Tether Achieves Record-Breaking Profit in 2025

Tether International has announced over $10 billion in net profit for the first three quarters of 2025, solidifying its dominance as the world’s most profitable private company in the stablecoin sector. The achievement highlights USDT’s continued leadership amid global market volatility and rising demand for dollar-pegged digital assets.

Unprecedented Growth in USDT Circulation

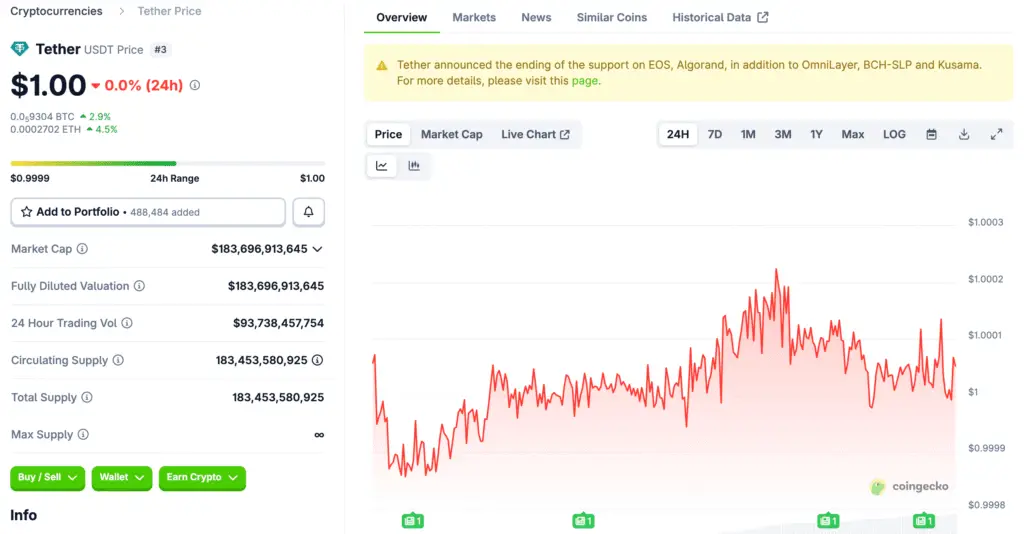

Throughout 2025, Tether minted over $17 billion worth of new USDT tokens, boosting total circulation to $174 billion by September and surpassing $183 billion by October. This growth underscores Tether’s unmatched market presence and user confidence in its digital dollar, especially as investors seek stability amid shifting macroeconomic conditions.

Tether Emerges as a Major U.S. Treasury Holder

In an unprecedented development, Tether’s holdings in U.S. Treasury securities have reached approximately $135 billion, officially making it the 17th largest holder of U.S. government debt worldwide. This surpasses the holdings of entire nations, including South Korea, marking a historic milestone for a private company operating in the crypto sector.

Recommended Article: Tether Earnings Milestone Reinforces Stablecoin Dominance And Multi Asset Treasury Confidence

Massive Reserve Backing and Strong Balance Sheet

Tether’s attestation report from BDO confirmed total reserves of $181.2 billion, exceeding its liabilities of $174.4 billion. The portfolio includes $12.9 billion in gold and $9.9 billion in Bitcoin, representing 13% of total reserves. With $6.8 billion in excess capital beyond what’s required, Tether continues to lead the industry in financial transparency and liquidity strength.

Paolo Ardoino Highlights Stability and Global Adoption

Tether CEO Paolo Ardoino credited the company’s performance to sustained user trust and institutional adoption. He noted that USDT remains the world’s most liquid and reliable stablecoin, bridging the gap between traditional finance and blockchain innovation. Ardoino emphasized Tether’s mission to promote financial inclusion through technological investment.

Half a Billion Users and Global Expansion Strategy

Tether’s user base now exceeds 500 million people worldwide, reflecting massive adoption in both emerging markets and developed economies. The company has diversified its operations into artificial intelligence, renewable energy, and telecommunications through independent subsidiaries, signaling a broader shift toward long-term infrastructure investments.

Legal Settlements and Strategic Initiatives

In October, Tether successfully settled its legal dispute with bankrupt crypto lender Celsius using private investment funds, ensuring that USDT reserves remained untouched. Additionally, the company initiated a share buyback program aimed at institutional investors and applied for an investment fund license in El Salvador, reinforcing its global regulatory positioning.

Financial Strength and Outlook for 2026

With group equity estimated at $30 billion, Tether has positioned itself as both a financial powerhouse and a systemic player in global finance. Its expansion into real-world assets and ongoing profit growth highlight a maturing business model that blends traditional financial principles with blockchain innovation. As 2026 approaches, Tether’s stability and profitability continue to redefine the future of the digital economy.