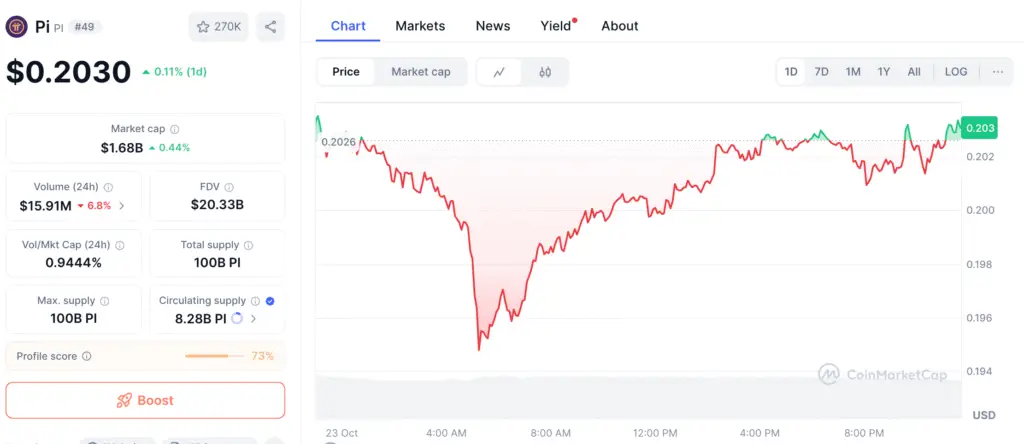

Pi Network Holds Key Support Above $0.20

Pi Network (PI) is still holding the $0.20 psychological level, which is an important support zone that has kept losses from getting worse as the market has been more volatile. The token traded just over $0.2000 on Thursday, staying in a narrow range and making a descending triangle pattern on the 4-hour chart.

As the price action gets closer to the top of the triangle, this structure, which has lower highs versus a flat support base, suggests that a breakout is coming. Analysts say that if the price breaks through resistance, it might start a short-term rise. On the other hand, if it doesn’t maintain support, it could start further selling pressure.

Pi’s KYB Policy Tightens Circulating Supply Amid Major Token Outflows

New on-chain data shows that demand is getting stronger on controlled exchanges (CEXs). PiScan says that more than 1.32 million PI tokens left exchange reserves in the last 24 hours. This is a big outflow that makes it harder to sell right away.

This trend normally comes before prices go higher, because a decrease in exchange supply usually means that long-term holders or institutional investors are buying more. The Pi Network’s Know Your Business (KYB) rules, which only allow verified businesses to be listed, further limit the circulating supply. This makes it harder for prices to stay stable when there are outflows.

Surge in Large Transactions Reflects Growing Adoption

At the same time, PiScan data showed two significant payments of around one million PI each happening during the same 24-hour period, about $200,000 for each transfer. These changes point to more activity in the ecosystem and more use of tokens. This might be because of developer testing or merchant integrations in Pi’s growing payment system.

Analysts see these big transactions as signs of real ecosystem participation. This supports the idea that Pi Network’s internal economy is slowly becoming better, even if there isn’t much access to outside exchanges.

Recommended Article: Pi Network Moves Closer to Global Finance With ISO 20022

Technical Setup: Triangle Breakout Approaches

From a technical point of view, the price structure of Pi Network is still stuck between a support level of $0.1919 and a resistance trendline that is going down. The first time the baseline support was set up was on October 11. This was the start of the present triangle pattern.

The fact that prices keep bouncing back from this level and the lengthy lower candle wicks show that buyers are quite strong in this area. A strong closing above the Pivot Point at $0.2086 after four hours would indicate a bullish breakout and might push the price up to the R1 resistance at $0.2249. If momentum picks up, traders can look for a short-term move up to the $0.24 area, where there was a consolidation earlier this month.

Pi Network Indicators Flatten as RSI Nears Neutral and MACD Stabilizes

Momentum indicators are starting to show hints of recovery. The Moving Average Convergence Divergence (MACD) has started to flatten down, even though it is still below the zero line. This means that bearish momentum is slowing down. The Relative Strength Index (RSI), on the other hand, is at 41 and is moving toward the neutral zone around 50. This shows that purchasing interest is slowly rising.

If the RSI crosses the midline at the same time as a MACD bullish crossing, it might mean that the upward strength is back, which would support the breakout theory.

Downside Risks Stay if Support Fails

Even while the technical picture is becoming better, traders are still wary of a false breakout. If PI can’t hold the $0.1919 base, it might break down to the downside, with the S2 Pivot Point at $0.1732 being the objective. This move would bring prices back to previous local lows, which would make the bullish setup useless.

But experts say that solid on-chain measures and recent withdrawals from exchanges give a fundamental buffer that might stop losses from continuing until macro sentiment gets worse.

Pi Network Nears End of Consolidation as Buying Momentum Strengthens

Pi Network’s price prediction is cautiously positive as it approaches the end of its consolidation period. Exchange outflows, payments, and stabilizing technical indicators suggest purchasing momentum is gathering. If the price breaks over $0.2086, momentum traders may expect a rise towards $0.22–$0.24.

However, maintaining support above $0.20 is crucial for recovery. Pi Network’s next move could set the course for 2025, as market liquidity increases and adoption signals strengthen. This calm consolidation could initiate a mini bull cycle for the PI token.