Solana’s Bullish Fractal Pattern Signals Major Upside

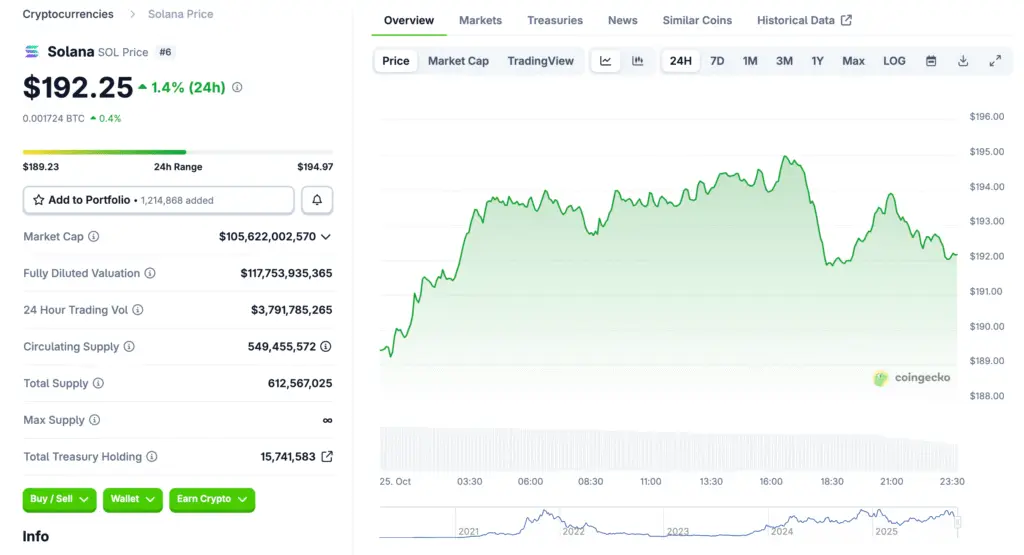

Solana’s chart shows a recurring bull fractal pattern that has previously led to strong rallies. Historical data from May, July, and August each produced gains of 72%, 58%, and 54% respectively. If this rhythm continues, $SOL could rise toward $198, building momentum for a $240 test and potentially a $300 breakout. Analysts believe renewed confidence and institutional inflows are setting up favorable conditions.

Institutional Adoption Strengthens the Solana Narrative

Solana’s increasing acceptance among major institutions underlines its long-term potential. Fidelity Digital Assets recently added $SOL to its crypto portfolio, citing the network’s high throughput capacity. This move provides new exposure channels for retail and institutional investors alike. Combined with treasuries in multiple countries holding nearly 15.7 million $SOL, adoption momentum remains strong.

Hong Kong’s Upcoming Solana ETF Boosts Market Sentiment

Hong Kong regulators have approved the city’s first Solana ETF, set for listing on October 27 under CSOP Asset Management. The listing could spark international participation and provide liquidity from Asia’s financial hub. Market participants expect the ETF to elevate Solana’s profile, positioning it alongside Bitcoin and Ethereum as a top institutional-grade asset. ETF availability historically attracts both speculative and strategic capital.

Recommended Article: BlockchainFX Approaches $10M as Whales Shift From Solana

Whale Accumulation and Treasury Holdings Indicate Confidence

Recent reports confirm that 13 major entities across three countries have locked 2.86% of Solana’s supply in treasuries. The largest, Forward Industries, holds 6.822 million tokens worth over $1.58 billion. Such allocations underscore faith in Solana’s scalability, transaction efficiency, and cost structure. Sustained whale accumulation often precedes sharp upside movements in high-liquidity tokens.

Snorter Token’s Trading Bot Draws Investor Excitement

Alongside Solana’s growth, Snorter Token ($SNORT) has captured attention for its AI-powered trading bot ecosystem. The bot operates natively on Telegram and features copy trading, scam detection, and ultra-fast execution. Its presale has already raised over $5.5 million, with claims going live on October 27. Investors are drawn to Snorter’s practical utility and potential to revolutionize on-chain trading.

How Snorter’s Technology Could Reshape Retail Trading

Snorter’s bot leverages Solana’s 65,000 transactions per second capacity to execute trades nearly instantly. This gives it an edge over traditional decentralized interfaces like Raydium or Jupiter. Features such as automated sniping, low execution fees (0.85%), and AI-driven risk filters make it accessible even to beginner traders. The project’s focus on simplicity and efficiency gives it viral potential within crypto communities.

Price Projections and Market Outlook for Snorter Token

If Snorter maintains momentum post-listing, analysts foresee a short-term price of $0.20 and a long-term target near $1.20 by 2030. Its integrated staking program, offering 102% APY, reinforces investor retention. Given its combination of meme appeal and real-world function, $SNORT could become one of Solana’s most successful ecosystem launches. Analysts call it a promising blend of entertainment and utility.

The Road Ahead: Solana and Snorter’s Shared Momentum

With Solana potentially targeting $300 and Snorter entering markets with cutting-edge tech, the synergy between infrastructure and innovation is clear. Both projects highlight how speed, scalability, and AI integration are shaping the next phase of crypto evolution. For traders seeking exposure to growth narratives, Solana’s ecosystem continues to deliver. Together, they represent the convergence of institutional trust and community-driven innovation.