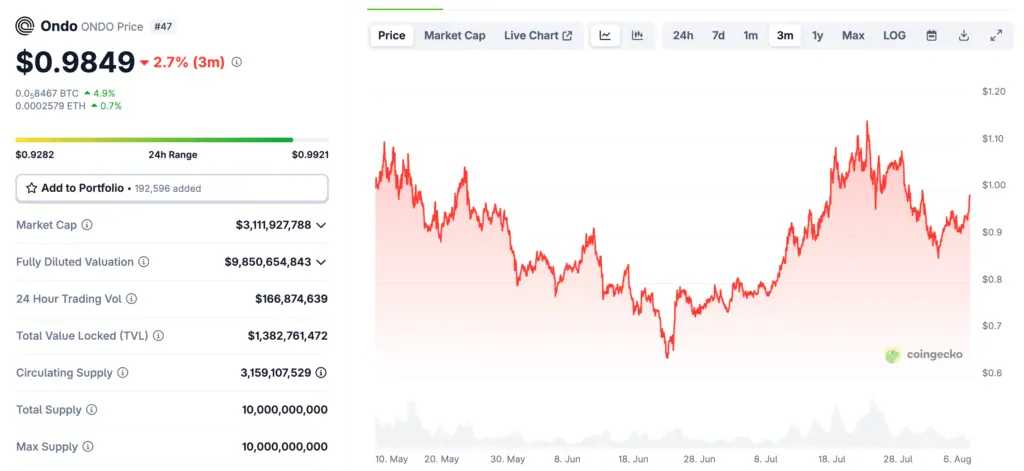

ONDO’s Price Movement and Market Dynamics

ONDO has been trading with increased volatility over the past three months, but recent news has helped it regain momentum. The asset inched closer to the $1 price level, adding 7% for the past day and trading near a one-week high.

A significant factor in its recent performance is the growing activity against the Korean won, which accounts for over 27% of its trading volume on exchanges like KuCoin. This strong interest from the South Korean market has provided a significant boost to ONDO’s price. However, the lack of an official public announcement from Robinhood has kept the rally somewhat muted, with the market awaiting confirmation to propel ONDO past the psychological $1 price point.

Institutional Interest and Ecosystem Development

Ondo Finance is quickly becoming a key infrastructure provider for tokenization, with the potential to set the standard for tokenized asset classes. The project has already participated in the production of experimental Ethereum tokens backed by public companies, bearing an “Ondo Tokenized” tag. The project’s exposure also grew significantly after Trump’s World Liberty Fi added ONDO tokens to its portfolio. These developments underscore a growing institutional interest in ONDO as a bridge between traditional and decentralized finance. The project’s commitment to building out its ecosystem, including the Nexus platform for tokenizing T-bills, positions it as a significant player in the evolving landscape of real-world asset tokenization.

Staking and Supply Metrics

One of the big problems for Ondo Finance is that it arrived during the 2021 wave of new projects with a low float. The platform raised $46 million in several rounds and public presales. As of August 2025, over 66% of the ONDO supply is still vested and awaiting scheduled cliff unlocks. The next significant unlock for ONDO is scheduled for early 2026, with most of the coins intended for ecosystem development. This vesting schedule is a crucial factor in managing supply and preventing a sudden price drop, as it ensures a gradual and controlled release of tokens into the market. It also signals a long-term commitment from the project team, building confidence among investors.

ONDO’s Place in a Growing Crypto Market

ONDO’s rally is part of a broader trend where innovative tokens are gaining traction as the market matures. The project’s unique focus on real-world asset (RWA) tokenization, a narrative that is gaining significant steam, sets it apart from traditional cryptocurrencies.

Its ability to attract major partners like Robinhood and its strong trading activity in key markets like South Korea indicate a growing demand for its services. As the crypto market continues to evolve, projects like ONDO, which combine a clear value proposition with institutional interest and a dedicated development roadmap, are likely to be at the forefront of the next wave of innovation.

ONDO’s Path to $1

Ondo Finance is well-positioned to ride the momentum from a potential Robinhood listing, which would expose it to a massive retail investor base. With its price inching closer to the psychological $1 level, the market is on high alert for an official announcement. ONDO’s strength is rooted in its real-world asset tokenization model, institutional interest, and strategic partnerships.

While the token faces challenges from its supply vesting schedule, its unique position at the intersection of traditional finance and crypto, combined with growing market visibility, presents a compelling case for a significant price surge. The coming weeks will be crucial in determining whether ONDO can capitalize on these developments and break through to a new price level.

Read more: ONDO Finance Leading Real-World Asset Tokenization