Solana Adds $530M in SOL to Treasury, Signaling Growing Institutional Confidence

Solana surprised the markets by incorporating 2.2 million SOL tokens valued at $530 million into its corporate treasury, indicating a strong commitment from institutional investors. This calculated action reflects previous Bitcoin accumulation tactics employed by prominent companies, highlighting Solana’s increasing recognition as a treasury-grade digital asset.

This decision underscores evolving perspectives within the realm of corporate finance. Established companies are beginning to investigate crypto assets as tools for hedging and sources of innovation, adjusting their strategies to align with new macroeconomic conditions where digital currencies are taking on more prominent roles.

Growing Interest in Solana Among Institutions in Asia

Executive Chairman Joseph Chee has highlighted an increasing surge of institutional interest in Solana across Asian markets. Recent conferences and private investment forums have highlighted SOL, enhancing its reputation beyond mere speculative trading.

This increase signifies a core shift in viewpoint. Solana is transitioning from a developing blockchain ecosystem into a dependable treasury asset, aligning itself with Bitcoin and Ethereum as preferred choices for institutions seeking diversification and innovative strategies.

Liquidity Growth and Market Momentum Strengthen Bullish Outlook

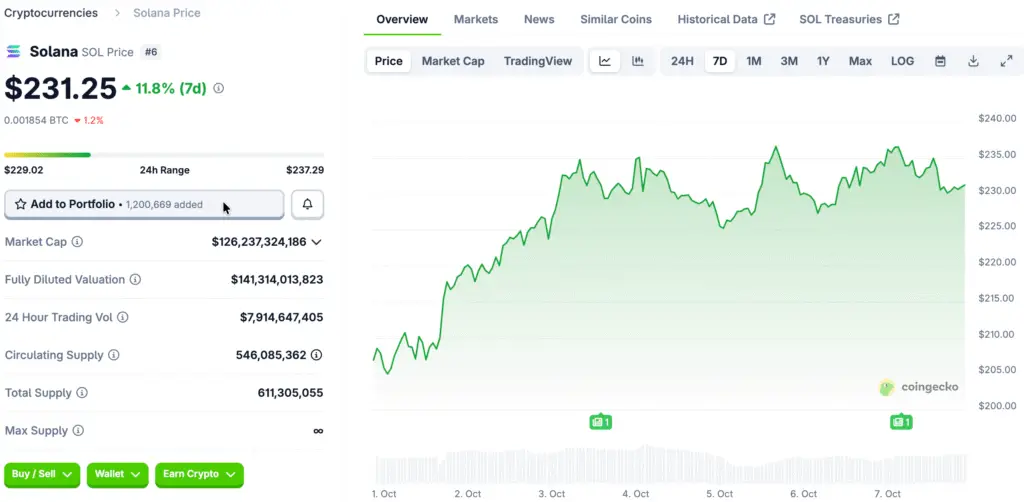

The market dynamics of Solana are swiftly changing in response to this influx of institutional interest. Daily transaction volumes typically reach about 3,500, and the number of active wallets is consistently on the rise. These indicators suggest a growing user base and increasing involvement within the network.

The activity in DeFi strengthens this upward trend. The total value locked (TVL) in Solana’s ecosystem continues to rise, bolstered by staking yields of approximately 7%. Market analysts anticipate a bullish breakout if SOL can sustain daily closes above $247.9, with potential targets set at the $265 and $276 levels.

Recommended Article: Solana Challenges Ethereum in Stablecoin Expansion

Solana Joins Corporate Treasury Strategies as Firms Embrace Digital Asset Integration

The incorporation of Solana into conventional treasury strategies signifies a wider corporate movement towards embracing digital assets. Organizations are integrating cryptocurrencies into their financial structures, weighing potential returns against regulatory obligations.

These changes redefine the way businesses manage liquidity, risk, and innovation. Pioneers are harnessing Solana’s speed and scalability to establish themselves at the leading edge of a swiftly evolving digital economy, merging traditional financial frameworks with innovative blockchain technologies.

Regulatory Complexities Challenge Startups and Institutions Alike

Although significant acquisitions highlight increasing acceptance, the intricacies of regulation continue to pose a challenge. Involvement from institutions brings to light the operational challenges, particularly regarding compliance and cross-border transactions, that both established companies and new ventures need to tackle.

Smaller Web3 companies encounter more intense obstacles. As the need for liquidity increases, effectively maneuvering through diverse regulatory landscapes necessitates strong legal strategies and solid banking partnerships. The constraints outlined here shape the competitive environment for upcoming entrants.

Strategic Planning Essential for Navigating Emerging Market Trends

With the rise in global regulatory scrutiny, it is essential for both large institutions and nimble startups to enhance their strategic planning efforts. Effective liquidity management and transparent compliance mechanisms are increasingly vital for sustainable operations.

Companies leveraging Solana’s growing market presence are adjusting their financial strategies to guarantee stability. The capacity to quickly adjust to changing regulations will distinguish successful individuals from those who fall behind in this competitive landscape.

Solana’s Institutional Surge Marks a Defining Crypto Moment

Solana’s $530 million treasury acquisition signifies more than just a financial deal—it highlights a cultural transformation in the adoption of cryptocurrency by institutions. As Solana secures its position in corporate portfolios, its impact will resonate across the landscape of global finance.

This moment underscores a blend of possibilities and challenges. For both emerging companies and established giants, acknowledging and adjusting to this new institutional trend will be essential. Individuals who adeptly maneuver through the changing terrain are poised to succeed in the upcoming stage of digital asset integration.