Solana: A New Beacon for Yield-Seeking Investors

In a digital world where investors are constantly searching for platforms that combine cutting-edge technology with reliable financial returns, Solana is emerging as a front-runner. This is especially true for firms like DeFi Development Corp (DDC), which are leveraging Solana’s sophisticated proof-of-stake model to generate significant yield. With DDC forecasting an enticing annualised organic yield (AOY) in the ballpark of 10%, the platform’s ability to generate daily income is proving to be a powerful draw for institutional players.

This paradigm shift is prompting a reevaluation of traditional crypto strategies, as many are redirecting their attention from the stagnant waters of Bitcoin towards the fertile ground of Solana’s staking rewards. This innovative approach is not just a passing trend; it’s a new benchmark for how institutional capital is engaging with the crypto market.

Mastering Reserve Management with Solana Tokens

DDC’s strategic approach to amassing Solana (SOL) tokens is a prime example of astute reserve management. The firm’s holding of an impressive 1.3 million SOL, with a value approximating $250 million, signals a robust commitment to Solana’s ever-expanding ecosystem. This strategy mirrors the behaviour of traditional financial institutions that are increasingly focused on raising capital to fortify their crypto holdings.

Such a concentrated manoeuvre empowers organisations to not only build a formidable position within a competitive market but also to have a significant influence on the network itself. By strategically acquiring a substantial amount of the token, DDC is demonstrating its confidence in the long-term viability of Solana and its ability to become a dominant player in the blockchain sphere. This approach is a clear indication that institutional players are moving beyond simple investment and are becoming active participants in the ecosystems they support.

Maximising Revenue with Validator Partnerships

At the core of DDC’s revenue enhancement strategy is its proactive engagement within the Solana validator ecosystem. By forging critical validator agreements and partnering with a variety of projects, DDC is amplifying its earning potential through shared network rewards. These collaborations, which even extend to popular memecoins, are a strategic way to diversify DDC’s income streams while maximising the benefits of staking.

This approach highlights a crucial truth in the blockchain space: community engagement and active participation are not merely advantageous; they are fundamental for sustained success. By becoming a key player in the validator network, DDC is not just earning a yield; it is actively contributing to the security and stability of the Solana blockchain, which in turn strengthens its own investment and market position.

The Shifting Landscape of Crypto Investments

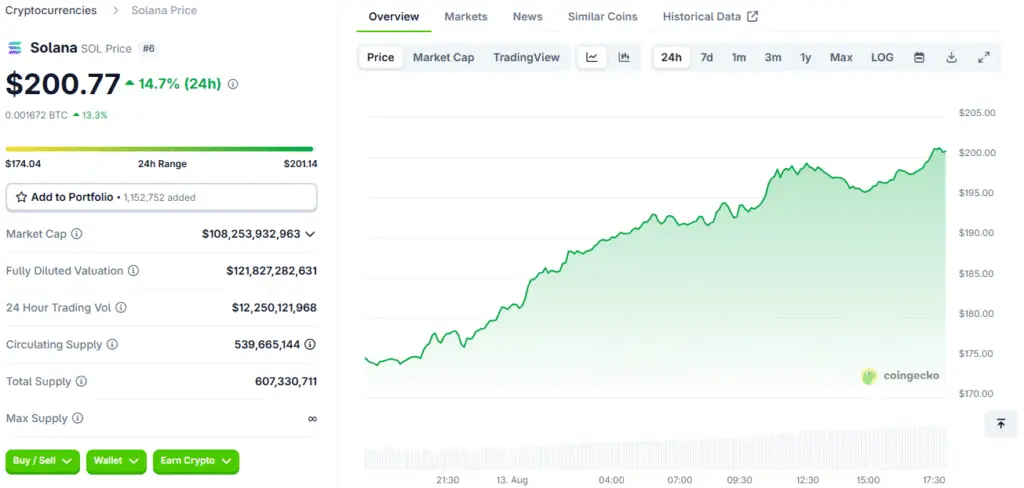

As cryptocurrency continues its transition into the mainstream financial landscape, entities like DDC are pivotal in shaping investor outlooks. The firm’s strategic actions, combined with the burgeoning market cap of Solana, reflect a profound institutional interest that bodes well for the future of crypto. Recent market developments, including a staggering 12.45% uptick in SOL’s value within just 24 hours, illustrate the complex interplay between institutional buying power and overall market traction.

Analysts predict that these trends could usher in a new wave of institutional commitment, solidifying Solana’s position as a formidable player within the blockchain sphere. This is a clear signal that the market is moving past its early, speculative phase and is now being driven by sophisticated institutional strategies that focus on yield, utility, and long-term value.

Navigating the Risks of a Single-Chain Strategy

While the allure of Solana’s staking rewards is strong, the inherent risks of a single-chain strategy cannot be ignored. An overreliance on one blockchain, as DDC is practising, can expose investors to a host of vulnerabilities. These include potential technical shortcomings, which can lead to network downtime or security breaches, as well as shifting regulatory landscapes.

This is especially challenging for smaller Web3 startups that may lack the resources to navigate these complexities. Thus, a critical part of a successful strategy, even a concentrated one, involves striking a balance between maximising yield and maintaining adequate operational liquidity. For DDC, this means carefully managing its reserves to ensure it can withstand market shocks and regulatory changes while still reaping the benefits of its staking strategy.

Charting a Path for Solana and the Future of DDC

The methods employed by DeFi Development Corp lay bare the thrilling trajectory that Solana is on within the cryptocurrency arena. Their focus on yield optimisation and validator partnerships highlights the powerful role that institutional involvement can play in elevating a blockchain platform’s profile. However, this landscape demands careful navigation, especially given the risks associated with concentrated staking strategies.

As the boundaries between traditional finance and decentralised technologies blur, we find ourselves on the cusp of significant, transformative shifts in the investment story, heralding a new chapter in how digital assets are perceived and utilised. The forward momentum driven by DDC’s bold investments promises to reinforce Solana’s status and foster a vibrant ecosystem that thrives in the wake of this evolution.

Read More: Solana Price Analysis: Bullish Channel vs. Short-Term Weakness