Why tokenized gold needs transparent, real‑time verification

Asset‑backed tokens live or die by trust in reserves and redemption integrity. GLDY aims to mirror vaulted gold, but proof must be machine‑verifiable, not marketing. Real‑time attestations reduce information gaps that speculators can exploit during stress. With transparency, pricing aligns more closely to net asset value across venues and chains.

Chainlink Proof of Reserve replaces blind trust with cryptographic checks

Proof of Reserve automates data flows from custodians and auditors into smart contracts. Those feeds trigger alerts and can halt minting if collateral falls below thresholds. For GLDY holders, on‑chain proofs provide continuous assurance that supply matches bullion. This design reduces counterparty opacity and supports institutional due diligence.

Price Feeds anchor fair markets and support derivatives integrity

Low‑latency, tamper‑resistant oracles publish reference gold prices to on‑chain venues. Accurate pricing helps AMMs, lenders, and perps maintain tighter spreads and safer parameters. With reliable benchmarks, GLDY can serve as collateral in more protocols with lower haircuts. Deeper integrations widen utility beyond simple buy‑and‑hold exposure.

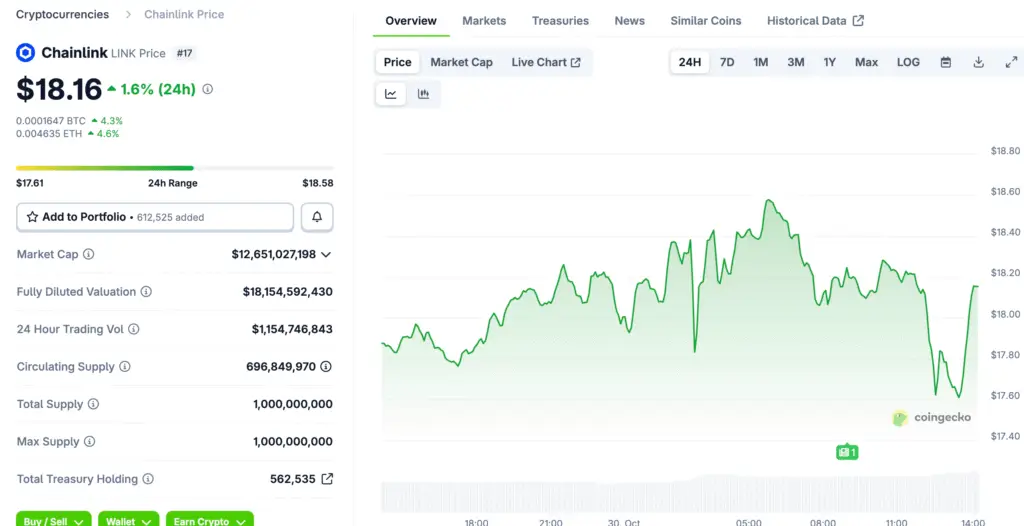

Recommended Article: Chainlink Adoption Grows as Major Partnerships Boost Investor Confidence

CCIP and the Cross‑Chain Token standard unlock composability

Streamex will ship GLDY as a Cross‑Chain Token that moves natively across Base and Solana. CCIP handles messaging, security, and replay protections for cross‑domain transfers. That abstraction lets users bridge without managing brittle bespoke wrappers and synths. Uniform semantics improve developer ergonomics and reduce integration complexity.

Compliance, controls, and the institutional adoption checklist

Institutions require auditable processes, circuit breakers, and role‑based permissions. Chainlink’s Automated Compliance Engine can enforce transfer policies across jurisdictions. Combined with PoR, that stack meets higher bars for reporting and supervisory review. The result is a token that behaves like infrastructure, not a trading stunt.

Liquidity flywheels: how utility can attract market‑making depth

When reserves are verifiable and prices are dependable, market makers quote tighter. Tighter spreads reduce user slippage, lifting volumes and fee revenue for venues. As GLDY’s integrations grow, more vault providers and brokers may participate. That network effect can compress discounts and keep parity with spot bullion.

Risks remain: operational, custody, and cross‑chain considerations

Oracle updates rely on accurate, timely inputs from custodians and auditors. Vault logistics, insurance, and jurisdictional rules must be continuously maintained. Cross‑chain complexity increases the surface area for implementation mistakes. Clear incident playbooks and staged rollouts help mitigate those residual risks.

Outlook: toward a transparent, composable standard for RWAs

If GLDY proves resilient through market cycles, it becomes a template for RWAs. The combination of PoR, robust pricing, and secure interoperability sets a high bar. Tokenization then shifts from marketing narrative to reliable financial plumbing. That is how real‑world assets earn durable trust on public blockchains.