XLM Rebounds as Cross-Border Utility Expands

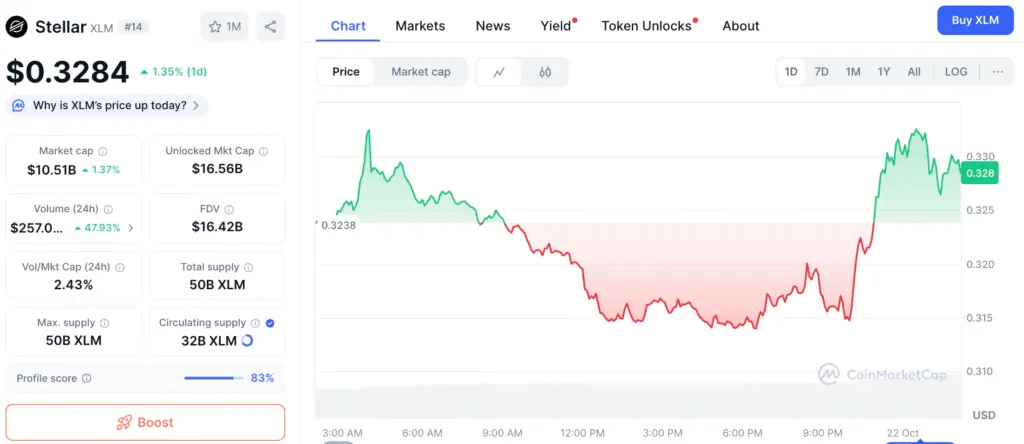

Stellar (XLM) has come back as one of the best-performing cryptocurrencies in late October because more and more people are using it for worldwide payments. The cryptocurrency, which was created to make cross-border payments easier, is trading around $0.326. It looks like it is starting to rise again after months of staying the same.

Technical experts say that an inverse head-and-shoulders pattern is building on the daily chart, with a breakout neckline at about $0.497. If there is a lot of volume behind this structure, it might push XLM up to $0.82, with $1 being a psychological level for investors looking for a full market recovery.

Technical Outlook: Building Toward a Breakout

Stellar’s short-term momentum is strengthening, with support around $0.317 being a critical level. Analysts predict that if XLM can hold this level, it will slowly move towards $0.385, a key resistance mark. If the price closes above $0.497 daily, it could confirm a breakout pattern and open the way to $0.68 and $1.00, potentially gaining 200% from where it is.

However, if the price doesn’t stay above the $0.317–$0.30 zone, it might briefly drop before regaining momentum. On-chain data shows increasing whale activity, with big addresses building up holdings after a low liquidity period. This suggests institutional interest may be returning as the Stellar ecosystem continues to grow its payment network.

Stellar’s Ecosystem Gains Real-World Traction

Stellar’s native network is expanding beyond remittances and gaining collaborations in banking, stablecoin issuance, and fintech interfaces. The Stellar Development Foundation (SDF) has strengthened partnerships in emerging economies like Africa and Southeast Asia, where quick, cheap payments are needed.

Recent changes include the launch of anchor connectors for regulated partners to convert money to bitcoin, strengthening Stellar’s position as the global settlement layer for cross-border transactions. The addition of Soroban, Stellar’s smart contracts platform, has sparked interest from developers, as it allows DeFi protocols and payment systems to build directly on XLM infrastructure.

Recommended Article: Stellar Price Recovers Toward $0.385 With XLM Momentum Rising

Market Sentiment and On-Chain Signals

Since early October, people’s feelings toward XLM have become a lot better, thanks to a general sense of hope in the altcoin sector. Trading volumes on centralized exchanges have gone up, and social engagement data suggests that Stellar is rising along with key payment-focused projects like XRP and Remittix (RTX).

On-chain analytics show that fewer tokens are coming into exchanges, which might mean that holders are shifting their tokens to private wallets. This is a frequent indicator of long-term confidence. On the other hand, technical indicators like the MACD and RSI show that bearish momentum is fading, which might mean that XLM is about to start accumulating again before its next upward move.

Stellar’s Payment Focus Supports Bullish Outlook Despite Market Risks

Several technical models say that XLM’s short-term resistance is at $0.385 and its medium-term goals are between $0.82 and $1.00. To get to $1, the network would need to keep growing and more money would need to come back into the crypto market.

Experts say that even while the overall trend is still positive, there might be short-term volatility because of global economic instability and changing investor risk appetite. Still, Stellar’s explicit focus on real-world payment infrastructure makes it a great candidate for long-term importance.

Competitive Landscape: The PayFi Movement

The development of a new generation of PayFi (Payments + DeFi) businesses like Remittix (RTX), which combine the speed of blockchain with the ease of access to traditional financing, has helped XLM soar again. Stellar wants to work with enterprises, but Remittix wants to help regular people and small businesses with its crypto-to-bank payment bridge.

Analysts say that the two ecosystems work well together: Stellar offers the infrastructure for regulated payments, and Remittix creates solutions for consumers that use those rails. They all show how blockchain-powered finance is growing.

Stellar Targets $1.00 as Bulls Watch Key Breakout Above $0.497 Level

Stellar’s recovery will depend on if it can break over $0.497 with robust trading volume and favorable on-chain momentum. If this is true, economists say that the price will climb more quickly toward $0.82–$1.00 by the end of Q4 2025.

Stellar’s long-term fundamentals are still strong since more people are using it, more whales are buying it, and technical indications are trending positive. If you’re looking for growth in the payment industry, XLM may be a good choice, but you’ll need to time the breakout just right.