Stellar Approaches a Pivotal Breakdown Stage

Stellar (XLM) is facing intensified downward momentum following a significant technical failure that has undermined investor trust. Analysts indicate that the asset is approaching a particularly precarious stage in 2025, as market momentum increasingly tilts towards sellers.

A significant alert was issued by TheBlockBull, who characterized the chart configuration as “Nuke Town Incoming.” His examination uncovered a significant collapse beneath a long-standing upward trendline that had consistently bolstered several recoveries since early 2025.

Key Trendline Breakdown Signals Bearish Shift

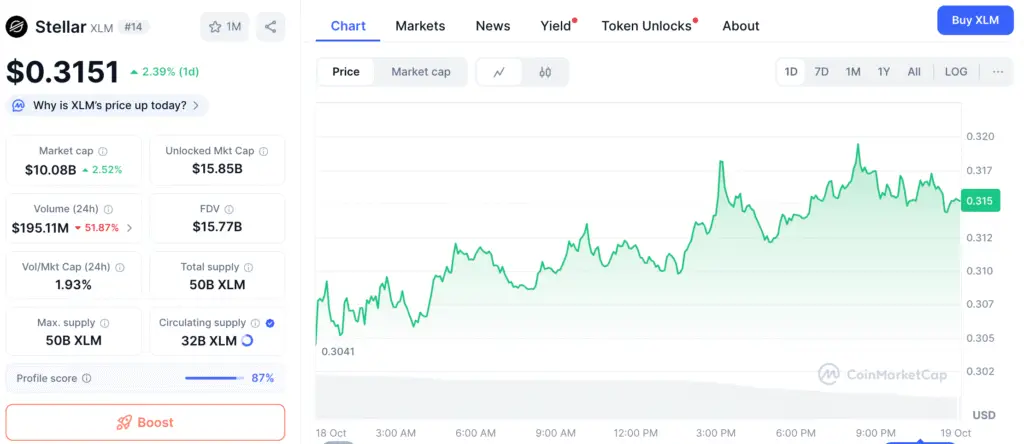

XLM is presently valued at approximately $0.31, having faced multiple setbacks at the $0.33–$0.34 resistance zone. The unsuccessful retest and the following drop beneath the crucial support line indicate that the trendline has transformed into resistance, a significant technical change that frequently signals further downturns.

This level has acted as a foundation for previous recoveries over the year, aiding the coin in bouncing back from multiple declines. Nonetheless, the latest analysis indicates a resurgence of bearish dominance and the possibility of further movement towards lower support levels.

Stellar Risks Drop Toward $0.20 as Key Annual Support Zone Approaches

Should the downward trend continue, experts anticipate XLM will approach the $0.20 mark, a significant demand zone coinciding with the annual low. Historically, this level has served as a pivotal point where a relief rally may initiate or further capitulation may occur.

A continued decline to this price level might draw in buyers looking to capitalize on historic lows, but an inability to maintain the $0.20 mark could lead to further losses in unexplored areas for the year.

Recommended Article: PEPE Price Prediction 2025: Can It Rival Utility-Based Tokens?

Stellar Slides 8.7% to $0.30 as Altcoin Volatility Hits Mid-October Peaks

BraveNewCoin reports that Stellar is currently trading at approximately $0.30, reflecting a decline of 8.74% in the last 24 hours. The current market capitalization of the token is $9.48 billion, accompanied by a daily trading volume of $335.2 million. Stellar boasts a circulating supply of 32 billion tokens, ensuring sufficient liquidity even during the market correction.

The recent sell-off in the broader market has highlighted Stellar’s vulnerabilities, as mid-October witnessed heightened volatility among altcoins. Experts observe that market participants are exercising caution, with overall sentiment leaning towards pessimism as efforts to recover consistently falter at resistance levels.

Stellar’s Price Action Reflects Persistent Selling Despite Signs of Relief

On the XLM/USDT chart, Stellar is currently priced at $0.2969, reflecting a notable decline of 4.90% over the past 24 hours. Numerous unsuccessful efforts to recover $0.32 highlight a significant decline in upward momentum, as sellers take control of the price dynamics beneath the $0.29 level.

The MACD indicates a downward trend, revealing a bearish crossover as the signal line ascends above the MACD line. The red histogram bars reflect ongoing negative momentum; however, a reduction in size may suggest a potential short-term consolidation if selling pressure starts to diminish.

Chaikin Money Flow Suggests Hidden Accumulation Trends

Amidst the overall downturn, on-chain indicators reveal a degree of resilience. The Chaikin Money Flow (CMF) holds steady at 0.13, indicating that despite ongoing capital outflows, there is evidence of accumulation occurring at these levels.

If buying pressure increases, XLM may try to make a brief recovery toward $0.33–$0.35, which aligns with immediate resistance points. Experts emphasize that regaining these levels is crucial to overturn the existing negative trend.

Stellar Faces Key Test at $0.29 Support as Market Weakness Persists

Currently, Stellar finds itself in a precarious situation, as signs of technical frailty coincide with broader market declines. Maintaining a position above $0.29 is essential to prevent a significant decline toward $0.20.

As traders prepare for continued fluctuations, signs of accumulation indicate that some investors perceive the downturn as a tactical chance. The future of XLM’s stability at current levels or potential decline hinges on its capacity to draw consistent buying interest in the upcoming days.