Solana Gains Momentum Ahead of Key ETF and SEC Regulatory Decisions

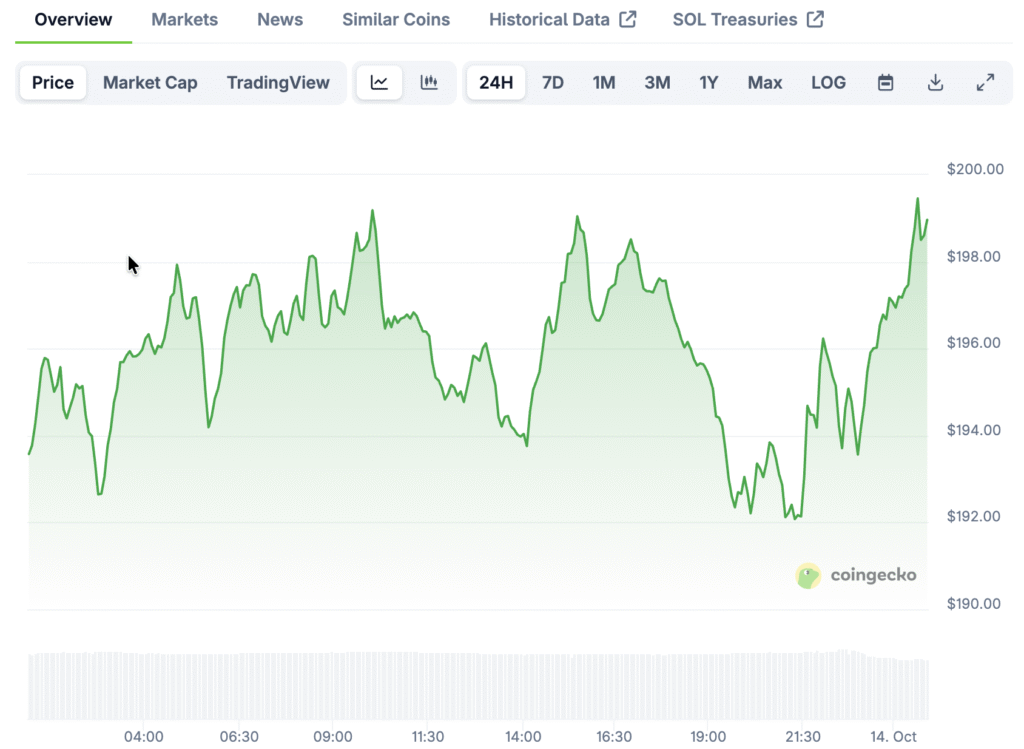

Solana is regaining investor attention after recovering from recent lows around $191 and demonstrating a strong short-term performance. The asset has experienced a remarkable recovery of over 6% within the last 24 hours, currently trading at approximately $193 and swiftly regaining bullish sentiment.

Market participants are gearing up for a possible surge driven by ETFs, with optimism building as we approach key SEC decisions this week. Experts indicate that gaining regulatory approval might act as a significant trigger, potentially releasing billions in institutional investment for Solana in the near future.

SEC Expected to Announce Solana ETF Decisions as Confidence Reaches Peak

The United States Securities and Exchange Commission is anticipated to make an official decision on several Solana ETF applications by October 16. Proposals from Bitwise, 21Shares, and Canary Capital are currently under review, although there are temporary delays due to the ongoing government shutdown.

Eric Balchunas, a senior ETF analyst at Bloomberg, recently expressed that “approval odds are really 100% now,” indicating a significant increase in overall confidence. Once confirmed, these ETFs have the potential to elevate Solana into new valuation realms as global investors receive regulated exposure for the first time.

Analysts Predict Policy Resumption Could Trigger Major ETF Inflows Soon

Nate Geraci, president of NovaDius Wealth Management, anticipates that the introduction of ETFs will significantly pave the way for mainstream capital to flow into crypto assets with conviction. He highlights that “once the shutdown ends, ETF inflows will skyrocket,” suggesting a significant link between the resumption of policy and the momentum of the market as a whole.

This development places Solana in a strong position to capitalize on two sources of demand, merging institutional investments with the excitement of retail-driven speculation at the same time. Experts suggest that these structural inflows have the potential to create lasting price floors, which could support prolonged rallies towards all-time highs in a sustainable manner.

Recommended Article: Solana Tops DEX Volume, Overtaking Ethereum and Binance

Improving Momentum Indicators Strengthen Bullish Outlook for Solana Price

Recent 4-hour chart readings show that momentum indicators are improving, reinforcing bullish control following last week’s severe liquidation event. The MACD oscillator has shifted into positive territory, and the RSI has increased from 33 to 42, confirming ongoing accumulation below crucial support levels.

The signals suggest an increasing confidence among buyers who are effectively defending the zones around $191 to $193, thereby establishing a solid foundation for another upward movement. If the current volume continues in tandem with the optimism surrounding ETFs, Solana may very well confront the intermediate resistance at $220 before reaching new highs.

Solana’s Expanding DeFi Ecosystem Strengthens Its Core On-Chain Metrics

In addition to speculative trading, Solana’s on-chain fundamentals demonstrate notable strength, supported by the rapid evolution of its growing decentralized finance ecosystem. The network remains at the forefront in terms of transaction speed, scalability, and developer engagement, while consistently drawing in cutting-edge applications across various sectors.

The capacity to handle thousands of transactions each second while maintaining low fees guarantees sustained competitiveness among layer-one blockchains worldwide. This resilience strengthens investor confidence that Solana continues to be a leading force, able to maintain growth despite macroeconomic challenges.

Analysts Predict Next Bullish Wave Could Drive Prices Past $300 Mark

Projections from analysts suggest that Solana’s upcoming bullish phase could see prices ranging from $250 to $300, fueled by expected ETF inflows that are likely to boost momentum. The asset’s previous 60% increase in August and September highlights the possibility of further growth if the right factors come together effectively.

A confirmed breakout above the $220 resistance level could affirm these projections and signal a continuation toward triple-digit valuations not seen since 2021. Models based on momentum indicate that breaking through the $300 mark would reaffirm Solana’s position as a leading network asset in the cryptocurrency space.

Solana ETFs Could Drive Global Institutional Adoption and Innovation

The approval of Solana ETFs would mark a notable achievement for the integration of alternative blockchain technologies into regulated financial systems across the globe. This could broaden institutional engagement that has primarily focused on Bitcoin and Ethereum, while also solidifying Solana’s reputation among leading assets comprehensively.

This acknowledgment could stimulate further creativity and investment within its ecosystem, driving increased liquidity and engagement as time progresses. With growing optimism, traders are united in their belief that demand driven by ETFs could confidently push Solana to a new all-time high, surpassing $300.