Solana Surpasses Rivals in Blockchain Revenue

Solana has outperformed other major blockchains by generating $4.67 million in revenue within a single day. This surge places it ahead of Ethereum, which recorded $3.82 million during the same period. The increase in network revenue reflects Solana’s growing dominance in DeFi, NFTs, and meme coin markets. As the ecosystem expands, demand for SOL continues to strengthen across multiple sectors.

On-Chain Activity Fuels Market Optimism

Rising transaction volume and developer engagement have solidified Solana’s reputation for speed and scalability. Its low fees and high throughput make it attractive for decentralized applications and retail traders alike. The surge in network activity also correlates with growing liquidity in Solana-based DeFi protocols. These fundamentals have fueled renewed investor confidence as the blockchain continues to set new performance benchmarks.

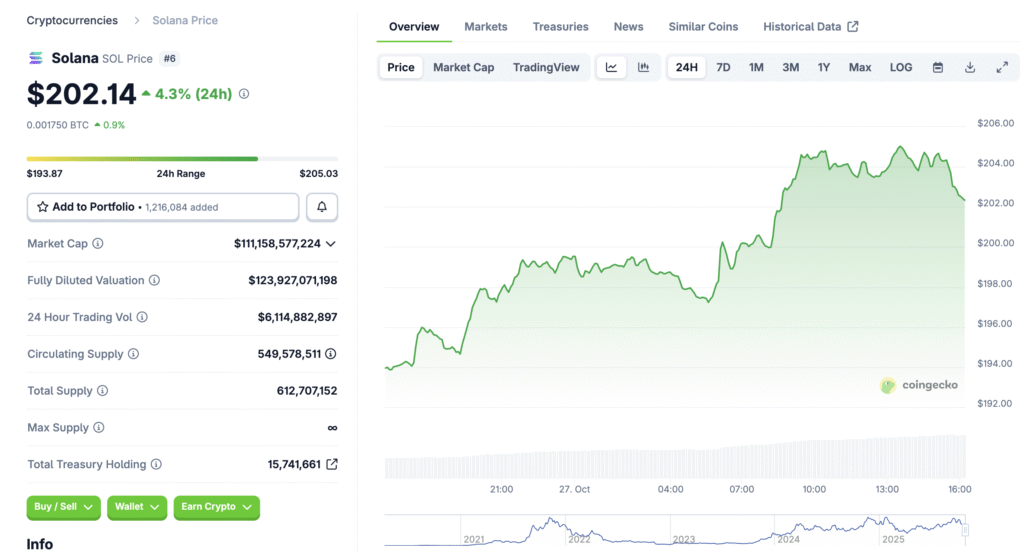

SOL Price Rebounds Toward $200 Resistance

Solana’s native token, SOL, has rallied near the $200 level after recovering from early October declines. The price movement coincides with improved on-chain metrics and broader market recovery. Technical indicators show strong support forming near $184, with resistance observed around $199–$203. A decisive close above this range could confirm the next bullish continuation phase.

Recommended Article: Solana Faces Resistance at $200 Despite Market Optimism

Technical Indicators Suggest Momentum Building

Chart analysis reveals expanding Bollinger Bands and rising momentum signals. The 50-day simple moving average currently acts as dynamic resistance at approximately $200. Meanwhile, volume remains moderate but consistent, supporting the sustainability of the current uptrend. If SOL can maintain its structure above $184, it may target $220 in the near term.

Institutional Adoption and Ecosystem Growth

Solana’s expanding partnerships with financial institutions and gaming developers are driving organic network growth. Projects across DeFi, NFTs, and real-world assets are increasingly selecting Solana for its efficiency. Institutional liquidity has also been rising, with treasury funds and ETFs showing growing interest in SOL exposure. This widespread adoption underscores Solana’s position as one of the most robust ecosystems in crypto.

Market Analysts Highlight Sustainable Growth

Experts describe Solana’s current performance as more sustainable compared to past speculative cycles. The consistent fee generation demonstrates real network utility rather than short-lived hype. Analysts argue that revenue leadership reflects a maturing blockchain economy focused on usability and scalability. This organic demand is likely to support higher valuations as long as ecosystem fundamentals remain strong.

Can Solana Maintain Its Momentum?

Despite the bullish setup, Solana must sustain its growth amid rising competition from other high-performance blockchains. Maintaining user engagement and developer participation will be crucial to avoiding short-term fatigue. Analysts note that a consolidation above $200 could confirm renewed market confidence. However, failure to hold this range may prompt short-term profit-taking before further advancement.

Outlook: Solana Positioned for Continued Expansion

Solana’s impressive network performance and revenue dominance position it as a leader in blockchain innovation. With price momentum aligning with on-chain growth, the blockchain is well-placed for another rally phase. A confirmed breakout above $200 would validate bullish projections and attract additional institutional capital. As 2025 progresses, Solana remains one of the most promising contenders in the next phase of market expansion.