PENGU Consolidates Near Support After Heavy Selling

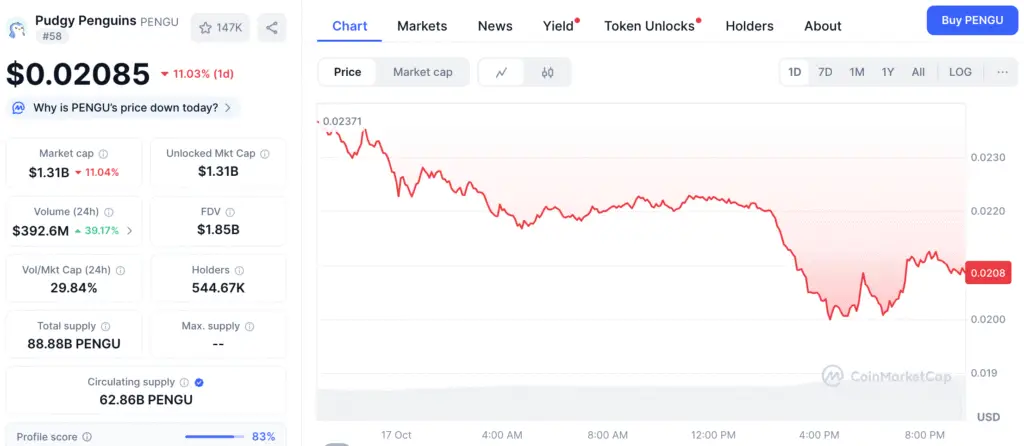

Pudgy Penguins (PENGU) is currently positioned at approximately $0.023, maintaining a position just above an important support level as traders assess the likelihood of a significant breakout or a possible retreat. Following an extended period of selling pressure, the mood in the market continues to be delicate, as the majority of participants are taking a careful approach.

The token’s price movement currently stands at a critical juncture, with momentum indicators signaling oversold conditions. Experts indicate that sustaining support within the range of $0.0225 to $0.0230 is essential for PENGU to initiate a rebound towards significant resistance levels.

Funding Rates Indicate Significant Short Positioning

Recent data from derivatives platforms reveals that funding rates have dropped to almost -40% APR, reflecting a significant bearish sentiment among traders. The current trend of aggressive short positioning indicates that numerous participants are anticipating further declines. However, this also creates the possibility of a short squeeze should the market experience an unexpected reversal.

In the past, these significantly adverse funding conditions have frequently led to pronounced relief rallies, particularly when paired with stable open interest. If PENGU’s price stabilizes around $0.023 amid a crowded short position, a rapid liquidation event could lead to a significant price surge.

PENGU Approaches Crucial Resistance With Breakout Targeting $0.035

At this juncture, $0.026 emerges as a crucial resistance level that could validate a bullish turnaround. The token is currently navigating a narrowing wedge formation, and a decisive breakout above this area may reveal potential upward targets in the range of $0.030 to $0.035, corresponding with identifiable liquidity clusters on the chart.

The token remains confined within a narrowing range, hindered by multiple rejections at descending resistance lines. Nonetheless, wedge compression usually culminates in expansion, indicating that a substantial shift may occur once the existing balance is disrupted.

Recommended Article: Pudgy Penguins Bulls Eye $0.05 Breakout After Holding $0.03

Intelligent Financial Insights Indicate Continued Distribution

Recent on-chain data from Stalkchain indicates that savvy investors have been notably selling PENGU, positioning the token as one of the most frequently offloaded assets in the past 24 hours. This activity indicates that significant investors are cashing out or lessening their stakes, which often signals a potential short-term decline or a period of sideways movement.

Although the signals from savvy investors have diminished the confidence of high-value stakeholders, this does not inherently indicate a long-term negative outlook. Experts interpret this as a phase of distribution, where seasoned investors realize profits before re-entering the market at more favorable prices once accumulation areas develop.

PENGU Faces Persistent Resistance as Bears Maintain Short-Term Control

While there is potential for a short squeeze, it is important to acknowledge that downside risks are still evident. Market technician BRUH points out that PENGU is consistently creating lower highs, remaining constrained beneath descending resistance. Recent price rejections around $0.026, along with sustained closes below $0.024, indicate a prevailing bearish sentiment in the short term.

The subsequent discernible support zone is positioned between $0.020 and $0.018, where there is potential for liquidity to reestablish itself. Market participants anticipate that a revisit to this range could establish a foundation for renewed buying activity, provided that the selling pressure diminishes.

Volume and Momentum Confirm Neutral Bias

Data from BraveNewCoin reveals that PENGU’s trading volume has exceeded $250 million, even with a 4% drop in daily price. The market structure indicates a measured approach to selling, characterized by stability rather than frantic liquidation, suggesting that traders are maintaining vigilance instead of surrendering.

Momentum indicators like RSI and MACD are indicating a lack of strong follow-through from buyers. If the price does not recover to $0.026 in the near future, the outlook for the short term is likely to stay focused on a phase of consolidation or a slow descent within the range of $0.022 to $0.018.

Balanced to Wary Perspective Within Narrow Boundaries

PENGU’s market is currently neutral to cautious due to intense short funding, diminishing investor involvement, and constricting technical frameworks. Experts predict a possible surge in Pudgy Penguins’ price range of $0.030 to $0.035, but a breakdown of existing support could lead to further evaluations around $0.018.

As market participants assess the tension between downward momentum and a sudden rally, PENGU is at a pivotal moment, poised for a potential breakout or another decline before buying interest picks up again.