Upexi Increases Solana Treasury Holdings

Nasdaq-listed treasury firm Upexi reported a 4.4% increase in its Solana holdings, reaching over 2.1 million SOL. The growth comes despite recent price corrections in the broader crypto market. Since September, Upexi has added nearly 88,750 SOL, highlighting its continued confidence in Solana’s long-term potential.

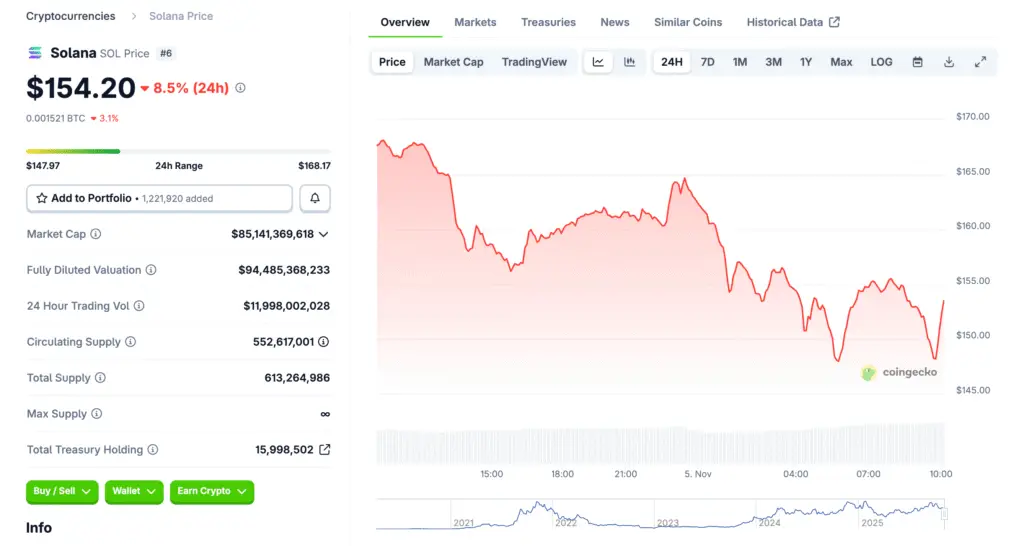

Treasury Value Fluctuates With Solana Price Swings

At the end of October, Upexi’s holdings were valued at $397 million based on Solana’s $188.56 closing price. However, the subsequent market drop to around $160 reduced this valuation to roughly $340 million. Despite the short-term decline, the firm still holds a $15 million paper gain.

Unrealized Gains Reflect Long-Term Profitability

Upexi’s total Solana purchases amounted to $325 million, acquired at an average price of $157.66 per SOL. Even after recent pullbacks, the company’s unrealized gains showcase its effective accumulation strategy. Executives emphasize that treasury performance should be measured over multi-quarter periods rather than daily volatility.

Recommended Article: Solana Consolidates as 2025 Market Leader Amid Investor Optimism

Investor Returns Outperform Solana’s Price Gains

Since launching its treasury program in April, Upexi investors have seen a 96% return, compared to Solana’s 24% gain. The company’s adjusted SOL per share climbed 82% in dollar terms, reflecting efficient capital deployment. Analysts note that this performance positions Upexi as a standout among digital asset treasuries.

Strategic Positioning Amid Weak Market Sentiment

CEO Allan Marshall stated that Upexi remains focused on creating incremental shareholder value despite reduced market enthusiasm. He pointed to consistent staking rewards, portfolio diversification, and disciplined treasury management as key strengths. The firm remains confident in Solana’s ecosystem growth and staking yield potential.

Staking Revenue Provides Steady Cash Flow

Nearly all of Upexi’s Solana holdings are staked, earning between 7% and 8% annual yield. This generates approximately $75,000 in daily revenue, offering predictable income during volatile periods. Such consistent returns enhance the firm’s resilience to price fluctuations.

Discounted Locked SOL Boosts Long-Term Value

About 42% of Upexi’s holdings consist of locked SOL purchased at discounted prices. These built-in gains provide long-term upside once vesting periods conclude. The approach underscores management’s focus on maximizing capital efficiency for shareholders.

Outlook: Upexi Maintains Confidence in Solana’s Future

Despite market-wide corrections, Upexi’s strategy continues to outperform peers. The firm’s disciplined approach, strong returns, and yield generation suggest resilience against market downturns. As Solana’s ecosystem expands, Upexi’s growing treasury may serve as a benchmark for other institutional investors entering the digital asset space.