SUI Price Holds Bullish Structure Despite Pullback

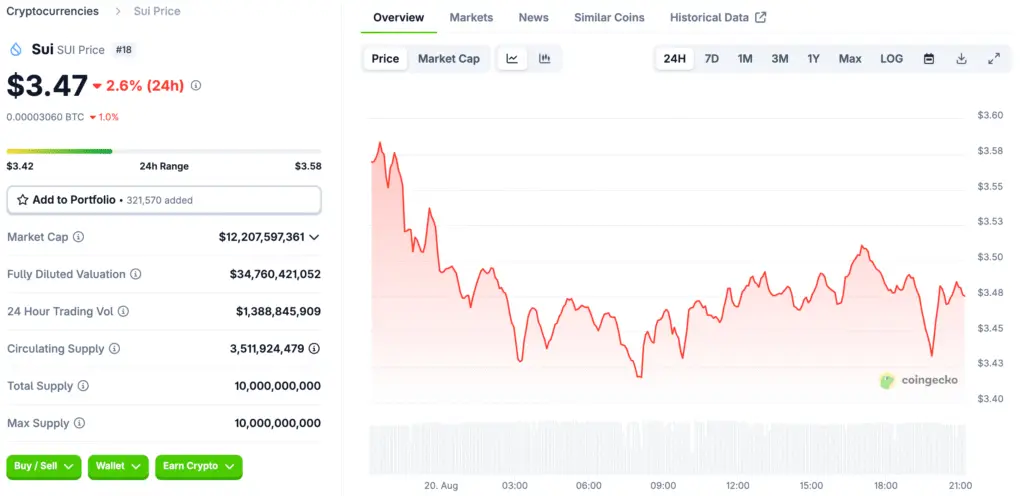

The cryptocurrency market has been volatile in recent weeks, but SUI continues to hold a bullish technical setup. At the time of writing, SUI trades at $3.49, down just over 3% in the past 24 hours, yet maintaining its position within an ascending triangle pattern. This chart formation, which has been developing since June 2025, shows higher lows converging toward resistance around $4.46–$4.50.

The pattern suggests steady accumulation at progressively higher levels, with buyers stepping in to defend key support. So long as SUI remains above the crucial $3.40 trendline, the bullish case remains intact. A clean breakout above resistance could propel the token toward $5.50, representing a potential 57% upside from current levels.

Robinhood Listing Opens SUI to Millions of New Investors

A major catalyst for SUI’s recent momentum is its listing on Robinhood, one of the most widely used trading apps in the United States. For the first time, millions of U.S. retail investors can now trade SUI directly, expanding its exposure to a broader audience. Historically, Robinhood listings have triggered notable inflows into crypto assets.

With SUI joining the platform, analysts suggest this could boost demand and liquidity, particularly among retail traders seeking the “next Solana or Avalanche”. The timing of the listing is especially significant, coming just as SUI consolidates near a breakout level. This convergence of technical and fundamental drivers could amplify the next price movement.

Market Sentiment Turns Positive

Investor sentiment toward SUI has improved notably in August. Data shows weighted sentiment rebounding to +0.533, reflecting renewed optimism among traders. Meanwhile, the 14-day Money Flow Index (MFI) sits at 48.75, signalling neutral momentum.

This balance between buying and selling pressure leaves room for upward movement if demand accelerates. Trading volume has also surged, with daily SUI pair gains exceeding 4.5% on several exchanges. Higher volume tends to validate price action, reinforcing the breakout potential suggested by the ascending triangle formation.

Institutional Adoption Strengthens the Bullish Case

Beyond retail adoption, institutional interest in SUI continues to grow. In a recent development, Swiss Bank Sygnum announced it would offer custody and trading services for SUI, making it accessible to regulated institutional investors. Adding to this momentum, Mustafa Al Niama, a former Goldman Sachs executive, joined Mysten Labs, the core team behind Sui, to lead capital markets integration.

His entry underscores the project’s ambition to bridge traditional finance with blockchain innovation. Sui Network fundamentals also remain strong. The network has surpassed $80 billion in cumulative decentralised exchange (DEX) volume in the first half of 2025, while its DeFi total value locked (TVL) has climbed past $2.15 billion. These milestones highlight the growing utility and adoption of the ecosystem.

Technical Outlook: $4.50 Resistance Is Key

From a technical perspective, the immediate focus remains on the $4.20–$4.50 resistance zone. A breakout above this level would confirm the ascending triangle and open the path toward $5.00–$5.50 targets, supported by Fibonacci retracement levels, particularly the 0.786 retracement at $4.25. On the downside, support levels at $3.80 and $3.50 are critical.

A decisive breakdown below $3.40 would invalidate the bullish structure and expose SUI to deeper declines. One potential headwind is SUI’s token unlock schedule. In August 2025, over 44 million SUI tokens worth approximately $171 million were released, with unlocks continuing through 2030. These periodic releases could add selling pressure if not absorbed by market demand.

SUI Price Prediction: Balanced but Bullish

With a current market capitalisation near $13 billion, SUI remains among the top-tier altcoins despite broader crypto market weakness. Its mix of technical momentum, retail accessibility via Robinhood, and growing institutional adoption creates a compelling narrative for long-term growth.

If bulls succeed in breaking the $4.50 ceiling, analysts see SUI testing $5.50 in the short to medium term. However, failure to hold above $3.40 would undermine the bullish thesis and potentially shift momentum to the downside. For now, the balance tilts in favour of continued accumulation and a potential breakout, making SUI one of the most closely watched altcoins heading into September 2025.

Read More: FLOKI Robinhood Listing Sparks Rally Past $1 Billion Mark