Solana Regains Momentum Amid Market Revival

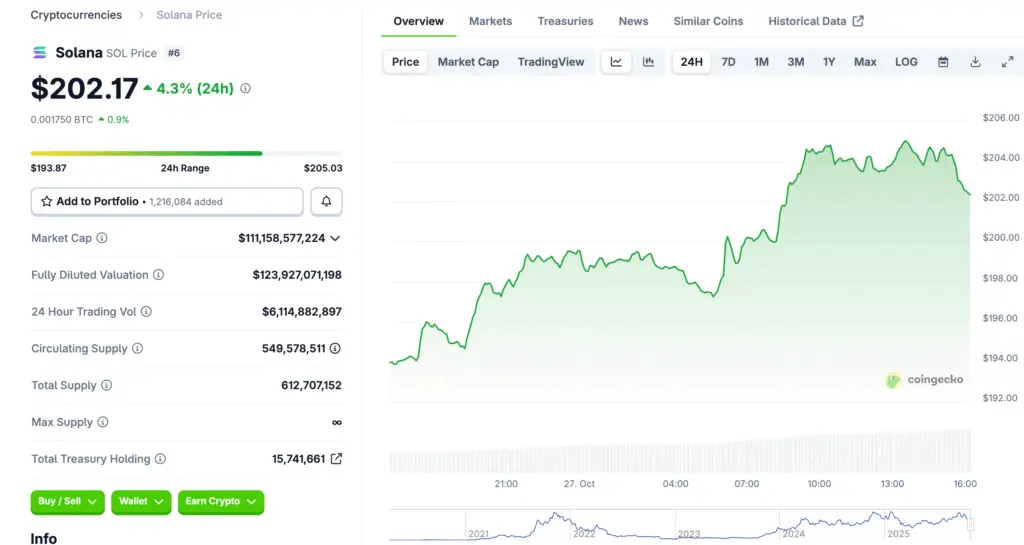

After a slow start to October, Solana has reclaimed its bullish momentum thanks to improving macroeconomic conditions. Bitcoin and Ethereum have both rebounded strongly, lifting overall crypto market sentiment. Solana surged past the $200 level on Sunday, signaling renewed institutional and retail interest. This upward shift follows major policy changes from the U.S. Federal Reserve that have eased liquidity concerns.

Federal Reserve Easing Sparks Risk-On Sentiment

The recent rate cut and pause in quantitative tightening have injected optimism back into the market. Lower borrowing costs typically encourage greater investment in risk assets, including cryptocurrencies. Analysts believe these policies could mark the beginning of a sustained bull cycle. With additional rate cuts expected in December, traders anticipate more liquidity entering the crypto ecosystem.

U.S.-China Trade Agreement Boosts Market Confidence

Geopolitical relief has also fueled the market rally. The new trade consensus between U.S. Treasury Secretary and China’s Li Chenggang has de-escalated tensions. This agreement is set to be finalized during an upcoming meeting between Donald Trump and Xi Jinping. As a result, investors are showing renewed confidence in global markets, translating into stronger crypto inflows.

Recommended Article: Solana Faces Resistance at $200 Despite Market Optimism

Analysts Predict Solana Could Hit $290 in November

Top crypto trader Ali Martinez predicts that Solana could rise to $290 in November. His analysis points to the token’s successful defense of the $180 support level and continued trading within an ascending channel. Other analysts, including TraderSZ and BitBull, support bullish forecasts with price targets ranging from $300 to $500. These predictions suggest that Solana could outperform other altcoins as the next rally phase begins.

Institutional Demand Strengthens Solana’s Case

Institutional adoption continues to play a major role in Solana’s success. The upcoming launch of spot Solana ETFs is expected to attract significant capital from traditional investors. Furthermore, several asset management firms are adding SOL to their crypto portfolios. This trend highlights Solana’s growing acceptance as a reliable blockchain for high-speed, low-cost transactions.

Snorter Token Emerges as the Next 10x Crypto

Alongside Solana’s rise, a new meme token called Snorter (SNORT) is gaining momentum. The project has already raised over $6 million in its presale, driven by viral attention on social media. Snorter powers a Telegram-based trading bot designed for instant token detection and secure transactions. Its low trading fees and advanced automation tools have made it one of the most anticipated launches in the Solana ecosystem.

Snorter Bot Simplifies Crypto Trading for Everyone

The Snorter Bot combines real-time token sniping, contract scanning, and automated trading in one intuitive interface. It helps traders identify new opportunities while minimizing exposure to scams such as rug pulls or honeypots. The platform also offers copy trading features, allowing users to mirror profitable wallets. These innovations make Snorter especially attractive to both novice and experienced crypto investors.

Solana and Snorter Drive a New Market Cycle

With Solana approaching key resistance levels and Snorter capturing investor imagination, the market appears primed for another bullish wave. Analysts expect Solana’s performance to continue setting the pace for the broader altcoin sector. As liquidity increases and investor sentiment improves, both assets could see substantial appreciation by year’s end. This convergence of institutional support and innovative projects positions Solana and Snorter as standout performers in the 2025 crypto cycle.