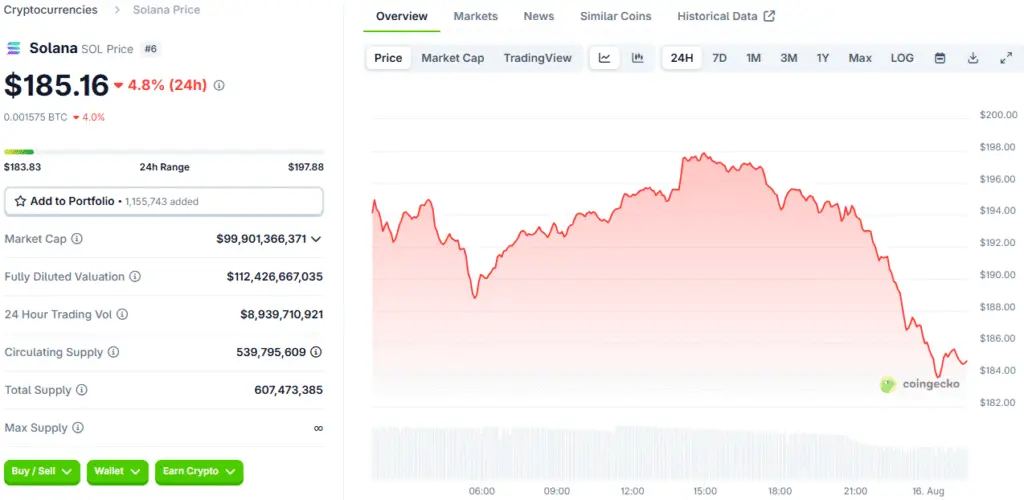

The SEC’s Latest Delay for Solana ETFs

The Securities and Exchange Commission (SEC) has once again delayed its decision on the approval of spot Solana ETFs, pushing back the deadlines for proposals from firms like Bitwise and 21Shares to October 16. This delay, while disappointing to investors, follows a typical pattern for the agency when reviewing new and innovative crypto products. The SEC often uses these extensions to gather more information and carefully consider the implications of a new financial product before giving it a green light.

This specific delay affects a number of firms, including Greyscale, Fidelity, and ProShares, all of which have applications for Solana funds under review. Notably, BlackRock, a major player in the ETF space, has confirmed that it has no immediate plans for a Solana product, a point that highlights a divergence in institutional strategies.

A Shift in Regulatory Posture

The SEC’s decision to delay the Solana ETFs comes at a time when the agency’s overall posture toward cryptocurrencies has shifted dramatically. Under the new Trump administration, the regulatory environment has become more favourable toward crypto. In July, the agency introduced policy updates that have opened the door for ETF options trading and a broader range of crypto product approvals. This has led to a flurry of new ETF applications covering everything from XRP to Dogecoin.

The new, more accommodating regulatory climate is a stark contrast to the previous administration’s more restrictive stance. However, as the Solana ETF delay shows, a friendlier environment does not mean that approvals will be fast-tracked. The SEC is still taking a methodical and cautious approach, particularly with products that are not yet as widely adopted or understood as Bitcoin and Ethereum.

The Implications for an Altcoin Season

The SEC’s delays on the Solana ETF applications could have a short-term impact on market momentum, but they do not necessarily derail the broader “altcoin season” narrative. A primary driver of this market cycle has been the increasing flow of institutional capital into altcoins, a trend that is not solely reliant on ETF approvals. The recent regulatory changes, such as those allowing in-kind creations and redemptions for crypto ETFs, are a positive development that will ultimately help the market to mature.

While the delay on Solana is a setback, the fact that so many firms are even applying for these products is a powerful signal of institutional interest. This shows that a wide range of investors, from Greyscale to Bitwise, believe that Solana has the potential to become a mainstream investment vehicle.

SEC’s Cautious Review: A Necessary Step for a Mature Market

The SEC’s cautious approach to Solana ETFs is rooted in a number of factors. While the network has impressive technical capabilities, with high transaction speeds and low fees, it is not yet as proven or as widely adopted as Bitcoin or Ethereum. The SEC is likely taking its time to understand the nuances of the Solana ecosystem and its security. The commission’s careful review is also a way to ensure that the new ETFs will have a stable and reliable foundation for investors.

This cautious approach, while frustrating for those who want quick approvals, is a necessary step to build a mature and trustworthy market. The SEC’s goal is to protect investors, and by taking its time, it is ensuring that any new product, like a Solana ETF, is introduced to the market with a clear set of rules and safeguards.

The Divergent Path from Bitcoin and Ethereum

The Solana ETF applications are following a similar but distinct path from Bitcoin and Ethereum. While the SEC has already approved ETFs for both of those cryptocurrencies, the process was long and arduous. Solana, as a newer and less-established asset, is likely to face a similar level of scrutiny. The fact that a major player like BlackRock has no plans for a Solana product highlights the divergent views on the asset’s maturity and its long-term potential.

This means that Solana’s journey to a spot ETF will be unique, with its own set of challenges and opportunities. The market is now watching closely to see if the SEC’s more favourable regulatory posture will lead to a faster approval time than the one Bitcoin and Ethereum experienced.

Solana ETF’s Delay Is a Pause, Not a Rejection

For investors, the SEC’s delay is a reminder that the path to institutional adoption is not always a straight line. While the new regulatory environment is a positive development, it does not guarantee immediate approvals. The market will now be looking to October for a new update on the Solana ETFs. In the meantime, the focus will likely shift to other drivers of growth, such as the health of the Solana ecosystem, its technical upgrades, and its ability to attract new projects and users. T

he fact that so many firms are already seeking approval for a Solana product is a powerful endorsement of the network’s potential. The delay is not a rejection; it’s a pause, and it gives investors time to prepare for what could be a major price movement if and when the SEC finally gives its approval.

Read More: Solana and Dogecoin Surge as Bitcoin Nears New All-Time Highs