The crypto market is heating up again as reports suggest the SEC is preparing to approve Dogecoin (DOGE) and XRP ETFs — a move that could legitimize crypto in the eyes of traditional finance. But while retail investors are distracted by the ETF buzz, the real move is happening elsewhere. Ethereum’s biggest DeFi token, Paydax (PDP), is quietly preparing for what analysts say could be a 45,000% rally in just two weeks.

DOGE & XRP ETFs Are Coming, But They’ll Lock Up Billions In Idle Crypto

Despite the temporary closure of the U.S. Securities and Exchange Commission (SEC), several ETFs, including Dogecoin and XRP ETFs from Grayscale, 21Shares, and Bitwise, are still on track to be listed. This approval from the SEC means investors will soon gain access to DOGE and XRP exposure directly through traditional platforms like Fidelity and Robinhood, without ever using the blockchain.

It’s a bullish signal — one that finally opens a regulated, familiar gateway for institutional money to enter crypto. But here’s the catch: when Dogecoin and XRP ETFs go live after approval from the SEC, billions in DOGE and XRP will be locked in institutional custody wallets, effectively removing them from the open crypto economy. They won’t be tradable, stakable, or usable in DeFi.

Imagine holding $50,000 worth of Ethereum or Dogecoin in an ETF while a new DeFi token starts exploding or a bull run kicks off. You can’t move fast, you can’t use it as collateral, and you can’t liquidate easily to jump into the next opportunity. That’s exactly the kind of inefficiency Ethereum’s biggest DeFi token, Paydax (PDP) was built to fix.

Paydax (PDP) Turns Idle Capital Into Opportunity

While traditional ETFs lock capital inside institutional vaults, Paydax keeps crypto assets alive — liquid, productive, and always accessible. Here’s how:

Unlocks Idle Crypto Capital

As Ethereum’s biggest DeFi token, Paydax (PDP) lets users take out stablecoin loans using their crypto or tokenized real-world assets as collateral, including gold, art, and luxury items—providing liquidity without selling their holdings. In simple terms, Paydax gives traders what ETFs take away: flexibility.

Multiple Yield Opportunities

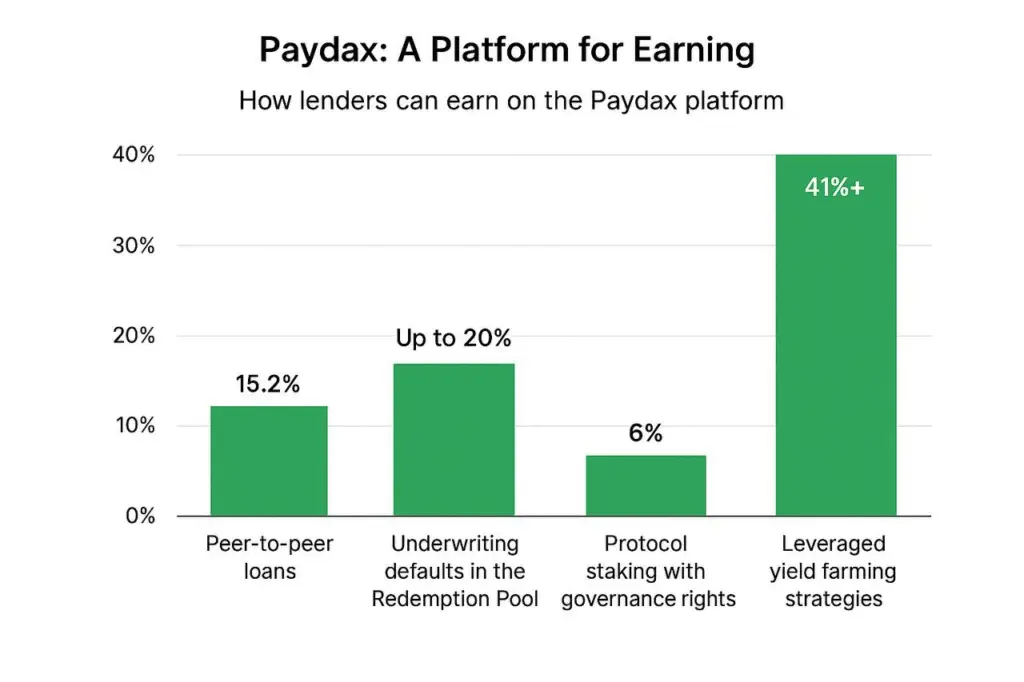

Unlike Dogecoin and XRP ETFs, which investors will likely only earn when prices rise, Paydax users can earn yield even in sideways markets through:

- Stablecoin staking → up to 6% APY.

- Redemption Pool → up to 20% APY.

- Protocol Staking→ up to 5% APY, along with governance rights.

- Yield farming (5x leverage) → up to 41.25% APY.

These multiple income streams transform the PDP token into a compound-earning asset, rather than a static ETF that only moves when prices rise, solidifying its place as Ethereum’s largest DeFi token.

Why Analysts Believe PDP Could Deliver 45,000% Returns

Speculation alone can’t drive a 45,000% rally in just two weeks. What makes Paydax (PDP) different is that its presale comes with fundamentals usually seen only in post-listing projects. This Ethereum’s biggest DeFi token already powers a live dApp where users can borrow, lend, stake, and earn. On top of that, Paydax offers strong safeguards: audited smart contracts by Assure DeFi and a fully doxxed leadership team provide the kind of protection most DeFi tokens lack.

The real game changer, however, is PDP’s tokenomics. Capped at $10 billion, tokens are reserved for staking, ecosystem growth, and incentives, with limited team holdings to prevent dumps. Meaning, every platform activity, from loans to staking, requires PDP tokens. Thus generatinga constant, built-in demand for the token. For early investors, this translates into the potential for explosive growth—up to 45,000% in just two weeks.

The Math Behind PDP’s Explosive Potential

Consider the math: Dogecoin and XRP, both with billion-dollar market caps, need massive inflows to move even a few percent—post-ETF approval from the SEC or not. But the Ethereum token, Paydax (PDP), still at just $0.015, doesn’t. Even moderate adoption could spark 45,000% gains in two weeks.

| Token | Current Price | Market Cap Base | Growth Potential | Key Catalyst |

| Paydax(PDP) | $0.015 | low-cap | Up to 45,000% in 2 weeks | Unlocking idle ETF liquidity, exchange listings, and partnerships with major firms |

| DOGE | $0.2529 | $4.27 billion | 300% | ETF approval attracting retail flow |

| XRP | $2.88 | $7.43 billion | 30 to 40% | XRP ETFs demand and mainstream adoption from institutions. |

The table shows that, while DOGE and XRP are poised to climb post-ETF approval from the SEC, PDP’s low-cap base makes every dollar impactful. As liquidity from Dogecoin and XRP ETFs flows into the DeFi token, Paydax could turn small bets into five-figure wins—fast.

Conclusion: The Real Wealth Shift Might Not Come From ETFs

While the world watches for Dogecoin and XRP ETFs approval from the SEC, the real wealth opportunity lies in Paydax. Its unique mix of working product, transparent leadership, institutional partnerships, and utility-driven tokenomics makes it a rare DeFi token that’s early — yet already functional.

With PDP still priced at $0.015, the window for early entry may not stay open for long. Once liquidity from Dogecoin and XRP ETFs starts flooding in, combined with major partnerships with top crypto firms like Sotheby, Brinks, and Onfido, and listings on major exchanges, Paydax could be the DeFi token leading the next major wealth wave in crypto. Stake your claim with Ethereum’s biggest DeFi token now, using the code PD25BONUS for a 25% buying bonus.

Build A Stronger Position With The Paydax (PDP) Presale:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper