A new class of altcoin exposure arrives on Wall Street

The launch of the first U.S. Solana staking exchange‑traded fund marks a structural shift. For the first time, mainstream investors can gain SOL exposure with embedded staking yield. That yield component may attract income‑oriented mandates that previously ignored non‑yielding crypto products. Early prints showed solid opening volumes, signaling robust curiosity from diversified allocators.

Why staking yield inside an ETF could change portfolio math

A roughly five‑percent native yield alters comparative frameworks versus spot BTC and ETH funds. Yield can offset volatility and improve risk‑adjusted returns in multi‑asset models. Institutions constrained by custody or staking policies can now access both exposure and income through a single wrapper. This could broaden the addressable investor base and smooth demand across cycles.

Inflow scenarios and the precedent from earlier crypto ETFs

Analysts model between three and six billion dollars of net inflows during the first year. Benchmarks from the inaugural Bitcoin and Ethereum funds provide a rough upper and lower bound. Even the low end would meaningfully deepen secondary market liquidity in SOL. Stronger uptake could compress spreads further and tighten tracking error versus net asset value.

Recommended Article: Solana Weakens Below $200 as Market Awaits Next Support Zone

Second‑order effects for altcoin market structure and liquidity

A successful SOL staking ETF validates yield‑bearing altcoin exposures in regulated form. That unlocks the possibility of additional products targeting other high‑throughput chains. As institutional flows diversify, DeFi and tokenized‑asset ecosystems may see improved depth. Liquidity that arrives via ETFs often proves stickier than speculative spot rotations.

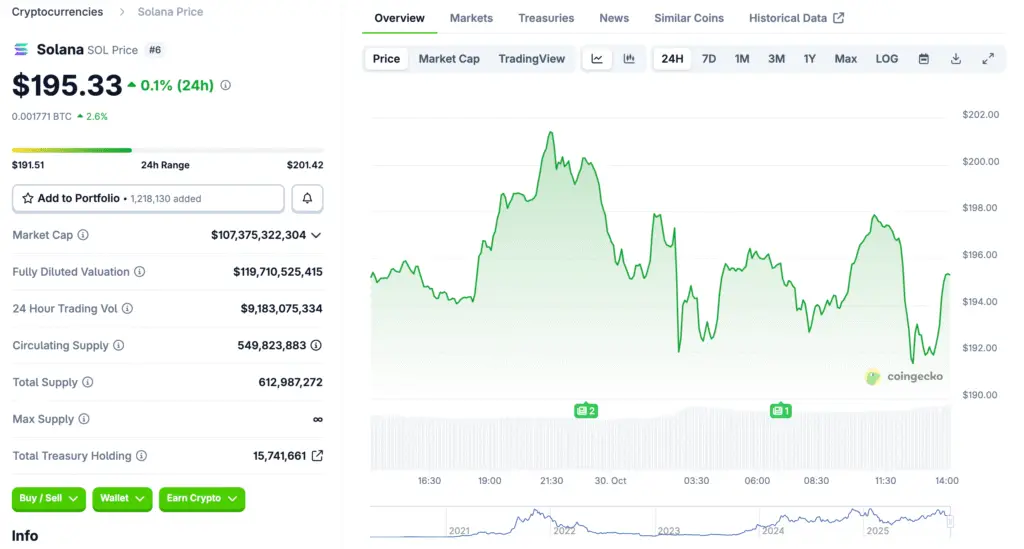

Price implications: flows, not hype, decide trend durability

Near‑term price reactions often overshoot on launch headlines before normalizing. Sustained inflows and consistent secondary turnover are the durable drivers of trend. If net subscriptions persist while on‑chain activity remains elevated, higher ranges can hold. Conversely, a fade in demand risks mean reversion back toward pre‑launch levels.

Comparing SOL’s yield‑adjusted profile to BTC and ETH exposures

BTC funds offer the deepest liquidity but no native income, appealing to pure beta seekers. ETH ETFs bring smart‑contract exposure and a growing institutional base but limited yield pathways. SOL’s product introduces a growth‑plus‑income hybrid that may fit different mandates. Asset allocators can now build more nuanced mixes across crypto factors and cash‑flow profiles.

What to monitor after the opening‑day excitement fades

Track cumulative creations and redemptions, not just headline day‑one volume spikes. Watch bid‑ask spreads, premium‑discount behavior, and options depth for maturation signals. Observe whether on‑chain fees, transactions, and active addresses trend alongside ETF demand. Alignment between product inflows and network usage is the hallmark of healthy adoption.

Portfolio takeaways for both crypto‑native and traditional investors

Crypto‑native participants may hedge basis using ETF markets while farming on‑chain opportunities. Traditional investors can start with small, policy‑compliant allocations while studying volatility. Diversifying across BTC, ETH, and SOL funds can reduce idiosyncratic risk tied to any single narrative. Above all, let position size follow liquidity realities, not headlines, as the product season matures.