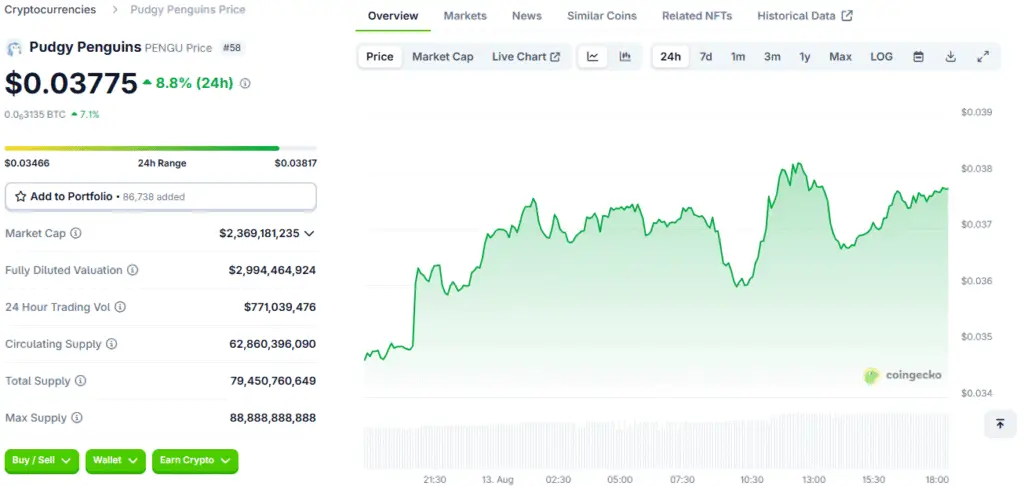

PENGU’s All-Time High Followed by an 11% Correction

The PENGU token, a major player in the Solana meme coin ecosystem, recently experienced a significant price drop. After reaching an all-time high of over $0.048, its price fell by more than 11%, a decline that was fuelled by a combination of factors. The primary contributors to this sell-off were large-scale liquidations by “whales” and a general market sentiment that pointed to a potential continuation of this downtrend.

The correction followed a period where PENGU had flipped all other Solana meme coins by market capitalisation, suggesting that some profit-taking was inevitable. This volatility, however, appears to be a short-term market correction rather than a long-term trend reversal, as a number of key indicators are now pointing to a potential rebound.

Insider Wallets and the CPI Data Spark

The price decline was initially triggered by a wave of selling from insider-linked wallets. On-chain analysis revealed that a staggering $66 million worth of PENGU had been moved to exchanges since mid-July, as early investors took profits. This selling pressure was exacerbated by a general market tension in the lead-up to the latest CPI data release. During this period, liquidity was pulled from most altcoins, except for Ethereum, due to a broader market dominance by Bitcoin.

However, the release of the CPI data, which showed annual inflation was less than the expected 2.8%, was a crucial turning point. The positive macroeconomic news sparked a buying resurgence across the market, providing a much-needed lifeline for PENGU and other altcoins that were in a correction phase. This suggests that the decline may have been more a reaction to market uncertainty than a fundamental weakness in the token itself.

Seller Dominance and a Potential Reversal

While the price has dropped, the underlying market dynamics are now suggesting a potential reversal. According to CoinGlass data, the long/short ratio for PENGU was 0.94, with sellers dominating by 52%. However, this is a much less dramatic imbalance than a similar scenario in the past, where seller dominance dipped to a ratio below 0.90 before rising sharply.

The fact that the funding rates on most exchanges have been turning positive is a significant sign that buyers are making their way back into the market. A positive funding rate indicates that the price of the perpetual future is trading above the spot price, and short position holders are paying long position holders to keep their positions open. This suggests that the market sentiment is shifting back towards a bullish outlook, and the recent price drop could be short-lived.

Declining Open Interest and Volume

The recent price correction for PENGU was accompanied by a noticeable decline in key market metrics. The open interest, which is the total number of outstanding derivative contracts that have not been settled, fell from a high of $607 million on July 24 to $464 million. This drop indicates that a number of positions were closed, which is common during periods of high volatility.

Similarly, the trading volume was also hit, falling from over $5 billion in mid-July to just over $1.07 billion at the time of writing. While these figures may seem negative, they are a normal part of a price correction. The fact that funding rates are now turning positive suggests that this decline may be bottoming out and that new capital is now entering the market, setting the stage for a new rally.

The Symmetrical Triangle Pattern

On the daily price chart, PENGU has been forming a symmetrical triangle pattern over the past few weeks. This is a technical analysis pattern that is often seen during periods of consolidation before a major price move. The price is currently bouncing off the diagonal support level of this formation, a move that was anticipated by a prominent analyst on X. The ultimate test for a bullish flip will be for PENGU to break above the declining resistance of this triangle.

A failure to do so could result in further consolidation or even a drop below the formation. However, the fact that the price bounced off the support level and is now trending sideways around its recent highs is a positive sign. This pattern has historically signalled a bullish continuation on the charts, suggesting that the recent drop may be a temporary pause before the next major move.

A Controlled Correction A Sign of Strength

The price drop for PENGU, while significant, was a controlled correction rather than a full-blown panic. The lack of volume during the selloff indicates that the rotation of capital was measured and not a mass exodus of investors. This is a key distinction, as it suggests that a strong base of long-term holders remains committed to the project. The fact that the token is now ranging around its highs, despite the correction, is a sign of underlying strength.

In the past, such patterns have historically signalled a bullish continuation. The confluence of positive macroeconomic data, a shifting sentiment among traders, and a compelling technical chart pattern all point to a high probability that PENGU’s recent drop is a temporary setback before the next major price rally.

PENGU’s Bullish Setup Awaiting a Breakout

The stage is now set for a potential bullish flip, but the ultimate test for PENGU will be its ability to break above the declining resistance level of its symmetrical triangle pattern. While the price has found a floor and is showing signs of a reversal, the slow movement to the upside suggests that sellers may still have some control. The confluence of bullish indicators, including reduced exchange reserves, positive funding rates, and a favourable macroeconomic climate, creates a powerful narrative for a new rally.

The coming days and weeks will be crucial as the market determines whether PENGU has the sustained buying pressure needed to break through this resistance and begin its next parabolic phase. For investors, the current moment is a classic accumulation period, with all eyes on the chart, waiting for a definitive breakout.

Read More: PENGU Price Surge A Robinhood Listing Fuels Growth