SUI Price Holds Firm After Weeks of Market Volatility

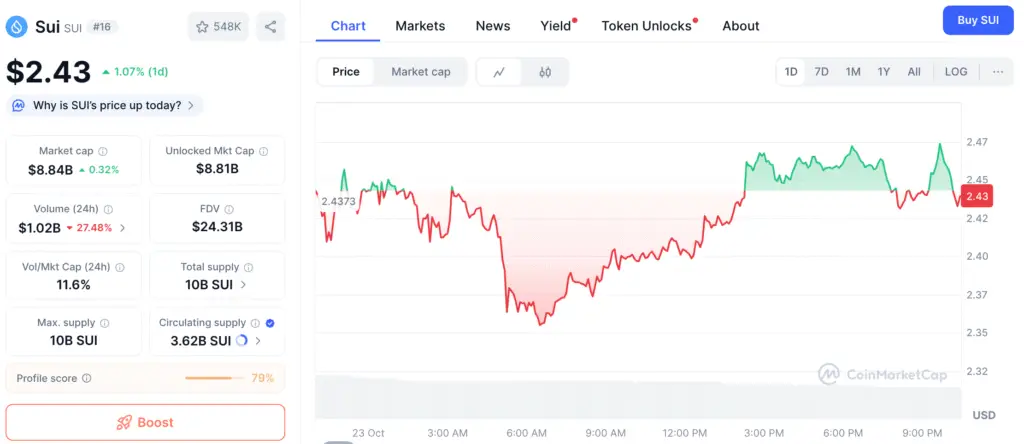

Sui (SUI) has stabilized around the $2.43 level following a rough start to October, which has made investors more hopeful about its long-term future. Even if the rest of the crypto market is down, with Bitcoin down to $108K and Ethereum dropping more than 4%, SUI’s structure is starting to show indications of recovery.

Analysts say that the way the token’s price moves is similar to how big cryptocurrencies have behaved throughout accumulation periods before their breakout cycles. If SUI’s price rises over $3, it might start a larger rebound that could take it out of its year-long consolidation zone and bring back optimistic optimism across its ecosystem.

ETF Momentum Builds With Canary’s SEC Filing Update

Canary Funds submitted an amended S-1/A registration with the U.S. Securities and Exchange Commission for its proposed Spot SUI ETF, which got a lot of attention from investors. The amendment includes improvements to the administration, but most importantly, it verified ticker registration on the Cboe exchange, which is an indication that work is being done toward getting regulatory clearance.

Analysts consider the submission as a big step forward for the Layer-1 blockchain, even if a final decision is still pending. An authorized ETF would let institutional investors buy Sui through regular markets. This would make it more accessible and might lead to more liquidity when trading starts.

Ecosystem Growth Accelerates With Stablecoins and “SUI Bank”

Sui’s team is still growing their ecosystem by adding real-world financial interconnections, not just through market speculation. Co-founder Stephen Mackintosh talked about ideas for a local “SUI Bank” project that would combine blockchain technology with traditional finance. He stressed the need for building infrastructure that lasts.

Two stablecoins, suiUSDe and USDI, have already been released on the network. They are meant to make decentralized financial activities more efficient and improve liquidity. Mackintosh said that 90% of ecosystem income will be put in network development, which shows that Sui is focused on scalability, token liquidity, and user growth.

Recommended Article: SUI ETF Speculation Sparks Optimism for Major Price Breakout

Technical Patterns Indicate Evolving Market Structure

Traders’ recent technical updates suggest that SUI’s price action has changed from a basic triangle pattern to a more complicated diametric formation. The prior breakout trigger didn’t work because of low volume, so analysts are telling people to be careful until a better signal comes along.

Traders who are keeping an eye on SUI’s charts are using stringent risk management techniques, such as trailing stops and taking profits early at resistance levels. The changing wave shape signals that volatility might continue in the short term, but the long-term path is still the same.

Sui Enters Accumulation Phase With Key Support Holding at $2.26–$2.50

People who watch the market think that SUI is presently in a long accumulation period that is similar to Solana’s consolidation in late 2024 before it shot up. Key support levels between $2.26 and $2.50 are still holding, and more activity on the blockchain is giving patient investors more confidence.

Once the economy starts to improve, this time of stability might be the start of a breakout. If the cryptocurrency keeps moving up over $3, it might start the next bullish phase, which would aim for resistance levels above $5 in the longer term.

Long-Term Targets: Can SUI Really Reach $100?

SUI’s long-term forecasts are optimistic, with analysts suggesting a potential price rise of $100 by 2035 if adoption accelerates. This growth requires continued growth in Sui’s ecosystem and successful integration of institutional money through the proposed ETF.

Sui’s transaction throughput is above 297,000 TPS, and its community-driven efforts and developer ecosystem make it a potential alternative to established Layer-1 competitors. However, institutional money integration through the proposed ETF is necessary for sustained growth.

Stability, Regulation, and Adoption Define Sui’s Future

Sui is one of the most promising Layer-1 blockchains as we approach 2026 because it has a lot of new technology, a lot of financial uses, and a lot of regulatory support. The recent development with ETFs and the addition of stablecoins are important steps in its progression toward being more relevant to the general public.

There is still a chance of short-term volatility, but the project’s strategic strategy and reinvestment structure imply stable long-term growth. If things keep going the way they are in the ecosystem, Sui might eventually go from consolidation to breakout, which could lead to the long-awaited $100 milestone.