Evernorth Unveils $1B Treasury to Acquire XRP

Ripple has revealed its backing for Evernorth, a newly listed digital asset treasury aimed at gathering and overseeing XRP reserves. The company is seeking to generate more than $1 billion in net proceeds to acquire XRP from the open market.

The funding round features direct investments from Ripple Labs and co-founder Chris Larsen, along with significant contributions from prominent crypto firms like Pantera Capital and Kraken. The initiative underscores Ripple’s increasing dedication to formalizing XRP’s position within the realm of global finance.

Ripple Leaders Step In as Strategic Advisors

Evernorth will function autonomously while benefiting from strategic guidance provided by prominent Ripple executives, such as CEO Brad Garlinghouse, Chief Legal Officer Stuart Alderoty, and the departing CTO David Schwartz. The advisory partnership aims to synchronize Evernorth’s operations with the overarching objectives of Ripple’s ecosystem.

Garlinghouse highlighted that Evernorth aligns with Ripple’s vision of advancing XRP as a universal settlement asset for payments across the globe. He stated that the initiative would “enhance participation, build confidence, and provide tangible benefits to the XRP ecosystem.”

SPAC Merger to Finance XRP Acquisitions

Evernorth was established as a result of a merger with the publicly traded Armada Acquisition Corp II, a special purpose acquisition company. The agreement is anticipated to finalize in the first quarter of 2026, yielding more than $1 billion in net returns.

Asheesh Birla, the CEO and a former executive at Ripple, stated that the company’s approach combines yield generation from traditional finance with opportunities found in decentralized finance. This combined strategy seeks to produce profits while strengthening XRP’s on-chain liquidity and fostering its adoption.

Recommended Article: XRP Value Comes From Utility, Not Speculation, Ripple Confirms

Broadening Institutional Engagement with XRP

Evernorth aims not just to accumulate but to promote wider acceptance of XRP Ledger (XRPL) technologies. The organization intends to participate in validator operations, provide liquidity, and develop projects within the XRPL ecosystem.

Evernorth aims to establish a centralized treasury supported by institutional backing, positioning XRP as a digital asset of reserve quality. Experts anticipate that this initiative will draw in new institutional players who have historically regarded XRP as less utilized in comparison to rivals such as Bitcoin and Ethereum.

Ripple’s Expanding Network of Support Persists

Ripple has continuously focused on enhancing the practical applications of XRP, particularly in areas such as international transactions, decentralized finance frameworks, and strategic financial collaborations. The recent partnership with security firm Immunefi has initiated a $200,000 “attackathon” aimed at fortifying the forthcoming XRPL lending protocol.

This approach highlights Ripple’s twofold strategy of strengthening infrastructure while strategically allocating capital to enhance XRP’s position in the market as it prepares for the upcoming growth phase. The establishment of Evernorth represents a noteworthy achievement in that journey.

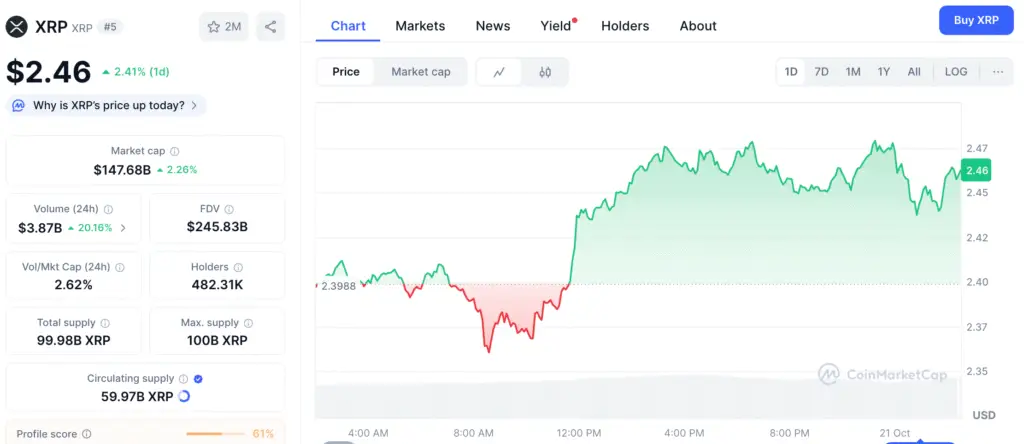

Response of the Market to the Evernorth Announcement

After the announcement, XRP’s price increased by 2%, hitting $2.44, whereas AACI shares experienced a minor decline of 2.5%, settling at $10.21. Market participants viewed the action as a phase of stabilization, fueled by increasing optimism regarding the entry of institutional players.

If successful, Evernorth’s $1 billion treasury will emerge as the largest publicly traded reserve of XRP. Recent initiatives have surfaced, such as Trident Digital’s ambitious $500 million plan to acquire XRP and Webus’s earlier $300 million venture this year.

A Calculated Move for XRP’s Institutional Prospects

Evernorth marks a significant advancement in establishing XRP as a credible digital reserve asset for institutions. The initiative merges financial resources, advisory knowledge, and cross-market collaboration to elevate XRP’s presence on the global stage.

With Ripple’s support and involvement from prominent crypto investors, Evernorth has the potential to enhance XRP’s acceptance in the mainstream and bolster its position in digital finance as the global landscape shifts towards blockchain-based settlements.