Stellar Shows Strong Recovery Amid Market Stabilization

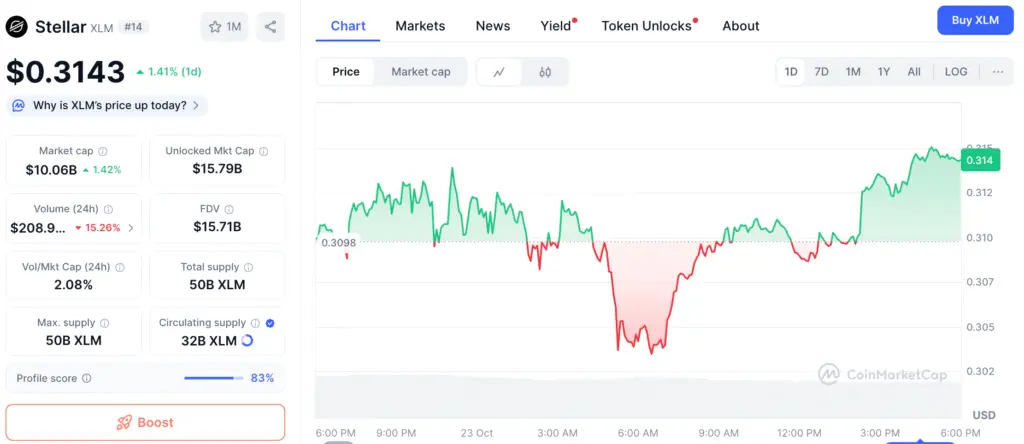

Stellar (XLM) has made a strong comeback, gaining investor trust as the global cross-border payments business recovers. Its current value is around $0.3143, a significant increase from lows under $0.19.

This rebound is driven by the positive crypto market mood, with investors shifting towards assets with real-world financial value. Stellar’s decentralized payment system connects banks, fintechs, and people across borders, making it one of the most undervalued coins under $1 as 2026 approaches.

XLM Market Structure Reflects a Healthier Foundation

TechFinancials analysts report a drop in open interest in Stellar futures from $160 million to $81 million, indicating a shift from speculative trading to organic accumulation.

The analysts suggest that maintaining support above $0.31 is crucial for traders, as a resistance zone between $0.34 and $0.38 could lead to a breakthrough to $0.45 and higher. If momentum continues, Stellar could reach a midterm goal of $0.52, indicating confidence in its long-term role in digital payments.

| Scenario | 2025 XLM Target (USD) | Market Outlook |

|---|---|---|

| Bearish | 0.28 | Breakdown below $0.31 amid weak demand |

| Neutral | 0.38 | Gradual recovery with moderate remittance growth |

| Bullish | 0.52 | Strong global adoption of Stellar-based payments |

This technical position makes Stellar look more like a steady-growth asset than a speculative spike currency. XLM is still important in the multi-trillion-dollar remittance sector because it has better liquidity and network utilization that lasts.

Cross-Border Payment Adoption Strengthens XLM’s Case

Stellar’s network is still getting partnerships from businesses and financial companies since it is recognized for fast and cheap international transactions. As the amount of money sent throughout the world rises, thanks to speedier digital payments and blockchain-based settlements, Stellar will profit from more banks and payment companies using it.

XRP is mostly about institutional corridors, whereas Stellar is more about financial inclusion. It focuses on smaller payment solutions that help microtransactions and populations who don’t have a lot of banking options. This method is in line with global development goals and makes Stellar more likely to be adopted in the long run.

Recommended Article: Stellar Price Recovers Toward $0.385 With XLM Momentum Rising

Investor Sentiment Shifts Toward Utility-Based Assets

Speculative trading is still a feature of the crypto world, but as the sector matures, investors are moving toward projects that have real-world uses that can be measured. Both retail and institutional investors are still interested in Stellar because it follows the rules, has clear governance, and grows through partnerships.

The number of USDC transactions on the Stellar network is still increasing, which has led to more activity on the blockchain. This shows that there is a need for robust and interoperable payment solutions. This ongoing activity on the network strengthens the idea that Stellar is still a key protocol in the growing blockchain payments ecosystem.

Stellar Holds $0.31 Support as RSI Neutral and EMAs Signal Stability

XLM’s daily chart shows a pattern of rising lows, and the token is still getting good support around the $0.31 level. The Relative Strength Index (RSI) is near neutral levels, which means there is opportunity for it to go higher without becoming too high.

Traders expect XLM to move up to the $0.38–$0.45 barrier zone if it can keep closing above $0.34 every day. On the other hand, if it loses support below $0.30, it might go back down for a short time before starting its long-term rise again. Stellar seems like it’s in a good place for a steady accumulation period before any big breakout, as both the 50-day and 100-day exponential moving averages (EMAs) are coming together below the price.

Broader Market Context: Comparing Stellar to Emerging Altcoins

Stellar is gaining traction in the remittance market, while the crypto market is exploring new cryptocurrencies with built-in yield models and DeFi compatibility. BlockchainFX and Remittix have hybrid systems that combine trading revenue and payment capabilities. Stellar is less competitive in these sectors due to potential returns.

However, XLM’s reliable network and regulatory compliance make it a top choice for investors seeking stability. With steady demand, Stellar can be used in various ways.

Stellar’s Path Toward Sustainable Growth

Stellar’s recovery trend appears more and more likely to last as we go into 2026. This is because of organic demand, institutional integration, and revived investor faith in blockchain payment systems. If Stellar keeps going in the same direction, analysts say that XLM might test $0.50 again in the next market cycle, which would be in line with the growth of digital remittance services.

Newer cryptocurrencies may offer larger short-term gains, but Stellar’s reliability, liquidity, and real-world use make it a key crypto asset for cross-border financing. For investors who want sustainable growth and a track record of success, XLM is still a good choice in the 2025 market.