Solana Defies Market Weakness

While much of the cryptocurrency market remains under pressure, Solana (SOL) has managed to buck the trend. The token has risen 1.07% in the past 24 hours, reaching $180.76, even as other leading altcoins like Ethereum and Cardano have struggled to hold their ground. This resilience highlights Solana’s increasing role as one of the standout assets in the 2025 digital asset landscape.

The broader market downturn has been fuelled by regulatory uncertainty, profit-taking, and macroeconomic pressures. Yet Solana’s ability to remain on an upward trajectory underscores both investor confidence and growing demand for the network’s unique capabilities, particularly in areas such as decentralised applications, NFT marketplaces, and high-speed transactions.

Solana Price Metrics Show Strength

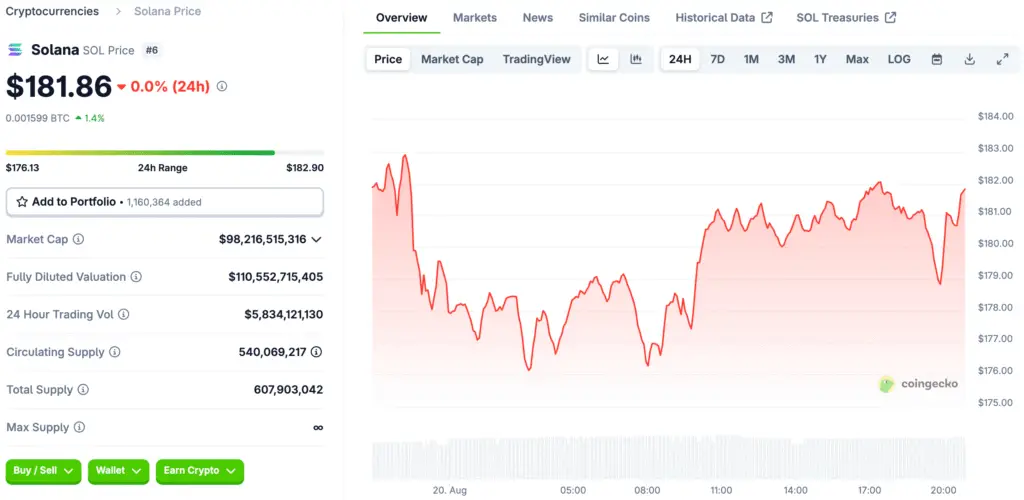

At its current level of $180.76, Solana’s market capitalisation has climbed to nearly $97.64 billion, reflecting a 1.09% increase. Although trading volume slipped slightly by 2% to $5.64 billion, the overall momentum remains tilted toward the upside. Technical indicators suggest that $182.92 is the immediate resistance level for Solana, while $176.11 serves as near-term support. This means that traders are watching closely for a potential breakout beyond resistance, which could accelerate momentum toward the $190 mark.

Conversely, a dip below support could test investor conviction in the short term. Despite these fluctuations, analysts note that Solana’s gradual price climb contrasts sharply with the volatility seen across the broader market. Bitcoin has wavered below $112,000, while Ethereum recently slipped to $4,150 amid waning network activity. Against this backdrop, Solana’s steady progress has drawn fresh attention.

Coinbase Launches Solana Derivatives

One of the most significant drivers behind Solana’s latest performance is the launch of U.S.-regulated perpetual futures contracts for SOL on Coinbase. The exchange’s move marks a major step in deepening institutional access to Solana, allowing hedge funds, asset managers, and other professional investors to take positions in SOL through regulated derivative markets.

This development has been widely interpreted as a vote of confidence in Solana’s long-term prospects. It also positions Coinbase as a key competitor in the battle among exchanges to expand their derivatives offerings. For Solana, the introduction of these products provides greater liquidity, improved market depth, and enhanced visibility among institutional players, potentially paving the way for broader adoption.

Institutional Adoption Accelerates

Institutional participation has long been viewed as a key driver of the next phase of crypto growth. By offering perpetual futures tied to Solana, Coinbase has made it easier for larger investors to gain exposure while managing risk.

Industry observers argue that this development could signal the beginning of a new wave of institutional interest in Solana, similar to what Ethereum experienced following the launch of its futures and ETF products. If institutional demand continues to rise, Solana could cement its position as the third most important crypto asset after Bitcoin and Ethereum.

Investor Sentiment Remains Bullish

Despite the slight dip in trading volume, sentiment surrounding Solana remains optimistic. The token’s ability to hold steady above $175, even during volatile trading sessions, has reinforced its reputation as a strong contender in the altcoin market.

Crypto analyst Marcus Liu commented, “Solana’s resilience is impressive. It’s not just a speculative play anymore; it has an ecosystem of real-world applications, from DeFi to NFTs. That’s what gives it staying power in a market that’s been shaky.”

This perspective is echoed by traders who see Solana as benefiting from both its technological edge in speed and scalability and its increasing acceptance across major exchanges.

How Solana’s Price Growth Is Noteworthy

The broader market has faced a series of headwinds in recent weeks. Ethereum’s network activity has dropped by 28% since July, while Bitcoin has struggled to break out of its current trading range. Regulatory concerns and macroeconomic uncertainty tied to the Federal Reserve’s upcoming policy meeting have also weighed heavily on investor sentiment.

Against this backdrop, Solana’s price growth is particularly noteworthy. Rather than succumbing to the selling pressure affecting other cryptocurrencies, SOL has continued to move upward, a sign of robust investor demand.

How Institutional Adoption Fuels Solana

Much depends on whether Solana can sustain momentum above its immediate resistance. If the token clears $182.92 decisively, analysts believe a run toward $190-$200 could unfold in the coming weeks. On the other hand, failure to hold current levels might invite a period of consolidation around the $170–$175 range.

Long-term, Solana remains well-positioned to capitalise on its low-cost, high-throughput blockchain model. With institutional adoption rising and key exchanges expanding product offerings, the outlook for SOL appears promising, even in the face of market volatility.

Solana Defies Broader Market Weakness

Solana’s latest performance demonstrates its ability to stand out in a challenging crypto environment. Backed by Coinbase’s launch of perpetual futures, strong investor sentiment, and a steadily expanding ecosystem, Solana has proven it can defy broader market weakness.

While short-term volatility is inevitable, the broader trajectory for SOL remains positive. If current trends continue, Solana could emerge not just as a resilient altcoin, but as one of the key pillars of the evolving digital economy.

Read More: Solana Price Outlook as DEX Volumes and TVL Growth Signal $200 Rebound Potential