Stellar Consolidates Near $0.31 as Market Eyes Next Breakout

A big analyst has set a daring target of $2 for Stellar (XLM) in the current cycle, which has brought the coin back into the spotlight. The prediction fits with a growing agreement that Stellar may be entering an accumulation phase, trading sideways for a long time before settling at the $0.31–$0.32 area.

This stability comes after months of people collecting profits in the cryptocurrency market. Stellar’s low volatility signals that speculative pressure has abated, giving long-term holders time to slowly build up their shares in preparation for the next long-term rise.

Long-Term Structure Shows Strong Base Formation

Stellar, a digital asset, has consistently grown over 11,000% since its inception, undergoing three bull periods and significant drops. This consistent growth has earned it the nickname of a strong digital asset. Currently, Stellar’s price structure resembles the accumulation zones before past rallies.

Analysts note that a flatter price channel indicates a tighter supply zone, indicating a potential positive turnaround. If this pattern continues, Stellar may be preparing for a significant breakout in the coming months.

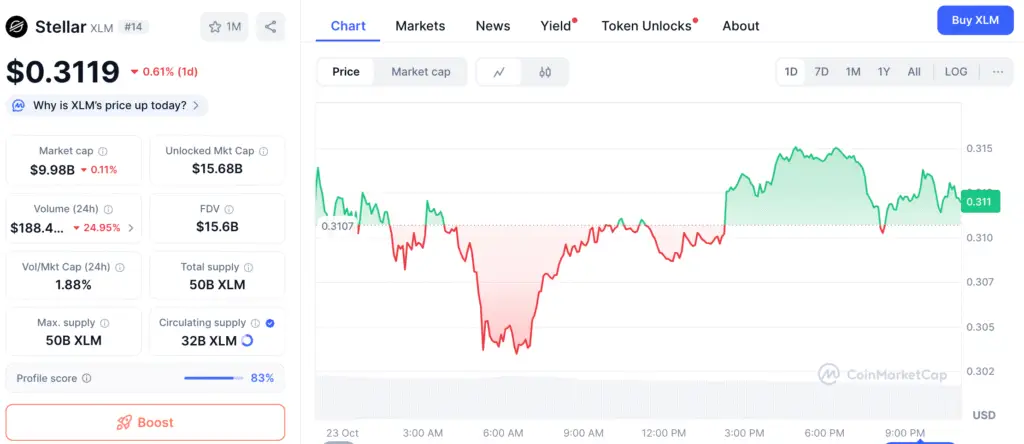

Stellar Climbs to 19th Spot With $10.13B Value as Volatility Declines

Recent statistics from BraveNewCoin show that Stellar is the 19th largest cryptocurrency in the world, with a market value of $10.13 billion and a daily trading volume of $173.4 million. The little 1.1% daily increase shows that volatility has gone down a lot, which means that trading conditions are now healthier and more stable.

This kind of reduction in activity is frequently a sign that the market is moving from speculative churn to accumulation. Analysts point out that Stellar has always had big directional expansions after quiet times, which makes them think that the current tranquil period might be the calm before a fresh upswing.

Recommended Article: Stellar Price Recovers Toward $0.385 With XLM Momentum Rising

Technical Indicators Signal Approaching Reversal

XLM’s Bollinger Bands have gotten a lot smaller, which means that volatility is about to come back. The price is now bouncing between $0.28 support and $0.35 resistance. The Relative Strength Index (RSI) is close to 38, which means that selling pressure is going down.

If Stellar bounces back from its present levels, it might rise back to $0.40–$0.43, which is where the upper Bollinger boundary is. Analysts say that a clean breakthrough over $0.38 on high volume would confirm the commencement of a larger recovery phase, which may lead to retests above $1 and eventually $2 by the end of 2025.

Stellar’s Accumulation Pattern Mirrors Pre-Rally Phases From Past Cycles

Market watchers say that Stellar’s present behavior is quite similar to what happened in previous accumulation zones before a rally. In the past, every time there was a period of tight consolidation and limited volume, the price went up by 5 to 10 times. The same signs for accumulation are back: less volatility, constant activity in wallets, and higher long-term holding ratios.

If the overall mood in the crypto world gets better, Stellar might get more institutional investors. Its concentration on cross-border payments and financial interfaces is still in line with the larger trends that are pushing blockchain adoption, which adds to the technical argument for a rise.

Path to $2 Hinges on Macro and On-Chain Catalysts

To reach the $2 mark, the network has to keep growing and the economy needs to be in good shape. More collaborations in remittance corridors and DeFi-related integrations might lead to more demand for XLM transactions, which would make the case for higher prices stronger.

Analysts say that short-term resistance levels between $0.50 and $0.60 might cause instability before a major breakout. However, if the price stays above $0.35 for a week, it would confirm that the positive trend is still going. If global liquidity improves combined with increased institutional ETF inflows, Stellar’s momentum might pick up speed very quickly.

Stellar Community Stays Bullish as Network Strengthens Real-World Use

Even if the market as a whole is being careful, many in the Stellar community are still quite hopeful. Technical stability, smaller exchange outflows, and more collaborations in the ecosystem all add up to a strong base for trust. More and more, traders see Stellar as more than just a speculative cryptocurrency; they see it as a fundamental network that supports payments in the real world.

As optimistic situations grow, researchers say that Stellar might go up five times in value over the next big cycle. The current consolidation period may be one of the best times for long-term investors to buy more shares before the next wave of market growth starts.