The Rise of Solana and Dogecoin

The cryptocurrency market is in a period of flux, with investor sentiment increasingly shifting away from the two largest cryptocurrencies, Bitcoin and Ethereum. This rotation is not a sign of market weakness but rather a reflection of a maturing ecosystem where investors are actively seeking higher-growth projects with significant upside potential. This movement is fueling a new “altcoin season,” where capital flows into alternative coins that offer innovative solutions or compelling community narratives.

The dominance of Bitcoin and Ethereum, which has defined the market for years, is beginning to wane as a diverse array of projects like Solana and Dogecoin capture a larger share of investor interest. This shift indicates a more discerning and adventurous investor base that is willing to explore beyond the established market leaders in search of exponential gains.

Solana’s Explosive On-Chain Growth Metrics

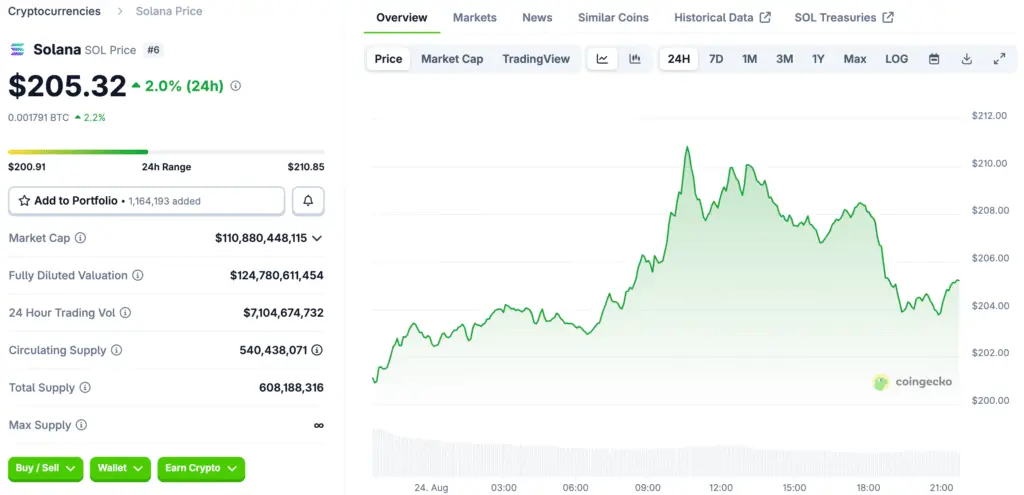

Solana has emerged as a frontrunner in this altcoin resurgence, driven by a series of impressive on-chain metrics that underscore its strength as a high-performance blockchain. The network has seen a 25% jump in Total Value Locked, or TVL, in just one month, signaling a massive influx of capital into its decentralized finance, or DeFi, ecosystem.

This growth is accompanied by a significant increase in stablecoin supply, which has surged by 156%, highlighting its growing utility as a platform for stable, fast transactions. Solana is now processing over 57.7 million daily transactions, a testament to its scalability and efficiency. Furthermore, it has captured a 27.7% share of decentralized exchange volumes, a figure that places it ahead of both Ethereum and the BNB Chain in a key metric. These statistics paint a clear picture of a network that is not only attracting capital but also becoming a hub for real-world developer and user activity.

The Staying Power of Dogecoin

Dogecoin, a meme coin, has a unique and powerful presence in the market, driven by its strong community and cultural relevance. Despite its origins as a meme coin, Dogecoin has consistently attracted and retained a loyal following of retail investors. Recent on-chain data shows significant whale accumulation, with over 680 million Doge tokens being bought up.

Price models suggest a short-term target of $0.282 and long-term projections of $1.07 in a bullish scenario. However, its massive circulating supply of over 145 billion tokens presents an obstacle to exponential price appreciation.

The Rise of Hybrid Crypto Projects

The market is attracting investors with innovative projects that combine the best of both worlds. MAGACOIN FINANCE, a new project, is gaining attention for its hybrid approach, combining Solana’s technical infrastructure with Dogecoin’s community-driven momentum. This strategy attracts investors seeking projects with speculative potential and a clear use case.

Analysts note that this hybrid model is increasingly mentioned in discussions about the best altcoins to buy, with early adopters receiving significant returns. This trend suggests the market is moving beyond utility versus meme coins, favoring projects that successfully integrate elements of both.

The Role of Market Conditions in Altcoin Season

The renewed interest in altcoins is not happening in a vacuum; it is shaped by broader market conditions. The current cycle is characterized by both institutional and retail investors showing increased activity in a diverse range of projects. On-chain data indicates that whales are making long-term strategic investments in networks like Solana, reinforcing its status as a top-performing altcoin.

However, there is also a growing sentiment that legacy meme coins like Dogecoin have limited potential for the kind of exponential gains they saw in previous cycles. As a result, many traders are looking for projects with more innovative structures and lower circulating supplies that offer a better risk-reward ratio. This market dynamic is creating a fertile ground for a new generation of altcoins to emerge and capture a significant share of the market.

Solana’s Long-Term Conviction vs. Doge’s Speculation

Whale movements serve as a powerful barometer for market sentiment. The on-chain data showing large-scale accumulation on the Solana network is a bullish signal that high-net-worth investors believe in the network’s long-term potential. This strategic positioning by whales reinforces Solana’s status as a top-tier altcoin with strong fundamentals.

On the other hand, the whale activity in Dogecoin, while significant, is viewed by some as a more speculative bet. The divergence in these two types of whale movements, one based on long-term conviction and the other on short-term momentum, highlights the complexity of the current market. Investors are advised to not only track price but also understand the on-chain dynamics that reveal the true intentions of large-scale players.

Solana’s Dominance and New Contenders

As the crypto market continues to evolve, projects like Solana are likely to remain dominant players due to their robust infrastructure and high developer engagement. However, the market is also showing a willingness to embrace new projects that offer novel structures and a combination of meme appeal and utility. This suggests that while Solana is a strong contender for a continued rally, the next major breakout could come from a project that successfully merges these two elements.

Analysts emphasize that for investors looking to navigate this landscape, it is crucial to select projects with transparent governance and clear use cases to mitigate risk. The current altcoin cycle is proving to be more mature and nuanced than previous ones, requiring a more sophisticated approach from investors.