Sui Faces Pressure After Sharp 46% Decline from Yearly High

Over the past month, Sui’s market performance has been worse, dropping 46% from its July high of $4.44. In the last 24 hours, the token has lost 7.5% of its value, and in the last 30 days, it has lost about 28%. This long fall happened at the same time as other problems in the market as the U.S. raised tariffs on Chinese imports, which stopped the recovery of altcoins.

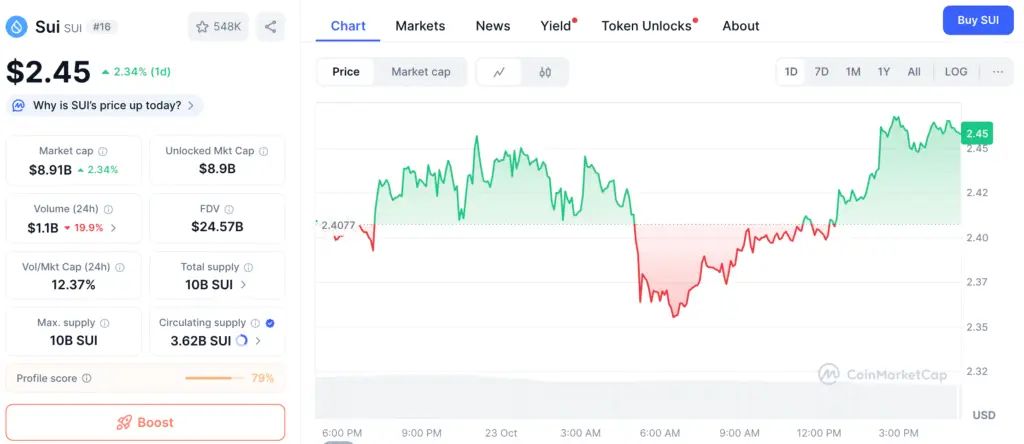

Analysts say that Sui’s price is still inside a technically defined support structure, even after the drop. Investors are keeping a careful eye on the $2.4 level, which has been a key demand zone during previous retracements. If Sui can hold this level, it might decide if it stabilizes or goes into a deeper corrective phase.

On-Chain Data Reveals Weakening User Activity

Recent on-chain data shows that Sui’s daily active users are going down, which means that fewer people are using it in the near term. The indicator shot up in the middle of the year when SUI hit its swing high, but it has since gone down, which is in line with how cautious investors are in altcoin markets as a whole.

The token’s slow price movement and lower liquidity turnover are partially due to this decline in user engagement. However, the foundations of the network still look strong since new decentralized apps are bringing in new liquidity. This means that the network might recover in the long run if user engagement picks up again.

Sui Lags Behind XRP and Solana as ETF Absence Slows Institutional Growth

While competitors like XRP and Solana got spot ETF listings, Sui hasn’t been able to get institutional trading instruments, which has slowed its short-term development. Investors see ETF approvals as important steps that help ETFs become more well-known and get more institutions to invest in them. Because Sui is not there, people are assuming that there is still not a lot of interest in the project.

Still, observers say that this stage might be an opportunity that isn’t getting enough attention. As regulations become clearer, Sui may ultimately see more institutional engagement, especially if its ecosystem keeps growing at its current rate.

Recommended Article: SUI ETF Speculation Sparks Optimism for Major Price Breakout

Momentum DEX Sparks Rapid On-Chain Growth

Even though prices have been going down, Sui’s decentralized exchange Momentum has been a big hit in its ecosystem. Since the end of September, the total value locked (TVL) of Momentum has jumped from $174 million to $500 million, a 187% increase in less than a month. About 25% of Sui’s total network liquidity is presently on the platform.

Momentum’s growth has already put it ahead of big competitors like NAVI and put it in a good position to take over Sui Lend as the top decentralized app on the network. This flood of money shows that investors are becoming more confident in Sui’s DeFi infrastructure. This might lead to higher prices when the general mood improves.

Sui’s Stablecoin Reserves Surge to $1.2B as On-Chain Demand Climbs

As Momentum DEX has grown, Sui’s stablecoin reserves have grown a lot, going from $535 million to $1.2 billion. This big jump shows that there is more demand for Sui-based financial activities and that both new and old users are bringing in more money.

These expanding reserves show that investors are putting money on the blockchain in the hopes of finding new possibilities in the future. In the past, the accumulation of stablecoins has been an early sign of increased on-chain activity and rising market momentum for the assets that back them.

Technical Outlook Suggests Possible Recovery Toward $3.4

From a technical point of view, Sui is now holding steady around $2.4, which has been a support level for bullish reversals in the past. Analysts point out that the trading volume has risen to $1.2 billion in the previous 24 hours, which is around 14% of the market cap that is now in circulation. This is a sign that more people are interested in buying at cheaper prices.

If SUI can keep this support and keep its volume growth going, it looks like it will bounce back in the short run to between $3.15 and $3.4. If the price breaks above those levels, it might start a bullish trend again and make it possible to challenge the $4 resistance zone that was reached earlier this year.

Sui’s Recovery Outlook Strengthened by Ecosystem Expansion

People are still wary about the market, but Sui’s internal ecology is growing in a good way. The success of Momentum DEX and the quick growth in stablecoin liquidity show that the network is laying the groundwork for long-term use.

Analysts think that if buying volume keeps up at the same rate, Sui might lead the next wave of layer-1 recovery. It’s still important for Sui to stay above $2.4, but if fundamentals improve, liquidity increases, and user engagement rises, Sui may make a big recovery toward $3.4 and maybe even higher as confidence returns to the altcoin market.