Whale Withdrawal Signals a Potential Bullish Shift

In a significant on-chain event, a newly created wallet has withdrawn 60,000 SOL, a transaction valued at approximately $11.23 million, from the Binance exchange. This large-scale movement, which took place over a 15-hour period, has captured the attention of market analysts and traders.

Such a substantial withdrawal could signal a shift in market sentiment for Solana, indicating a long-term bullish outlook. This type of whale behavior is often a precursor to major price moves, providing a valuable piece of the puzzle for understanding future market dynamics.

Transaction Details: 60,000 SOL Moved Off-Exchange

The withdrawal was traced to the address D87JTHDiB3Daj9jNL2xsasSuG5G22TZSPvpGBCNSsF6G. and represents one of the largest single movements of SOL off an exchange in recent days. On-chain data confirms that the transfer was executed in a series of transactions, with the average price for this specific accumulation calculated to be around $187.17 per SOL. This meticulous, multi-part transfer suggests a calculated and deliberate move by a sophisticated investor, rather than a single, impulsive trade.

Why Off-Exchange Moves Matter

When a significant amount of a cryptocurrency is moved off an exchange, it is no longer readily available on the public order books. This action is generally interpreted as a desire for long-term holding rather than imminent selling. This accumulation behavior by a large investor, or “whale,” is a widely watched on-chain signal, as it can reduce the available liquid supply of an asset, thereby creating upward pressure on its price. In the context of Solana, which has seen its exchange balances drop by over 27% since March, this particular movement reinforces the growing trend of institutional and large-scale investors opting for self-custody.

Solana’s Technical Foundations Are Strengthening

This event comes at a crucial time for the Solana network. While the daily trading volume for SOL has seen a 33% surge, on-chain data also indicates a slight decline in active addresses and a drop in Total Value Locked (TVL) in DeFi. Recent Q2 reports show a nuanced picture: while speculative trading activity in meme coins and NFTs has cooled, the network is seeing impressive growth in real-world asset (RWA) tokenization.

This divergence suggests that while retail activity may be slowing, the core infrastructure and long-term value propositions of the Solana network, such as its scalability and institutional appeal, are strengthening. The network’s ability to process a record-breaking 107,664 transactions per second in a single block further solidifies its technical foundations.

Volatility and the Bitcoin Dominance Factor

This phenomenon is further highlighted by a recent surge in Bitcoin dominance, which often precedes capital rotation into high-growth altcoins like Solana. When capital flows from Bitcoin into altcoins, it can fuel significant rallies for assets with strong fundamentals and a high-growth trajectory. Historical data shows that whale accumulation phases on Solana have often been followed by periods of price appreciation.

However, it is important to note that a recent report from early August indicated that some whales were selling, creating a contradictory narrative. This current off-exchange movement, therefore, could be a key inflection point, signaling that a new wave of bullish sentiment among large holders is emerging.

Actionable Intelligence for Traders

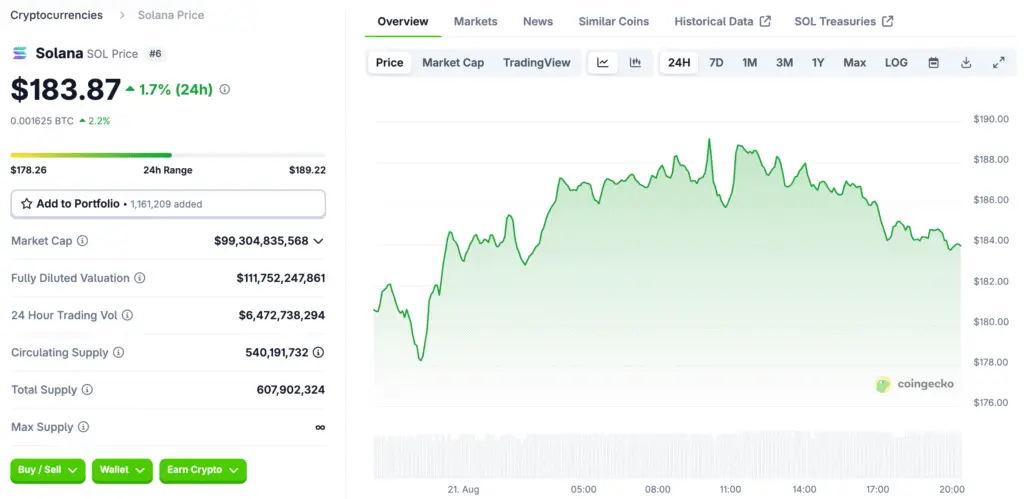

For traders, this event offers actionable intelligence. The fact that the funds were moved to a new address could be for a number of strategic reasons, including diversification of holdings, preparation for participation in decentralized finance on the Solana network, or simply to secure assets in a non-custodial wallet. From a technical analysis perspective, the short-term resistance is currently at the $190 level. If this resistance is broken, SOL could see a significant rally, potentially towards its all-time high.

Conversely, a key support level to watch is the 200 EMA, currently around $174. A break below this support could indicate a prolonged period of consolidation. The coming weeks will be a crucial test of whether Solana’s network strength can absorb potential selling pressure and regain the confidence needed for a sustained rally.

Why Real-Time Data Is Crucial in Crypto

Ultimately, this on-chain event serves as a strong reminder for traders to integrate real-time data and comprehensive analysis into their strategies to navigate the crypto market’s inherent volatility. This kind of whale activity, while not a guarantee of future price movements, provides a valuable piece of the puzzle for understanding market sentiment and potential shifts.

Read More: Solana (SOL) Price Climbs Despite Market Downturn as Coinbase Derivatives Fuel Optimism