Pi Network’s Price Slips Amid Mainnet Concerns

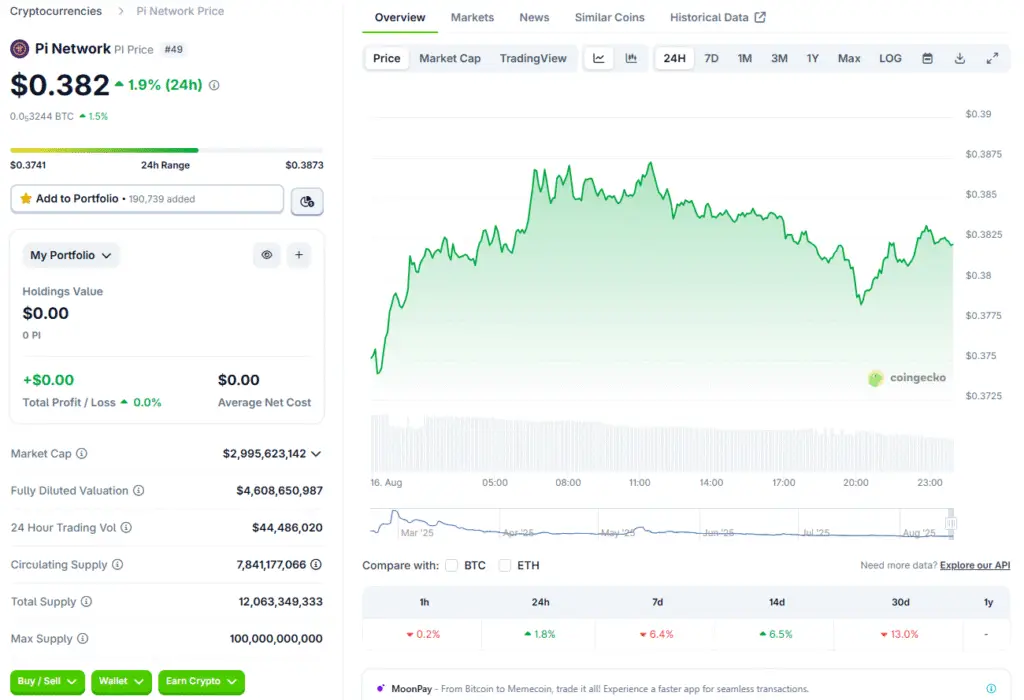

The Pi Network (PI) is once again making headlines, but the news is not as positive as many of its investors had hoped. Currently trading at $0.3844 with a $3.01 billion market cap, the token has slipped 5.11% in the past week, raising fresh concerns about its long-term outlook. The most pressing issue is the project’s unlaunched Open Mainnet.

For years, the project has remained in its enclosed mainnet phase, which prevents coins from being freely traded on global exchanges. Without this crucial transition, Pi lacks true liquidity and reliable price discovery. This has led to a great deal of frustration within the community, as millions of users have been waiting for years to be able to trade their mined tokens.

Limited Utility Despite a Massive User Base

A cryptocurrency’s value is ultimately tied to its real-world use cases, but Pi still struggles to deliver meaningful adoption. Although the project boasts a massive user base and has a number of decentralised applications (dApps) within its ecosystem, most of these dApps remain underdeveloped or lack active user engagement.

Experts caution that unless Pi can demonstrate tangible progress with its dApp economy and peer-to-peer functionality, its large user base alone won’t be enough to sustain its value in the long run. The project has yet to prove that it can build a robust ecosystem that provides a compelling reason for users to engage with the network beyond the act of mining. The lack of utility is a significant red flag that is causing many investors to be cautious about its future.

Centralisation and Transparency Issues

Another major concern for the Pi Network is its centralised governance. One of the core principles of blockchain technology is decentralisation, which means that no single entity has control over the network. However, the Pi Core Team retains significant control over the project’s development, which has raised questions about its transparency. Reports of a foundation wallet holding a large portion of the supply have only fueled this scepticism.

Without a clear path to decentralisation, critics warn that Pi risks being vulnerable to manipulation by a small group, which undermines investor trust and its long-term viability. The lack of transparency and a clear governance model is a major issue that the project must address if it hopes to be taken seriously as a decentralised cryptocurrency.

The Risk of Selling Pressure from Unlocks

If Pi eventually transitions to an open mainnet, a new set of risks will emerge. Millions of tokens that have been mined by early adopters could suddenly hit the market. This influx of supply may trigger sharp selling pressure, eroding prices just as they begin to trade freely. The slow Know Your Customer (KYC) verification process has also created a bottleneck, leaving millions of users unable to migrate their tokens.

If and when this bottleneck is resolved, it could lead to a massive wave of new sellers, which could cause a major price drop. This is a significant risk that investors must consider, as a sudden influx of supply could wipe out the gains that have been made during the presale phase.

Fraud and Scams Plague the Ecosystem

Concerns about the Pi Network are not limited to technical delays and centralisation; there are also a number of issues related to fraud and scams. Authorities in China have previously flagged fraudulent schemes that exploit Pi’s brand, with scammers luring victims by promising free mining via smartphone apps and encouraging them to recruit others for referral rewards.

In multiple cases, elderly individuals were persuaded to hand over personal data and even pension funds, only to discover it was a scam. These warnings underscore the importance of investor vigilance, especially as the hype surrounding the project continues to outpace its real progress. The existence of these scams is a major red flag that the project has not been able to address, and it is a major reason why experts are warning investors to be cautious.

A High-Risk Bet Without a Clear Path

With a $3.01 billion market cap and one of the largest user communities in crypto, the Pi Network clearly commands attention. However, until the project launches its Open Mainnet, addresses its KYC backlogs, and proves real-world utility, experts say it remains a high-risk gamble. Price predictions for 2026 vary wildly, from bullish calls above $5 to bearish outlooks under $1, but all agree on one thing: without a clear path to decentralisation and adoption, Pi is far from fulfilling its “next Bitcoin” narrative. The project has a lot of potential, but it has yet to prove that it can overcome the challenges that have plagued it for years.

Pi Network Scam Warnings and Market Risks

The fraud and scams associated with the Pi Network are not an isolated phenomenon but are part of a broader trend in the crypto world. As the market has grown, so have the number of scams that are designed to trick investors. These can take many forms, from simple phishing scams to more elaborate schemes that use social media and a network of fake accounts to lure in victims.

The warnings about the Pi Network are a good reminder that investors must always do their own research and be vigilant about the projects they invest in. The crypto market is still largely unregulated, and while this can lead to opportunities for growth, it also comes with a higher degree of risk. The best way to protect yourself is to be educated and to be cautious about any project that promises a high return with a low barrier to entry.

Read More: Pi Network Token Plunge, Lockup Controversy, and Unlocks