XRP Faces Sharp Decline Amid Market Uncertainty

XRP, the cryptocurrency associated with Ripple, has experienced a noticeable price drop recently. This decline comes at a time of heightened volatility across the crypto market, drawing investor attention to broader trends.

Market participants are closely examining regulatory pressures and overall sentiment to understand the causes. XRP’s movement reflects not just its internal issues but also its sensitivity to Bitcoin’s price trends and macroeconomic factors.

Regulatory Pressures Deepen Investor Concerns

One of the major reasons behind XRP’s recent fall is continued regulatory scrutiny. Since 2020, Ripple has been entangled in a legal battle with the U.S. Securities and Exchange Commission. This case has created persistent uncertainty over whether XRP is classified as a security.

Recent court updates briefly boosted optimism, but sentiment quickly shifted again. Investors continue to react sharply to legal developments, making XRP especially vulnerable to abrupt market swings and bearish narratives.

Market-Wide Trends Amplify XRP Weakness

XRP’s decline is also tied to overall crypto market behavior. When Bitcoin experiences price fluctuations, altcoins like XRP typically follow due to their interconnectedness. Recent Bitcoin pullbacks have triggered a domino effect across many digital assets.

This correlation shows that XRP’s performance cannot be analyzed in isolation. Broader sentiment shifts, liquidity changes, and macroeconomic factors combine to influence XRP’s trajectory alongside Bitcoin’s price action.

Recommended Article: Is There a Real Future for XRP in the Global Payments Market?

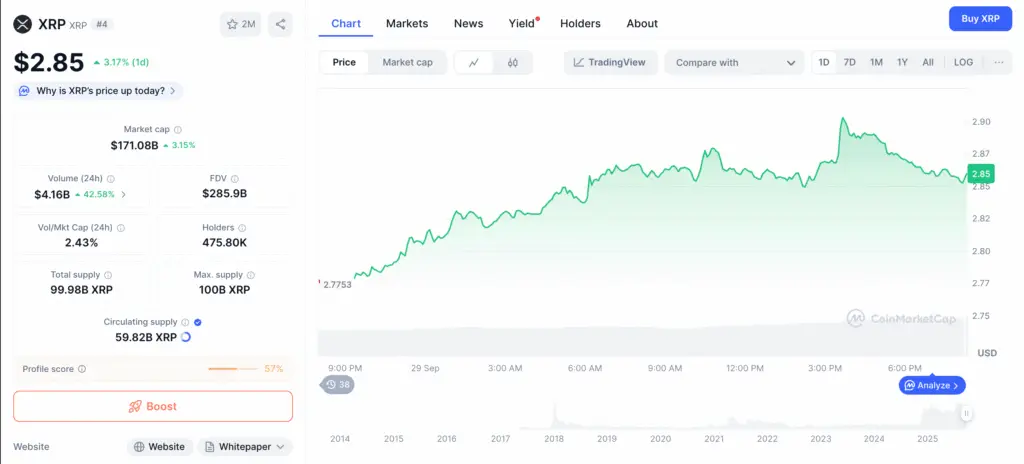

Technical Charts Indicate Bearish XRP Momentum

From a technical perspective, XRP has failed to maintain critical support levels in recent sessions. Analysts are observing bearish signals from indicators like moving averages, RSI, and Fibonacci retracement zones.

The lack of bullish signals has fueled trader pessimism. Unless XRP regains key levels, short-term momentum could remain negative, potentially opening the door for deeper retracements in the coming weeks.

Experts Highlight Key Bitcoin Recovery Scenarios

As XRP struggles, attention has turned toward Bitcoin’s future trajectory. Analysts suggest that a Bitcoin recovery could improve sentiment for altcoins as well. Breaking above key resistance levels may create a more bullish market environment overall.

Institutional adoption remains another strong bullish factor. Companies increasing Bitcoin exposure signal growing confidence, while favorable regulatory developments such as ETF approvals could also support significant price appreciation.

Bitcoin Price Predictions Vary Among Analysts

Expert opinions on Bitcoin’s near-term direction remain divided. Some believe Bitcoin could surpass its previous all-time highs near $69,000 if bullish catalysts align. Others remain cautious, citing macroeconomic risks such as inflation and interest rates.

This divergence reflects the uncertain macro backdrop influencing all digital assets. Bitcoin’s performance will likely remain the primary driver of altcoin trends, including XRP’s recovery prospects.

Diversification Strategies Gain Importance for Investors

Given the volatility surrounding XRP, many investors are turning to diversification. Holding a mix of assets like Bitcoin, Ethereum, and Cardano can mitigate risks from regulatory battles or isolated downturns.

XRP’s legal uncertainties make diversification especially attractive. Bitcoin’s established role and institutional support provide a more stable foundation, while other altcoins offer complementary growth opportunities in evolving crypto sectors.

XRP and Bitcoin Show Crypto Market Interconnectedness

The relationship between XRP and Bitcoin underscores how closely tied the crypto ecosystem is. Bitcoin’s rallies often lift altcoins, while downturns drag them lower. This dynamic makes monitoring Bitcoin’s price essential for XRP holders.

XRP’s decline illustrates this dependency clearly. Understanding these interconnections is crucial for investors navigating volatile markets and planning long-term strategies amid shifting sentiment and regulatory landscapes.