Tether Broadens Its Horizons with a Gold Treasury Initiative

Tether is securing a minimum of $200 million to establish a new company dedicated solely to tokenized gold assets. The initiative, revealed on October 3, 2025, signifies a pivotal transition away from digital currencies such as Bitcoin and Ethereum.

A new treasury firm is set to acquire and retain Tether Gold (XAUt), a token that is fully backed by physical gold stored in Swiss vaults. Tether is collaborating with Antalpha Platform Holding, a financial firm associated with Bitmain, to pursue this ambitious project.

Tokenized Gold Gains Momentum as Safe-Haven Demand Surges

Tether’s recent funding round highlights the growing interest from institutions in tangible assets such as gold, especially in light of the current global economic uncertainty. This year saw the launch of over 80 digital treasury firms, yet Tether stands out with its emphasis on gold instead of Bitcoin.

XAUt exceeded $1 billion in value on October 1, propelled by unprecedented gold prices surpassing $3,800 per ounce. The current market capitalization is approximately $960 million, reflecting a 46% increase in gold investment in 2025 amid challenging macroeconomic conditions.

Antalpha Partnership Strengthens Infrastructure and Global Reach

Tether currently holds an 8.1% stake in Antalpha, strengthening its relationship via the Real World Asset (RWA) Hub collaboration. The platform allows users to leverage XAUt collateral for borrowing, akin to home equity loans, effectively connecting blockchain with traditional finance.

Antalpha is set to launch vaults in prominent global cities, allowing holders to exchange digital tokens for tangible gold bars. Executives assert that this will render digital assets “more tangible” for retail users, merging the liquidity of crypto with the familiarity of gold.

Recommended Article: $20B Funding Round Could Push Tether to $500B—Meanwhile MAGAX Stage 2 Offers Early Entry at Lowest Price

Tether’s Broader Strategic Vision Extends Beyond Stablecoins

The gold treasury initiative is in harmony with Tether’s broader approach to expand its operations beyond the issuance of USDT. The organization currently possesses $8.7 billion in gold reserves and has ventured into Bitcoin mining, energy, and AI industries.

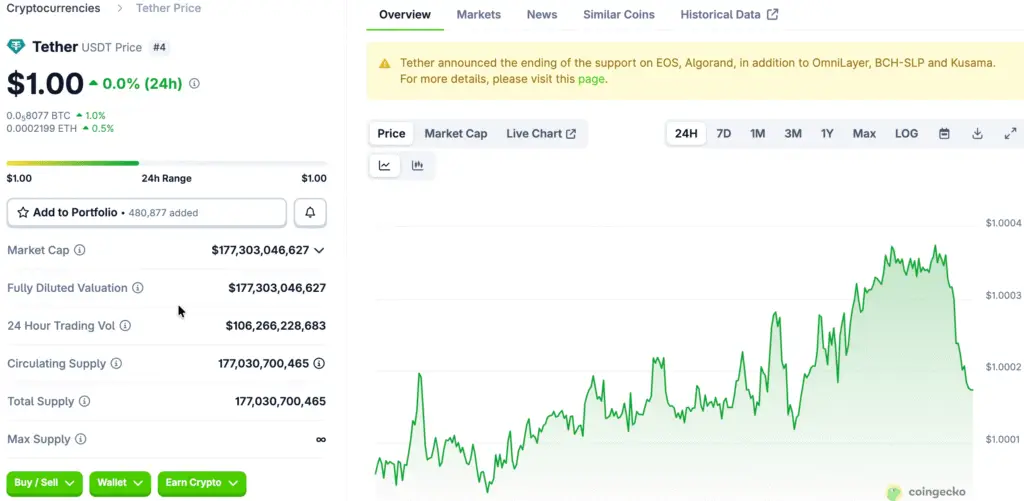

Tether is said to be aiming for a valuation of $500 billion, positioning it as one of the most valuable private companies in the world. The supply of USDT currently reaches $175 billion, establishing its dominance in the stablecoin market and generating significant liquidity throughout exchanges.

XAUt vs PAXG: Competing Models for Digital Gold Dominance

Paxos Gold (PAXG) previously achieved a valuation of $1 billion, yet it functions under more stringent US regulations compared to XAUt. PAXG conducts monthly audits and operates exclusively on Ethereum, drawing in more than 74,000 holders and achieving a daily volume of $67 million.

XAUt is based in El Salvador, operates across six blockchains, and issues quarterly reports through BDO Italia. The number of holders stands at approximately 12,000, with a daily volume of $23 million, suggesting a significant concentration among larger institutional investors.

Tether’s $200M Gold Treasury Boosts Liquidity as Tokenized Gold Gains Global Investor and Bank Interest

Since January, gold prices have surged by 48%, and tokenized gold products have attracted considerable interest from investors worldwide. In 2024, central banks acquired more than 1,000 metric tons of gold, underscoring gold’s significance as a reserve asset.

Tokenization enables fractional ownership, facilitates instant settlement, and provides wider access in comparison to conventional gold investment. The $200 million treasury held by Tether has the potential to enhance market liquidity, thereby increasing the appeal of XAUt to institutions in search of stability.

Key Questions Will Determine Project’s Long-Term Success

For Tether, achieving success relies on sustaining liquidity, enhancing transparency, and developing Antalpha’s anticipated vault network. Skeptics point out Tether’s track record of postponed audits, yet recent discussions with accounting firms indicate advancement.

The partnership brings together Tether’s leading position in stablecoins and Antalpha’s access to physical gold, forming a formidable entity in the market. If achieved, this has the potential to transform the trading, storage, and integration of gold within digital financial systems.

Tether’s $200M Gold Treasury Bridges Blockchain Innovation With Traditional Safe-Haven Investment Assets

Tether’s $200 million gold treasury marks a significant transition towards integrating traditional safe-haven assets with the efficiency of blockchain technology. This initiative establishes tokenized gold as a connection between cryptocurrency speculation and high-quality investment options for institutions.

This development has the potential to significantly influence the widespread acceptance of real-world asset tokenization, altering the way investors engage with commodities. Currently, Tether is placing its confidence in the idea that digital gold will be pivotal in the forthcoming transformation of global finance.