Highlights of SUI Price Consolidation Essential Market Levels

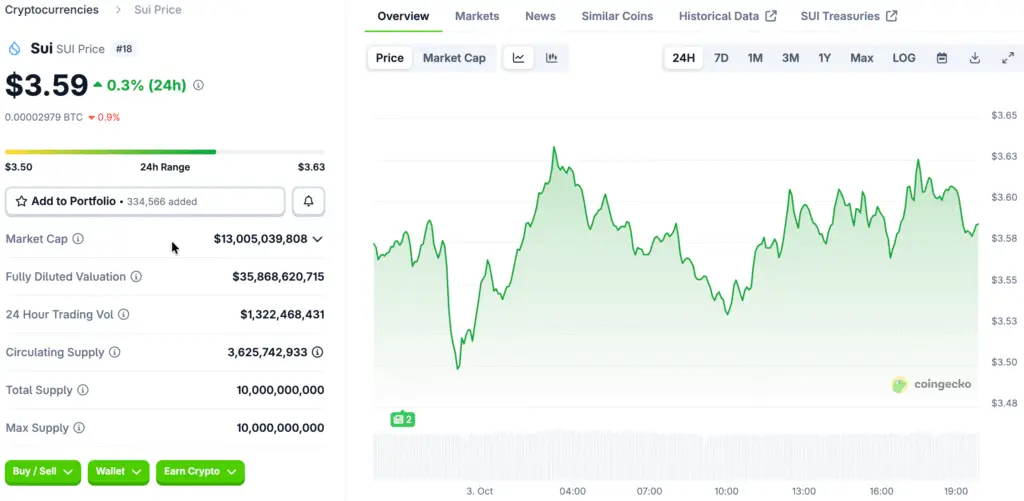

Sui is presently trading within the range of $3.25 to $3.59, establishing an important support level as traders keenly observe for potential bullish momentum. This price zone has emerged as crucial, offering structure and confluence that may facilitate a rally toward the $4 target.

Market participants are closely observing these levels, recognizing that a successful defense might indicate a resurgence of upward momentum. Maintaining this range would bolster the technical framework and enhance market confidence in SUI’s durability.

Macro Environment Supports Risk Asset Recovery

The U.S. Federal Reserve has initiated its rate-cutting cycle once again, implementing a 0.25% reduction in September, which has notably increased the appetite for risk assets. Markets are now expecting a minimum of two more cuts, which is likely to further drive capital rotation into crypto and growth assets.

Institutional treasuries are progressively increasing their allocation to crypto as inflation stays high and labor markets show signs of weakening, prompting a shift towards policy easing. The combination of these macro forces fosters a conducive environment for the growth of altcoins, as long as the technical levels hold steady.

Token Unlock Presents Immediate Market Challenge

From September 29 to October 6, around 44 million SUI tokens, valued at $143.9 million, are set to be released into circulation. This unlock signifies a notable supply wave that traders anticipate may lead to price fluctuations between 5% and 15% throughout the timeframe.

SUI has already experienced a decline of approximately 3%, falling from $3.32 to $3.21 as the impacts of early unlock began to take effect. Market sentiment is currently cautious; however, the upcoming futures listing from Coinbase has the potential to alleviate this pressure by attracting greater institutional participation.

Recommended Article: SUI Futures Debut on October 20 Signals Market Maturity

Institutional Catalysts May Alleviate Selling Pressure

Coinbase has announced that SUI futures are set to launch on October 20, indicating an increasing institutional interest in the token’s liquidity profile. Listings of derivatives generally draw in professional trading activity, enhancing market depth and possibly contributing to more stable price movements.

If organizations adopt these products, the purchasing demand may effectively manage the influx of unlocked token supply. Experts consider this development a significant factor that could enhance market structure in Q4, bolstering SUI’s long-term growth path.

Technical Outlook Focuses On Critical Support Zone

The support range of $3.25–$3.50 is crucial for maintaining SUI’s upward trend and preventing more significant pullbacks. A successful retest in this area would coincide with higher-timeframe demand zones, offering confluence entries for swing traders aiming for upward targets.

Important resistance levels are identified at $3.61 and $3.97, serving as sensible points for profit-taking should momentum increase. Traders highlight the importance of maintaining support, as a fall below these levels could quickly lead to significant downward pressure.

Balanced Forces Shape Near-Term Market Direction

The present market showcases a nuanced interplay between optimistic drivers and opposing supply challenges. Token unlock events bring about sudden fluctuations, whereas broader market trends and institutional advancements offer potential support in the medium term.

Traders need to monitor both fundamental and technical elements at the same time to accurately evaluate directional bias. A strong rebound from support may ignite a bullish trend, while any breakdowns could undermine the current recovery story.

SUI Aims for $4 If Buyers Keep Dominance

Sui was trading around $3.56 at the time of writing, showing a 9.34% increase over the past 24 hours, indicating a positive shift in sentiment among market participants. Maintaining support as momentum increases could drive SUI to $4, strengthening optimistic outlooks as we approach the end of Q4.

Nonetheless, ongoing selling due to token unlocks continues to pose a significant risk, which could hinder upward progress. Market participants are closely monitoring price movements, as this support zone is expected to shape SUI’s short-term market direction.