Sui’s Path Through Change and Uncertainty

Sui has had a lot of trouble lately after a $3.4 million hack at Typus Finance that made many worry about how strong its DeFi ecosystem is. Even though there have been some security problems, the community is starting to feel better as strategic partnerships bring back investment interest.

Sui’s relationship with Google to create the Agentic Payments Protocol (AP2), an AI-integrated blockchain project, is a big reason why people are so excited. This innovative idea might make Sui a leader in combining artificial intelligence with decentralized finance, which could lead to more trading and strategic accumulation among investors.

Anticipation Builds as SUI ETF Gains Traction

The possible introduction of an SUI exchange-traded fund (ETF) has become the main story that is shaping how people feel about the market. If the U.S. SEC approves it and it is published on the CBOE, the ETF may provide regular investors easy access to Sui without having to hold crypto directly.

If this happens, it might be like what happened with Bitcoin and Ethereum when the ETF was approved, when institutional inflows sped up a lot. Analysts think that Sui’s price might go up to between $3 and $4 by the end of the year. If trading picks up and institutions get involved, the price could even reach $4.50.

SUI Forms Bullish Wedge as Traders Watch Key $3 Resistance Breakout

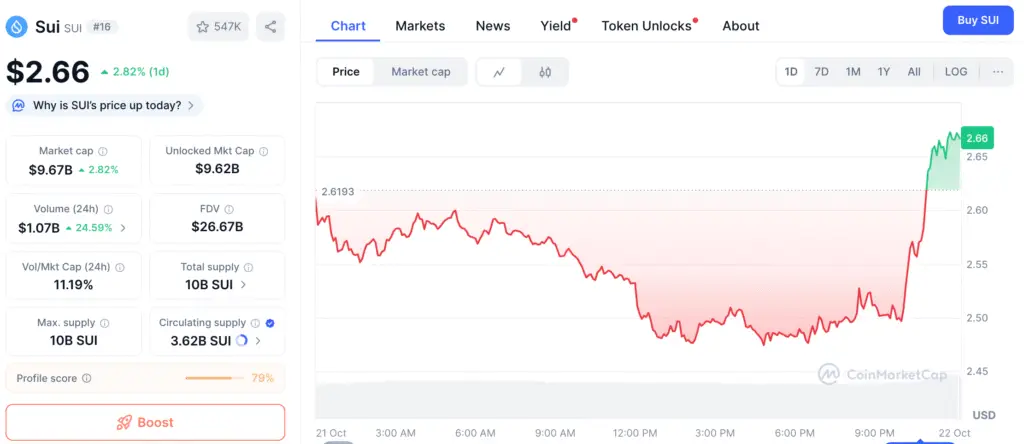

The chart suggests that Sui is making a wedge formation, which might mean that it will keep going up. The asset is now trading close to $2.50, and traders are waiting for confirmation over the $3 resistance level.

But there is a big problem with prices being stuck at $2.90 and $3.40. Analysts stress that a steady amount of purchasing is necessary for any move over $4.50. The $2.40 to $2.60 range is still a good place for strategic investors to buy shares before ETF-related volatility, at least for now.

Recommended Article: SUI Price Reversal Ignites Bullish Trend as Liquidity Jumps 19%

Market Sentiment Shapes Investor Behavior

Sui’s increasing community feeling is split between hopeful speculation and cautious realism. People in the community have made forecasts as high as $7 on social media, showing how excited they are about the next ETF changes.

Still, Sui CEO Evan Cheng is telling people to be disciplined and put real development in scalability and security ahead of price speculation. Long-term investors like this balanced view because they think Sui’s growing ecology is a better sign of its true worth.

Sui Balances Regulation and Decentralization in Pursuit of ETF Approval

Getting an ETF approved is a complicated process with a lot of rules. As regulators pay more attention to decentralized protocols and DAOs, Sui needs to show that it is following the rules while still staying true to its decentralized values.

It is still hard to find the right balance between innovation and regulation. Once the ETF roadmap is set, how soon institutions embrace it may depend on Sui’s capacity to swiftly adapt to new policy frameworks.

Trading Volume and Institutional Interest on the Rise

The amount of Sui trading has gone up by 80% in the last few days, even if the Crypto Fear & Greed Index is still quite low at 22. This difference shows that smart money investors are getting ready for possible catalysts by using present price levels as strategic entry points.

There seems to be more interest from institutions, as speculative sources suggest that fund inquiries and ETF custodial preparations are in the works. If these changes are real, they might mean that Sui’s liquidity profile is changing in a big way as we move into Q4 2025.

Will the SUI ETF Ignite a Long-Term Bull Cycle?

As excitement grows over the likely approval of the ETF, traders are looking for confirmation indications in volume and price movement. If Sui gets the go-ahead from regulators, it might bring in a lot of institutional money and move up the list of top cryptocurrencies.

Even while people are hopeful, there are still hazards because of the timing of regulations and the mood of the market as a whole. Sui’s ETF story is a key point in determining its long-term path in the Layer-1 space, whether it rises toward $4.50 or stays around $2.50.