Shiba Inu Leadership Ambiguity Raises Investor and Regulatory Concerns

The leadership structure of Shiba Inu remains unclear, raising concerns for investors and regulators. Historical trends indicate that this ambiguity can erode trust and threaten project viability. To mitigate this, Shiba Inu could focus on transparency and compliance with regulatory standards.

Recent surveys indicate that 78% of U.S. investors value visible leadership. Implementing real-time audits, public disclosures, and transparent governance could enhance investor sentiment, foster accountability, and build trust and market credibility.

A Token Burn Strategy Could Drive Scarcity and Value Appreciation

Token burns are a method to reduce supply and potentially increase asset valuations through scarcity. Shiba Inu has burned 41% of its total supply, marking its efforts toward deflationary economics. Experts suggest that organized and consistent burn schedules are crucial for impactful results.

Regular burn events reflect a commitment to value preservation and attract long-term investors, fostering sustainable growth. Effective burn strategies can align incentives, attract new participants, and engage the community in deflationary initiatives.

Shiba Inu Can Reignite Growth Through Engagement and Decentralization

The Shiba Inu community, known for its viral marketing and major exchange listings, has seen a decline in excitement, affecting its competitive edge. Reinvigorating community engagement could harness its marketing prowess and grassroots enthusiasm for development.

The project utilizes decentralized governance through BONE tokens, allowing holders to influence its direction. Improved participation, shared ownership, and community incentives can help restore morale and reenergize the Shib Army’s influence.

Recommended Article: Crypto News Today: Shiba Inu, Pepe Coin, and Magax Lead the Meme Coin Market

Regulatory Compliance Could Attract Institutional Capital in the Future

Clear regulations are vital for the adoption and sustainability of crypto assets among institutions globally. Shiba Inu faces compliance challenges but also significant opportunities if it adapts promptly. The evolving regulatory landscape in Asia emphasizes the benefits of aligning with new regulations.

The introduction of altcoin ETFs indicates regulators’ willingness to support innovative assets within established guidelines. Proactive engagement with regulators can convert challenges into opportunities, potentially enabling Shiba Inu to transition from speculation to a serious player in the financial sector.

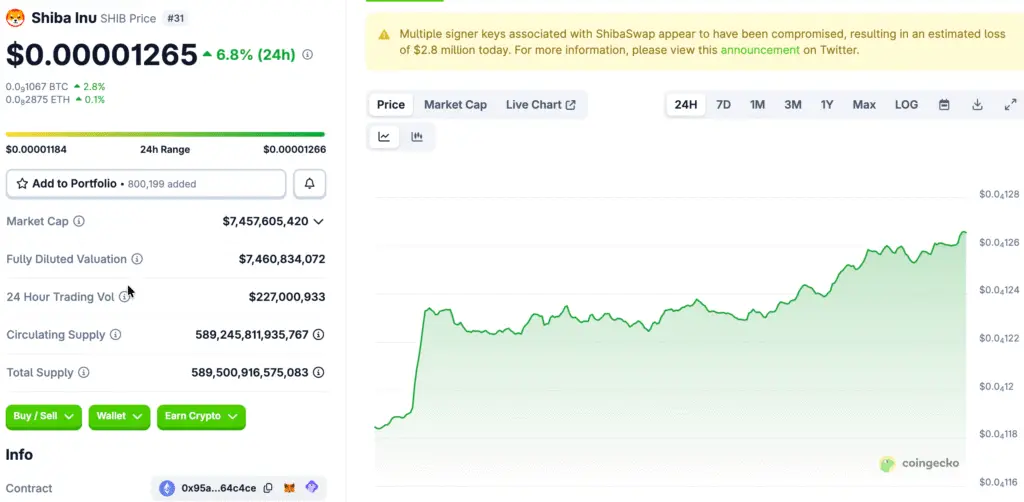

Shiba Inu Security Breaches Expose Ecosystem Weaknesses and Risks

Security incidents such as the Shibarium Bridge hack have undermined user confidence and exposed weaknesses in the infrastructure of the Shiba Inu ecosystem. The team implemented patches and recovery measures; however, fostering long-term trust necessitates clear and systematic improvements in security. Establishing strong security frameworks should be an essential operational priority moving ahead.

Restoring functionality to compromised systems is just the initial step in the journey to reclaiming credibility. Transparent communication regarding security audits, third-party verifications, and accessible communication channels can instill confidence in users. Showing a continuous dedication to safeguarding assets and averting future occurrences can assist in restoring trust among wary investors and doubtful onlookers.

Delivering Promised Ecosystem Products Strengthens Market Perception

The Shiba Inu ecosystem roadmap features bold initiatives such as Shib: The Metaverse and its own NFT marketplace. Nonetheless, ongoing delays and changing priorities have led to investor frustration and diminished market confidence in the team’s ability to execute effectively. Focusing on the timely completion of announced products can showcase maturity and operational seriousness to the wider market.

The effective execution of ecosystem projects will yield practical benefits, boosting long-term value propositions that extend beyond mere speculative trading. Investors are now seeking tangible results instead of endless declarations that lack execution. Finishing flagship products on time may indicate that Shiba Inu is moving away from hype-driven cycles towards sustainable, utility-focused growth strategies.

Strategic Execution Could Position Shiba Inu for a Meaningful Rebound

SHIB, despite an over 86% decline in valuation, retains strong brand recognition and community support. Key recovery strategies include enhanced transparency, organized burn efforts, increased community engagement, regulatory adaptation, improved security, and timely product launches.

The future recovery hinges on the leadership’s ability to align these initiatives with market expectations, potentially transforming Shiba Inu from a diminishing meme token into a serious market contender. Observers suggest that a disciplined approach could restore its relevance in a competitive landscape.