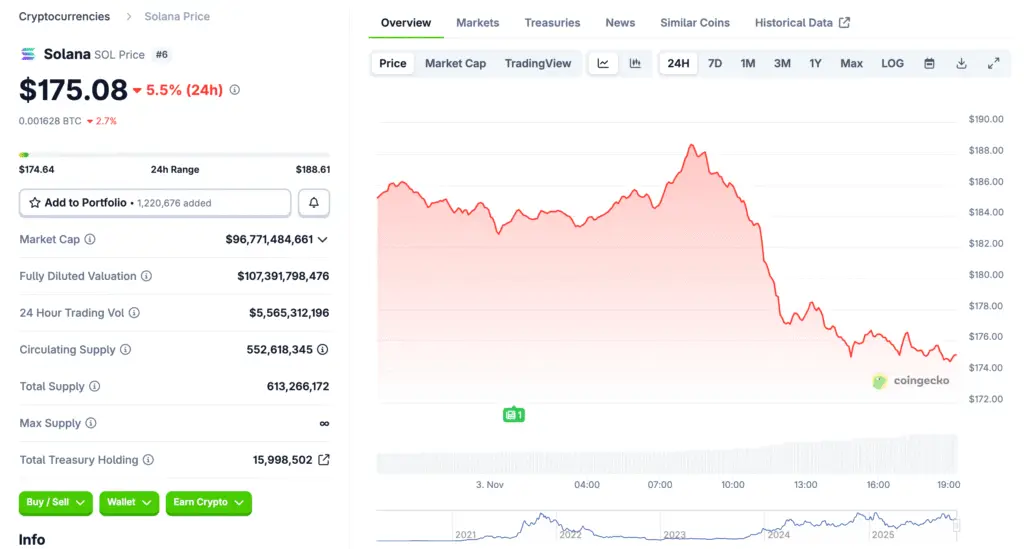

Solana Faces Renewed Selling Pressure

Solana’s recent attempt to sustain gains above $185 has failed, with sellers tightening control over the market. After peaking near $189, the cryptocurrency faced a sharp correction, dragging prices below $180. The ongoing weakness mirrors broader market sentiment as traders adjust to reduced risk appetite.

Bears Take Charge After $188 Rejection

Following multiple rejections near the $188 resistance zone, Solana’s bullish momentum lost steam. The price has now slipped under key moving averages, signaling potential continuation of the downtrend. Analysts warn that failure to recover soon could invite deeper losses toward lower support zones.

Technical Indicators Suggest Bearish Continuation

The hourly chart highlights a bearish trend line forming near $192, acting as resistance to any recovery attempt. Solana’s MACD has shifted deeper into the red zone, confirming bearish control. Meanwhile, the RSI remains below the 50 level, reflecting sustained selling pressure.

Recommended Article: Solana Staking ETF Debuts: What $3–$6B Inflows Could Mean

Key Support Levels to Watch: $175 and $172

Immediate support lies around the $175 zone, followed by stronger support near $172. If Solana fails to defend these areas, traders could see a retest of the $165 level. A decisive close below $165 would increase the probability of further declines toward the $150 region.

Volume and Liquidity Factors Deepen Volatility

Low trading volumes and thin liquidity have amplified Solana’s intraday volatility. Market observers attribute this to ongoing deleveraging across crypto assets. Such conditions often exaggerate price movements and can make recovery attempts less sustainable in the short term.

Potential Recovery Targets Above $188

Despite current weakness, there remains a scenario where Solana could recover. A breakout above $188 would invalidate the bearish structure and open the way toward $192 and $200. However, this would require strong buying support and renewed investor confidence.

Analysts Advise Caution Amid Short-Term Risks

Experts urge traders to maintain cautious positioning given Solana’s current technical setup. Until the price reclaims $188 resistance decisively, risks of further downside persist. Long-term investors, however, may view deeper pullbacks as potential accumulation opportunities.

Long-Term Outlook: Structural Support Remains Intact

While the near-term picture appears bearish, Solana’s long-term fundamentals remain encouraging. Its expanding ecosystem and strong developer activity continue to support optimism beyond the present correction. Once short-term volatility subsides, analysts expect a gradual recovery aligned with broader market stabilization.