Pi Network’s Vision for Financial Connectivity

By making its infrastructure operate with ISO 20022, the universal standard for financial messaging, Pi Network is making a big move onto the global financial arena. This step shows how serious the project is about closing the gap between decentralized finance (DeFi) and traditional banking systems. This will make it possible for institutions to trust each other and for transactions to happen across borders.

ISO 20022 gives the technological and legal support needed to connect blockchain-based payments with traditional financial institutions in a time when interoperability is what makes financial systems relevant. Pi Network’s dedication to this framework shows that it has changed from a cryptocurrency that was run by the community to a payment network that is ready for regulation and works with people all over the world.

What Pi Network Needs to Know About ISO 20022

ISO 20022 is a standard protocol that enables global payment systems to securely and efficiently share transaction data. Pi Network, if it follows ISO 20022, could enable Pi transactions to communicate directly with global banking networks, allowing Pi to function as both a digital money and a recognized financial entity.

This would enable transactions to be more legitimate, faster, and transparent. Pi Network is not only improving its technology but also preparing to integrate into the global financial system, making it one of the few blockchain initiatives that can meet regulatory and institutional criteria.

Pi Network Pursues ISO 20022 Compliance to Strengthen Global Trust

In today’s regulatory environment, compliance is crucial for long-term success. Pi Network’s ISO 20022 compatibility demonstrates its readiness to follow global financial rules, providing credibility and transparency. Standardized message formats and reporting mechanisms make Pi more trustworthy with regulators, auditors, and financial partners.

This proactive approach sets Pi Network apart from projects that don’t follow rules, demonstrating its ability to expand within a controlled, trustworthy, and legally recognized framework. This proactive approach sets Pi Network apart from other crypto platforms.

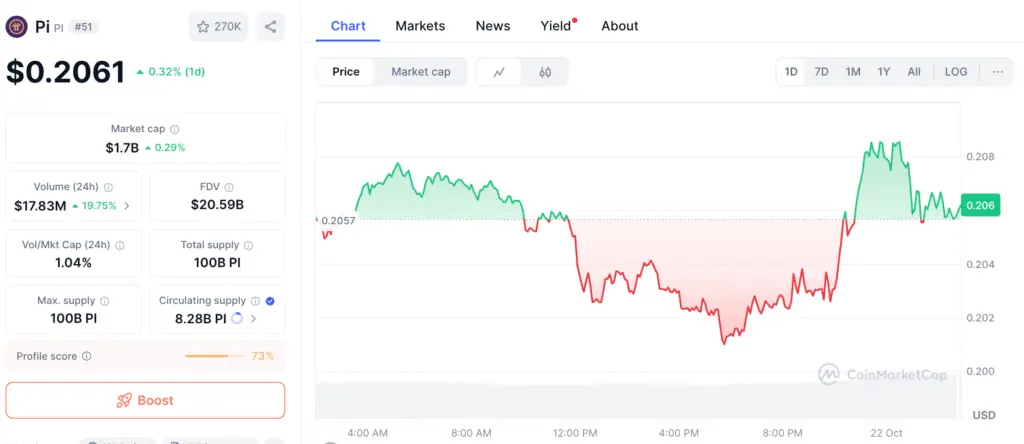

Recommended Article: Pi Network Chart Shows Bullish W-Pattern and $0.23 Breakout

Bridging Traditional and Decentralized Finance

Pi Network’s ISO 20022 plan aims to integrate traditional finance and decentralized ecosystems, enabling seamless communication between banks, payment processors, and fintech platforms. This could make money transfers across borders faster and cheaper, contributing to Pi’s goal of financial inclusion.

The project also enables collaboration between governments and businesses to develop blockchain-based payment systems compatible with existing banking APIs. Compliance with ISO 20022 could transform Pi from a small-scale cryptocurrency initiative into a universal settlement layer for digital transactions.

First-Mover Advantage Ahead of the 2025 Transition

Pi Network’s action is well-timed. By 2025, ISO 20022 will be the global messaging standard for cross-border payments. Major financial organizations, including SWIFT, the European Central Bank, and the U.S. Federal Reserve, will all use it.

Pi Network’s early compliance provides it a first-mover advantage since it can connect with existing banking systems before most of its competitors even start to adapt. This insight puts Pi in a good position to be a leader in the next phase of digital financial convergence. It can bring banks and fintechs straight into its ecosystem.

Technical Implications and Ecosystem Growth

The Pi Core Team is also working on APIs, compliance modules, and reporting layers that follow structured financial data formats as part of their attempts to harmonize with ISO 20022. These upgrades will probably happen at the same time as Pi’s wider release of capabilities that make it easier to use crypto and fiat money together, settle transactions across borders, and keep track of transactions in real time.

This structure will help developers by giving them a common way to design financial dApps, which will make it easier to connect to current banking systems. The move may also bring in institutional developers who need compliant infrastructures to run big apps.

Global Impact: A Step Toward Mainstream Finance

Pi Network aims to meet ISO 20022 standards, demonstrating that cryptocurrency can become a real-world financial solution for investors, regulators, and consumers worldwide.

If successful, Pi could be one of the first blockchain networks to operate in the same regulatory and communications context as global banks, transforming the way people view and use digital assets. This alignment could mark a new era in understanding decentralized technology and traditional banking, combining compliance, accessibility, and innovation.