TRX Consolidates Near Key Support Amid Market Uncertainty

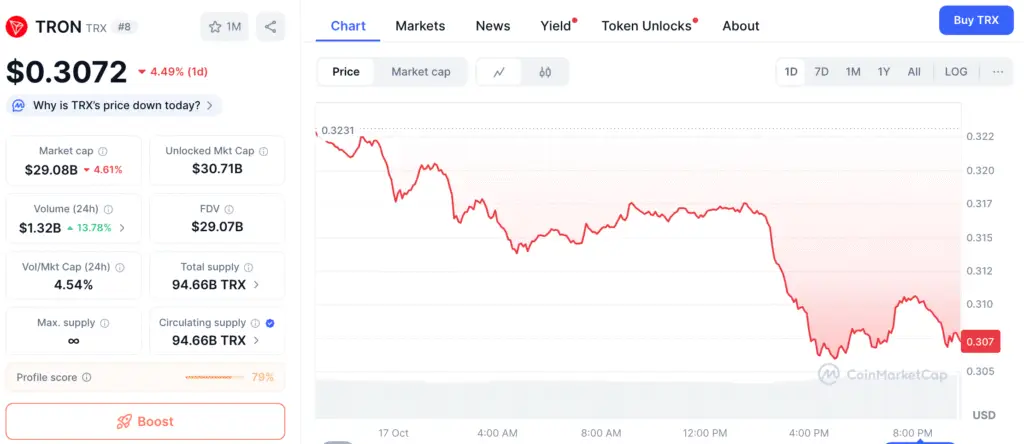

TRON (TRX) remains within a narrowing range following the latest market adjustments. At $0.32, the token appears to be stabilizing as investors assess mixed signals across various timeframes. While there may be some immediate challenges, experts anticipate a steady rebound to the range of $0.35–$0.40 should the momentum pick up.

Recent data reveals robust market engagement, as TRX daily trading volume consistently exceeds $130 million across major exchanges. The asset’s capacity to maintain this degree of liquidity highlights its strength, even amid a generally negative market atmosphere.

Analysts Diverge on TRX Price Targets for 2025

Predictions for TRON’s price in 2025 vary, with some analysts leaning towards moderate expectations while others adopt a more optimistic outlook. Changelly anticipates a period of stabilization within the range of $0.314 to $0.321, indicating a prudent perspective influenced by the prevailing market inertia.

In the latest analysis, PricePredictions.com has established a bold target of $1.03, suggesting a remarkable 222% potential increase from current levels. CoinCodex provides a more measured forecast, anticipating a value of $0.34, which corresponds with a steady midterm increase. The prevailing view indicates that TRON is fundamentally stable, yet it encounters obstacles prior to any notable shift in trend.

Technical Analysis Points to Possible Trend Reversal

Currently, TRX is trading near its 7-day simple moving average, accompanied by a relative strength index (RSI) of 37.7, which suggests a state of neutral momentum. The token’s current positioning suggests potential for upward movement, provided that buyers decide to re-enter the market.

The MACD histogram is currently at –0.0019, indicating a slight bearish trend. Nonetheless, the diminishing scale indicates a waning of selling pressure. This discrepancy between the neutral RSI and the softening MACD could signal an impending shift toward mid-band targets near $0.33.

Recommended Article: Tron Price Prediction Shows Q4 2025 Growth Toward $0.38

TRON Nears Lower Bollinger Band With Rebound Potential Toward $0.33

Analysis of Bollinger Bands indicates that TRX is currently positioned at 0.16, lingering close to the lower boundary set at $0.31. Historically, this closeness indicates a possible return to the average level near $0.33.

To maintain a continuous upward movement, TRX needs to finish above $0.35, coinciding with the upper Bollinger Band and serving as the resistance area for the past year. A move beyond this threshold may lead to a swift rise toward the $0.37–$0.40 range, marking the conclusion of a positive short-term trend.

Optimistic Outlook: Surpassing $0.35 Resistance Crucial for Progress

Experts pinpoint $0.35 as the pivotal threshold for validating a sustained upward trend. TRX is currently trading just under its 20-day and 50-day moving averages, which are converging around the $0.33–$0.34 range. Surpassing these levels may ignite fresh momentum, bolstered by the robust support of the 200-day moving average at $0.30.

If it achieves success, TRON may experience a surge towards the $0.37–$0.40 range, potentially returning to its prior 52-week peaks. The overarching framework continues to hold firm, with ongoing accumulation poised to drive growth in the medium term as we approach November.

TRON Holds Steady as Institutions Cushion Pressure Near $0.30 Level

The pessimistic outlook focuses on the $0.30 support level, which serves as both the 200-day moving average and a significant psychological barrier for traders. A significant drop beneath this level could lead to additional losses, targeting the range of $0.26–$0.28, indicating a potential decline of 15–20%.

Confirming the volume will be crucial. In light of technical uncertainties, the consistent engagement from institutions on Binance and various other exchanges indicates a restrained response to selling pressures. Experts consider any drop below $0.30 to be a fleeting adjustment in an otherwise steady long-term trajectory.

Traders Focus on $0.31 Accumulation Zone With Stops Below $0.295

For traders contemplating new positions, a multi-faceted strategy continues to offer the most equilibrium. Optimal accumulation areas are situated between $0.31 and $0.315, providing access near the lower support level. Determined buyers might seek breakout opportunities above $0.335, indicating initial validation of a bullish turnaround.

Participants with a conservative approach may choose to wait for a clear hold above $0.30 before committing their capital. It is recommended to allocate 1–2% of the overall portfolio for position sizing, while implementing stop-losses beneath $0.295 to manage potential fluctuations.

TRON Price Outlook Brightens With RSI, MACD, and Volume Alignment

Recent forecasts for TRX price suggest a possible increase of 10–25% over the next month, depending on the ability to hold support above $0.30 and successfully surpass the $0.35 resistance level. Key metrics to monitor are an RSI surpassing 50, a favorable MACD crossover, and daily volume exceeding $150 million.

If validated, TRON may establish itself as a leading contender among mid-cap tokens by late 2025. Nonetheless, a failure to uphold crucial support would undermine the optimistic outlook and redirect focus toward lower consolidation levels around $0.26–$0.28.