Solana’s Price Struggles Against Heavy Selling Pressure

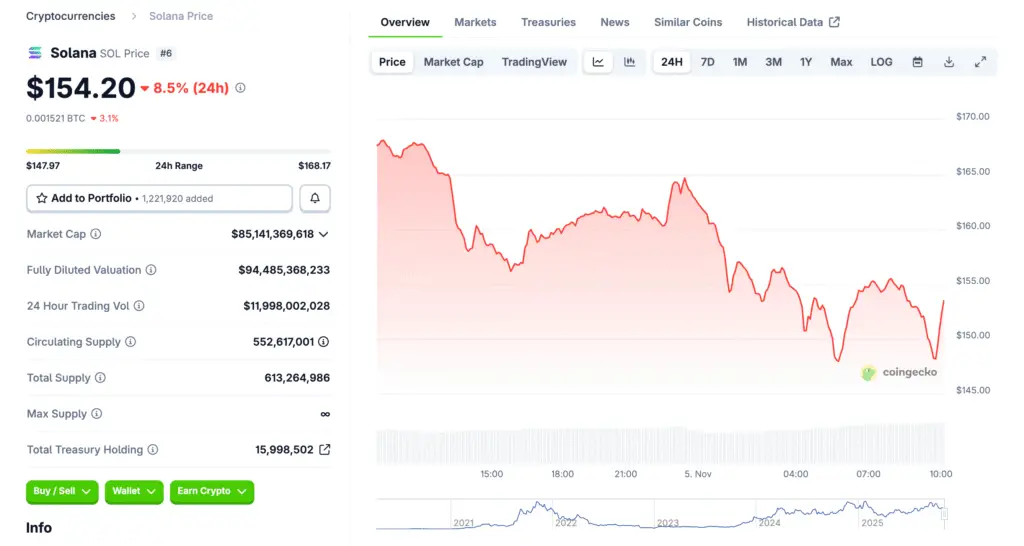

Solana (SOL-USD) has emerged as one of the most volatile cryptocurrencies in late 2025. Trading around $161, the token has fallen nearly 9% in 24 hours as traders react to leveraged liquidations and technical breakdowns. Despite near-term losses, institutional interest and whale accumulation continue to shape the network’s long-term trajectory.

Technical Breakdown Sparks Market Uncertainty

After failing to sustain momentum above $190, Solana’s price slipped below key support levels between $175 and $166. The decline triggered widespread liquidations across derivatives platforms. Analysts note that the loss of the uptrend from June confirms fading bullish momentum, though oversold conditions could soon invite a technical rebound.

Key Support Levels Define the Risk Zone

Solana’s immediate support sits at $160, followed by deeper floors near $145 and $125. If prices fall below $155, traders warn of potential dips toward $131 or even $95. However, a break above $180–$191 could flip sentiment bullish again, possibly leading to a rapid climb toward $200 and beyond.

Recommended Article: Upexi Expands Solana Holdings to 2.1M SOL Amid Market Volatility

Institutional Confidence Reinforced by ETF Growth

Institutional inflows continue to tell a different story. The Bitwise Solana Staking ETF (BSOL) recently surpassed $417 million in inflows during its first week, pushing total Solana ETF assets under management to over $750 million. This rapid adoption highlights Wall Street’s confidence in Solana’s scalability and staking yield.

Whale Accumulation Continues Despite Market Decline

On-chain data shows that large holders have been steadily increasing their positions. Between October 7 and November 3, long-term wallets reduced net outflows by 87%, signaling accumulation during the dip. A $26 million long position from a major whale confirmed renewed institutional entry at discounted price levels.

Ecosystem Expansion Strengthens Solana’s Utility

Solana’s ecosystem continues to expand aggressively. Partnerships with Western Union for stablecoin remittances and Franklin Templeton’s on-chain money fund integration are driving real-world adoption. Meanwhile, the launch of Solana’s Seeker mobile phone solidifies its vision for Web3-enabled consumer technology.

Technical Indicators Suggest Potential Recovery Setup

The funding rate for Solana futures has dropped to -0.03%, showing that short positions dominate the market. Historically, such conditions have preceded powerful short squeezes and relief rallies. Analysts expect a possible bounce if buyers reclaim the $175 resistance area.

Outlook: Solana’s Fundamentals Remain Strong

Despite the current correction, Solana’s network health and institutional adoption remain robust. ETF inflows, whale accumulation, and growing DeFi activity suggest that the foundation for a future rally remains intact. Analysts forecast a potential rebound toward $295–$500 in 2026, making Solana one of the top assets to watch in the coming year.