Solana’s Price Dip and Recovery

The cryptocurrency Solana ($SOL) is experiencing a notable market downtrend, with its price dipping to $187.92 after a 3.86% slump over the past twenty-four hours. The current price is, however, showing signs of recovery after a more substantial plunge from the $198 mark to a low of $183. This gradual upward movement suggests that while the initial news may have triggered a sell-off, the market is beginning to find a new floor, raising the possibility of a price rebound in the near term. This volatility highlights the market’s sensitivity to major news events, particularly those related to regulatory decisions.

The SEC’s Postponement and Market Impact

A key factor behind this decline is reportedly the delay in the U.S. Securities and Exchange Commission’s (SEC) decision on a Solana ETF proposal. The SEC has postponed the decision until October 16, a move that has been seen as a setback by some investors who were hoping for a quick approval under the current crypto-friendly administration. The delay has created a sense of uncertainty in the market, causing a temporary dip in price as traders adjust their expectations.

The SEC’s methodical approach, while frustrating for investors, is a common pattern for the agency when reviewing new crypto products. The postponement is a reminder that even in a more favourable regulatory environment, the path to institutional adoption is not always a straight line.

A Closer Look at Solana’s Market Stats

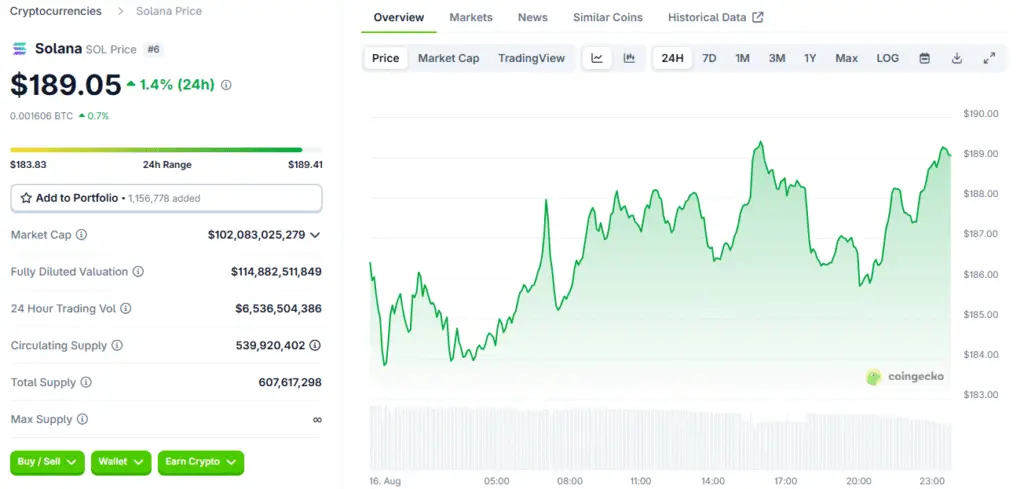

Solana’s price slump has been mirrored in its key market statistics. Its market capitalisation has dipped to $101.46 billion, a 3.87% drop over twenty-four hours. Similarly, the 24-hour trading volume has seen a considerable plunge of 42.98%. This decline in volume suggests that the selling pressure, while significant, was not accompanied by a high level of market activity, which could be a positive sign for a potential recovery.

The price analysis shows that after a brief jump to $198, the price dropped to a low of $183 before recovering to its current level of $187.92. This price action highlights the token’s volatility but also its ability to bounce back from a major dip.

Analysing Solana’s Key Price Levels

Based on the price chart, a number of key support and resistance levels have emerged for Solana. The immediate resistance level for $SOL is at $190, a price point that it will need to surpass to enter a more bullish trend. After that, it could face resistance at $198 and the psychological $200 mark. On the support side, the immediate support level for $SOL is at $183.76, a price that it has already tested and held.

After that, the next support levels are at $179.36 and $73.68. The price action around these levels will be crucial for determining the token’s next move. If it can break through the resistance levels with sustained buying pressure, it could signal a new rally, but a break below the support could lead to a steeper decline.

Solana Prices Await New Catalysts for Growth

While Solana’s price has dipped, the overall market sentiment remains a mixed bag. The postponement of the ETF decision has certainly injected a dose of uncertainty, but it has not derailed the broader crypto-friendly narrative. The market is still operating under the new administration’s more accommodating stance, which has led to a flurry of new ETF applications for various cryptocurrencies. However, this optimism is being tempered by the SEC’s cautious and methodical approach.

This tension between a more favourable political environment and a slow-moving regulatory process is what is creating the current volatility. The market is now looking for a new catalyst to push prices higher, and a positive update from the SEC on the Solana ETFs in October could be just that.

The SEC’s Cautious Approach to Solana ETFs

The path to institutional adoption for Solana is not a straight line, as the SEC’s delay has shown. While the network has impressive technical capabilities, with high transaction speeds and low fees, it is not yet as proven or as widely adopted as Bitcoin or Ethereum. The SEC is likely taking its time to understand the nuances of the Solana ecosystem and its security. The commission’s careful review is also a way to ensure that the new ETFs will have a stable and reliable foundation for investors.

This cautious approach, while frustrating for those who want quick approvals, is a necessary step to build a mature and trustworthy market. The SEC’s goal is to protect investors, and by taking its time, it is ensuring that any new product, like a Solana ETF, is introduced to the market with a clear set of rules and safeguards.

Solana’s Rally: A Narrative of Maturation and Dominance

The current price prediction for Solana is cautiously optimistic. The gradual recovery in its price, following the SEC’s postponement news, signifies its potential to shortly enter the green zone. In the case of the current trend’s continuation, analysts anticipate that $SOL could gain 4.25% over the next 30 days, which would take it to the $196.09 mark.

This prediction is based on the idea that the market has already priced in the ETF delay and is now looking at other fundamentals. The price prediction is a positive sign for investors, but it also highlights the need for caution, as the market remains volatile and is subject to sudden changes in sentiment. The future outlook for Solana will depend on its ability to build on its recovery and to attract new capital from both institutional and retail investors.

Read More: Solana ETF Approvals Delayed by the SEC