PowerBank Embraces Bitcoin as a Strategic Reserve Asset

PowerBank Corporation, a company at the forefront of clean energy development, has announced a groundbreaking new treasury strategy that marks a significant pivot towards digital finance. This innovative approach involves adding Bitcoin to its balance sheet, a move that aligns the company with a growing trend of publicly traded firms using the world’s leading cryptocurrency as a strategic reserve asset.

The decision to hold Bitcoin is not a speculative one; it is a calculated move to tap into the long-term value of a decentralised, deflationary asset. PowerBank has also forged a key partnership with Intellistake Technologies Corp., a company specialising in blockchain and digital asset management. This collaboration provides PowerBank with the necessary technical and custodial support to execute its new strategy while maintaining its unwavering commitment to environmental responsibility and sustainability.

Pioneering Clean Energy Finance with Bitcoin

The integration of Bitcoin into PowerBank’s financial strategy is a bold statement, especially given the traditional criticism of Bitcoin mining’s high energy consumption. However, PowerBank is approaching this challenge with a unique, sustainable model. The company has publicly stated that all Bitcoin acquisitions will be financed using net cash flow generated from its verified renewable energy sources. This indirect yet powerful link aims to address environmental concerns and demonstrate that Bitcoin can be a driver for clean energy growth.

This approach is supported by research from organisations like the Energy Web Foundation and the Cambridge Centre for Alternative Finance, which argue that linking Bitcoin to low-carbon energy sources can transform it from an environmental problem into a valuable tool for grid management. PowerBank’s strategy, by directly tying its Bitcoin purchases to its renewable energy output, positions the company as a pioneer in developing a more sustainable and financially robust model for the energy sector.

A New Duo for Sustainable Innovation

The partnership between PowerBank and Intellistake Technologies Corp. is central to the success of this new treasury strategy. Intellistake is providing a comprehensive suite of services, including technical advice, digital asset security, custody solutions, and blockchain infrastructure. This collaboration ensures that PowerBank can manage its Bitcoin holdings with a high degree of security and autonomy, without the need to rely on third-party custodians or exchanges.

This direct partnership allows PowerBank to maintain full control over its digital assets, a crucial factor for any company entering the volatile and complex world of cryptocurrency. Together, the two companies are exploring not just the use of Bitcoin as a treasury asset but also the broader potential of blockchain to revolutionise the clean energy financing landscape.

Expanding Finance Through Digital Assets

PowerBank’s innovative approach extends far beyond simply holding Bitcoin. The company is actively positioning itself as a leader in linking digital assets with clean energy development. By using net cash flow from its renewable energy projects to acquire Bitcoin, PowerBank is demonstrating a new model for financing. This strategy has already attracted significant attention from ESG-focused investors and the broader crypto community, indicating a growing interest in how developers can leverage blockchain and digital assets in their financing models.

A recent Bloomberg NEF survey, for example, found that roughly 60% of renewable energy developers are actively exploring similar blockchain or digital asset solutions. If PowerBank’s model proves successful, it could become a blueprint for other clean energy companies, inspiring a new wave of financial innovation that accelerates the global transition to sustainable energy.

Tokenization The Future of Energy Investment

Perhaps the most forward-thinking aspect of PowerBank’s new strategy is its commitment to tokenizing real-world energy assets. Through its partnership with Intellistake, the company plans to explore turning physical assets, such as solar farms and battery storage systems, into tradable digital tokens. This process, known as tokenization, has the potential to fundamentally change how capital is raised and how ownership is managed in the energy sector.

It could lead to easier access for a broader range of investors, faster and more transparent transfers of ownership, and new, more flexible ways to raise capital through fractional ownership. As analysts project the tokenized real-world asset market to reach a staggering $30 trillion by 2034, clean energy, with its stable, asset-backed value, is emerging as a prime use case. This strategic move positions PowerBank at the intersection of energy development and the future of capital markets.

The Broader Trend of Corporate Bitcoin Adoption

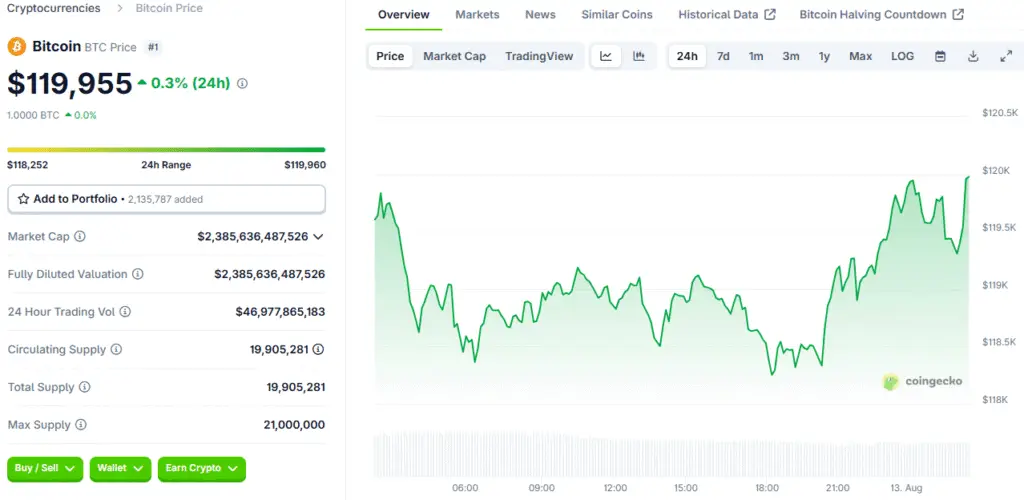

PowerBank’s decision to add Bitcoin to its treasury is part of a broader corporate trend that has gained significant traction. Companies like MicroStrategy, Block, and Tesla have all added Bitcoin to their balance sheets to diversify their reserves beyond traditional bonds and cash. These firms view Bitcoin as a scarce asset with a limited supply of 21 million coins, making it an appealing hedge against inflation and economic uncertainty.

Its decentralised nature and global liquidity also make it an ideal strategic reserve asset for the digital age. PowerBank’s commitment to transparency, stating it will openly report its future Bitcoin holdings, is also in line with the evolving best practices for publicly traded companies entering this space. While the company has not yet confirmed any specific purchases, its strategy outlines a flexible, market-based approach that prioritises financial prudence and long-term value creation.

PowerBank’s Strategy: Bitcoin Treasury and Asset Tokenization

Ultimately, PowerBank’s new approach represents a new model for clean energy finance. By integrating a multi-pronged strategy that includes holding Bitcoin as a treasury asset and exploring the tokenization of its physical assets, the company is demonstrating a new frontier for both decarbonisation and financial technology. With over 100 megawatts of renewable energy projects already developed and a pipeline of about 1 gigawatt, PowerBank has a solid foundation to test and prove the viability of these new financing methods.

The company is using its steady revenue stream from renewable energy to invest in digital assets, creating a virtuous cycle that links clean energy with advanced financial technologies. As the demand for sustainable, high-yield investment options grows, PowerBank’s forward-thinking strategy could open up entirely new value opportunities in both the energy and finance sectors, potentially changing the way the world funds its sustainable future.

Read More: Bitcoin Physical Attacks Rising Alarms in the Crypto World