Pantera Capital’s Ambitious $1.25 Billion Solana Plan

The cryptocurrency market is witnessing a significant trend as major institutional players increasingly turn their attention to Solana (SOL). Leading this charge is Pantera Capital, a prominent investment firm with a bold and ambitious plan to create a dedicated Solana treasury. The firm is reportedly seeking to raise a staggering $1.25 billion, with the primary goal of converting an unnamed Nasdaq-listed company into a “Solana Co.” This new entity would hold Solana as its primary treasury asset.

The plan is to execute this in two phases: an initial $500 million raise to kickstart the strategy, followed by a separate $750 million deployment. If successful, this would represent the single largest planned SOL-focused treasury, a move that could solidify the Pantera-backed company as the biggest corporate holder of the token and set a new standard for institutional crypto adoption.

The Growing Trend of Corporate Solana Treasuries

Pantera Capital is not alone in its pursuit of a Solana treasury. Its ambitious plan echoes a broader market trend that has seen a growing number of corporations and investment firms look to accumulate Solana on their balance sheets. This institutional interest is a clear signal that the market is maturing and that major players are beginning to recognize Solana’s potential as a high-performance blockchain with a growing ecosystem of decentralized applications and projects.

While Bitcoin has historically been the go-to treasury asset for companies like MicroStrategy, a new wave of firms is exploring Solana as a viable alternative. Its speed, low transaction costs, and scalability make it an attractive option for companies that want to not only hold a digital asset but also actively participate in its ecosystem.

Other Major Players Entering the Solana Market

The trend is not limited to Pantera Capital. Just recently, other major players, including Galaxy Digital, Multicoin Capital, and Jump Crypto, were also reported to be in discussions about building a separate Solana-focused treasury. These three firms are reportedly pushing to raise approximately $1 billion to fund their strategy, with support from the Solana Foundation.

The participation of such influential players in the crypto space underscores the seriousness of this institutional wave. The collective interest and capital flowing into Solana from these major firms could have a profound impact on the token’s market dynamics, potentially driving significant price action and legitimizing Solana as a top-tier institutional asset.

The Current State of Corporate SOL Holdings

While these new funds are still in the planning stages, several smaller publicly traded companies are already accumulating Solana. The current largest corporate holder is Nasdaq-listed Upexi, which reportedly holds around 2 billion SOL in reserve. Other notable corporate holders include NYSE-listed DeFi Development Corp. and Canada-based Sol Strategies, which also hold substantial amounts of SOL. Cumulatively, corporate balance sheets already hold nearly $700 million worth of Solana.

This existing foundation of corporate ownership provides a powerful precedent for the larger institutional efforts currently underway. If Pantera Capital and others succeed in their plans, this figure could rise sharply in the coming months, signaling a massive influx of new capital into the Solana ecosystem.

The Impact of Institutional Demand on Solana Price

The influx of institutional capital from these treasury plays is expected to have a significant impact on the price of Solana. The basic principle of supply and demand dictates that as more capital flows into a limited asset, its price will rise. The collective demand from these multi-billion-dollar funds could put tremendous upward pressure on the SOL token, potentially pushing its price to new highs.

This institutional demand also provides a layer of stability to the market. Unlike retail investors who may be more prone to panic selling, institutional players typically have a long-term investment horizon, which can help to reduce volatility and create a more mature market environment.

Navigating Solana’s Recent Price Dip and Technical Outlook

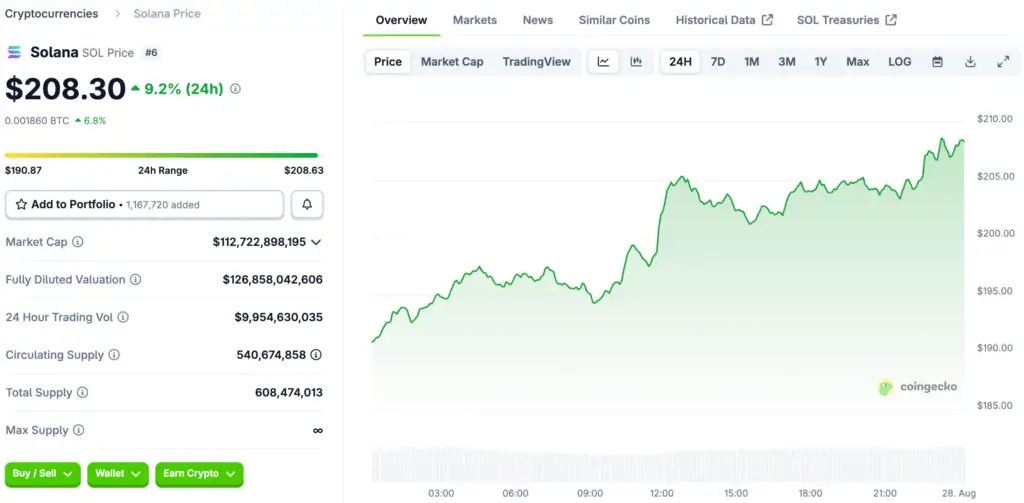

Despite the strong institutional interest, Solana has recently experienced a price dip, falling below the $200 mark and recording a nearly 8% drop in the past 24 hours. This decline reversed a week-long rally and left the token with more modest weekly gains. From a technical standpoint, the market is currently in a state of balance, with the Relative Strength Index (RSI) sitting near 51, indicating that it is neither overbought nor oversold.

The key for Solana will be its ability to hold above the crucial $185 support level. If it can maintain this level, the expected institutional moves could boost demand and put upward pressure on the token, potentially allowing it to test the $190 to $195 resistance range in the near term.

Solana’s Path to Institutional Mainstream Adoption

Pantera Capital’s ambitious plan and the similar efforts from other major firms underscore a powerful and accelerating trend: Solana is rapidly becoming a favorite for institutional treasury plays. This shift signals a new era for the token, where its value is increasingly recognized by large-scale corporate and financial players.

While recent price dips may have caused some short-term concern, the long-term outlook for Solana is bolstered by this growing institutional demand. The success of these treasury funds could usher in a new wave of capital, positioning Solana as not just a top-tier cryptocurrency but as a mainstream institutional asset.

Read More: Solana Price Skyrockets What’s Behind the Recent Rally