Stellar Shows Signs of Recovery After Extended Decline

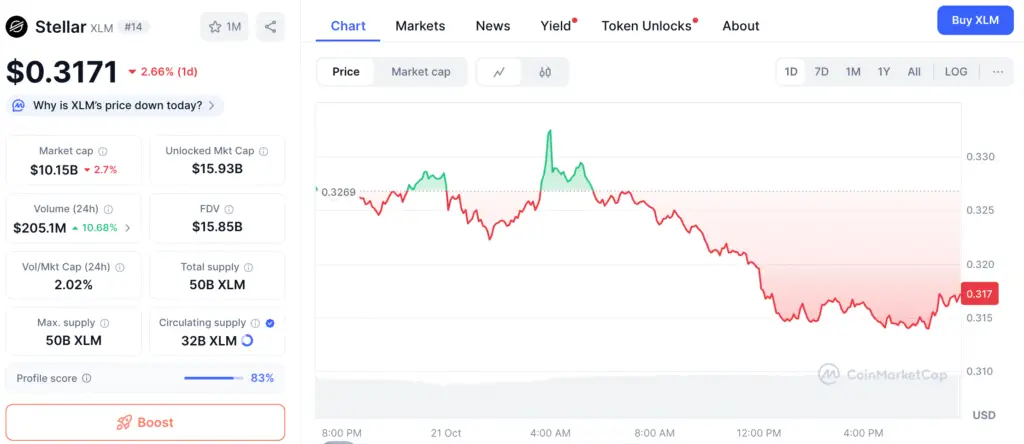

After months of decline, Stellar (XLM) is beginning to rise again, signaling renewed optimism among traders. The cryptocurrency had been on a downward trajectory from mid-July to September but eventually found strong support at the $0.31 level, hinting at a possible shift in momentum.

Stellar is currently trading near $0.328, slightly above recent lows, suggesting early signs of market recovery. If the overall sentiment across the crypto market remains steady, analysts believe the current price structure could establish the foundation for a long-term rebound.

Technical Structure Confirms a Clean Bounce

On-chain analyst Ali reports that XLM has rebounded cleanly from the lower boundary of its descending channel, forming a clear reversal signal on the charts. This move aligns with a broader crypto trend, as several assets begin to recover after months of consolidation.

Immediate resistance lies between $0.34 and $0.35, zones that previously halted upward attempts. A confirmed breakout above this region could open the path toward the upper channel boundary near $0.385, which served as resistance in late September.

Stellar Eyes $0.385 Target as Bulls Defend Key $0.31 Support Level

Traders are closely monitoring three price areas that could influence Stellar’s short-term trajectory. The $0.31 level remains the most critical support, serving as both a psychological and structural floor. Maintaining this base is essential for sustaining bullish momentum.

The mid-channel resistance near $0.35 is the key threshold for confirming renewed bullish control. Beyond that, the upper trendline target of $0.385 stands as the next major upside objective. A successful breakout above that level could trigger a larger rally in November 2025.

Recommended Article: Stellar Price Forecast Hints at Rebound Toward $0.50 Target

Market Indicators Show Less Selling Pressure

Technical indicators support the emerging bullish outlook for Stellar. The Relative Strength Index has exited oversold territory, indicating waning selling pressure. This shift typically precedes accumulation periods followed by strong upward momentum as confidence returns.

Additionally, trading volume has stabilized after several weeks of sharp declines, suggesting that speculative selling has slowed. Analysts believe this calmer environment could help buyers regain control and establish a stronger base before the next breakout attempt.

Broader Market Context Supports XLM’s Rebound

Stellar’s recent uptrend coincides with a broader recovery in the altcoin sector. As Bitcoin stabilizes around $108,000, traders are rotating capital toward mid-cap cryptocurrencies in pursuit of higher returns. Stellar has benefited from this renewed interest in utility-focused projects, particularly given its continued relevance in global payment infrastructure.

The network’s ongoing development in cross-border settlements, liquidity bridges, and fiat-to-crypto integrations reinforces its value proposition within the evolving blockchain landscape. This sustained progress strengthens investor confidence and supports the case for a prolonged recovery extending into 2026.

Historical Patterns Suggest Continued Growth

Historical data shows that each time XLM has rebounded from its channel trendline, it has delivered gains ranging between 10% and 18%. If this pattern persists, the token could approach $0.36 in the coming days, and if momentum strengthens, even rise toward $0.385.

Market analysts emphasize the importance of maintaining price action above $0.32 to confirm continuation of the current rally. Failure to hold this level could delay recovery, but overall technical conditions remain favorable as long as sentiment stays positive.

Stellar Positioned for Gradual Rebound

Recent price behavior suggests that Stellar may have passed the worst of its extended downtrend. The recovery from $0.31, combined with reduced selling pressure and improving technical signals, points to growing market resilience.

If bulls can surpass $0.35 and sustain consistent trading volume, a move toward $0.385 appears increasingly likely. Backed by solid fundamentals and its expanding role in global payments, Stellar is well-positioned to capitalize on the next phase of crypto market recovery heading into 2026.