Solana Treasury Strategy Offsets Heavy Losses

Upexi, a Florida-based consumer retail and supply chain company, has reported a net loss of $13.7 million for the fiscal year. Despite this downturn, the company’s Solana (SOL) treasury has helped offset losses through substantial unrealized gains.

The firm increased its holdings from 735,692 SOL in June 2025 to over 2 million by late September. This bold shift marks Upexi’s transformation into one of the largest publicly traded Solana treasuries.

Unrealized Gains Drive Positive Net Position

At its peak, Upexi’s treasury carried a net asset value of $433 million, based on SOL’s price of $214.76. With an average purchase price of $151.44, the company initially locked in $154.56 million in unrealized gains.

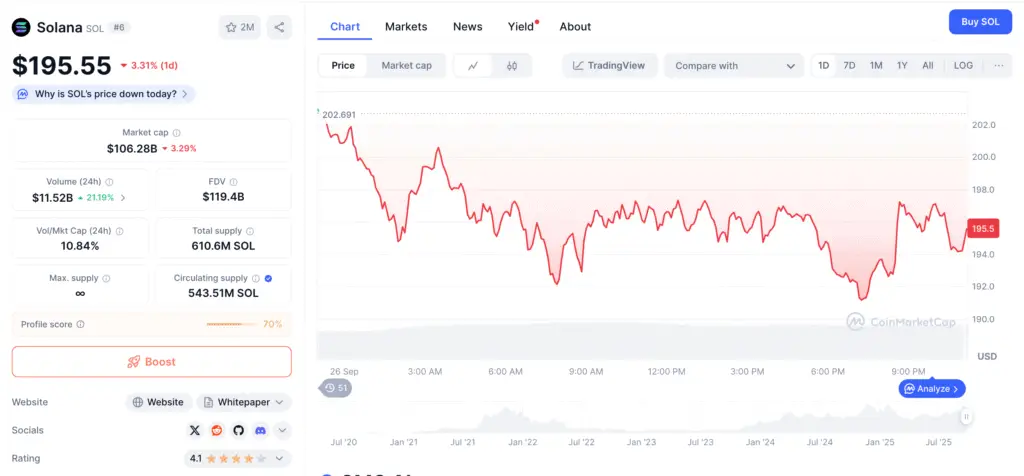

However, with SOL now trading closer to $195.55, these gains have narrowed to around $90.71 million. Even so, the treasury’s valuation continues to outweigh Upexi’s business losses.

Staking Rewards Generate Daily Revenue

Beyond holding, Upexi has staked its entire Solana position to maximize returns. The treasury currently earns an annualized yield of 8%, generating nearly $100,000 in daily staking rewards.

This passive income provides a reliable buffer, supplementing the company’s balance sheet even as its core retail operations struggle.

CEO Praises “Winning Strategy”

Upexi CEO Allan Marshall described the Solana strategy as a “winning approach” that has transformed the firm into a leading treasury company. He emphasized the company’s focus on delivering shareholder value despite business headwinds.

Marshall noted that Upexi remains “laser-focused” on building a long-term financial strategy centered on Solana’s growth potential.

Shareholder Reactions Remain Mixed

Despite the treasury’s success, Upexi’s stock performance reflects a different story. Since June 2021, shares have fallen by more than 96%. The April 2025 announcement of its Solana strategy briefly spiked shares from $2.30 to $15.51, but the surge was short-lived.

Analysts attribute the jump to a knee-jerk investor reaction to another Digital Asset Treasury (DAT) trend announcement, rather than sustained confidence in Upexi’s fundamentals.

Competition Heats Up Among Solana Treasuries

Upexi is now ranked as the third-largest Solana treasury holder among publicly traded firms. Aggressive purchases by competitors have reshaped the leaderboard in recent weeks.

Forward Industries leads with over 6.8 million SOL valued at $1.33 billion, followed by DeFi Development Corp. with more than 2.09 million SOL worth $411.2 million. Upexi remains in third place with 2.01 million SOL valued at $396 million.

The Future of Upexi’s Strategy

With ongoing staking rewards and steady treasury growth, Upexi’s Solana-focused strategy provides a financial cushion against its declining retail business. The firm’s ability to balance treasury management with operational improvements will determine its longer-term trajectory.

For now, Upexi’s Solana position highlights both the opportunities and risks of the DAT trend, where corporate treasuries are increasingly turning to crypto as a hedge against traditional losses.